Pizza Hut 1999 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our overall Company ownership percentage of total system

units was 23% at December 25, 1999, a decline of 5 percent-

age points from year-end 1998 and 11 percentage points from

year-end 1997.

The portfolio effect on ongoing operating profit included in our

discussions of results of operations represents the estimated

impact on revenue, restaurant margin, general and administra-

tive expenses and operating profit related to our refranchising

and store closure initiatives described above.

Results of Operations

Our Spin-off in 1997, the impacts of our facility actions over

the last three years, our 1997 fourth quarter charge and the

impacts of the disposal of our Non-core Businesses represent

significant items which complicate year-over-year comparisons.

Prior to October 7, 1997, our historical financial statements

were impacted by our lack of history as an independent, pub-

licly owned company. The amounts for certain items,

specifically general and administrative expenses, interest

expense and income taxes, included in our historical reported

results for periods prior to the Spin-off, include allocations or

computations which are not indicative of the amounts we would

have incurred if we had been an independent, publicly owned

company during all periods presented. See Note 2.

Comparative information is also impacted by the operations of

and disposal charges related to our Non-core Businesses in

1997. These disposal charges included an estimated provision

for all expected future liabilities associated with the disposal of

our Non-core Businesses. We were required to retain these

liabilities as part of the Spin-off. Our best estimates of all such

liabilities have been included in the accompanying Consolidated

Financial Statements. See Note 21. Actual amounts incurred

may ultimately differ from these estimates. However, we believe

the amounts, if any, in excess of our previously recorded liabil-

ities are not likely to have a material adverse effect on our results

of operations, financial condition or cash flow.

Following is a summary of the results of the operations of our

Non-core Businesses through their respective disposal dates:

1997

Revenues $ 268

% of total revenues 3%

Non-core Businesses

operating profit,

before disposal charges $13

Unusual disposal charges 54

Net loss (26)

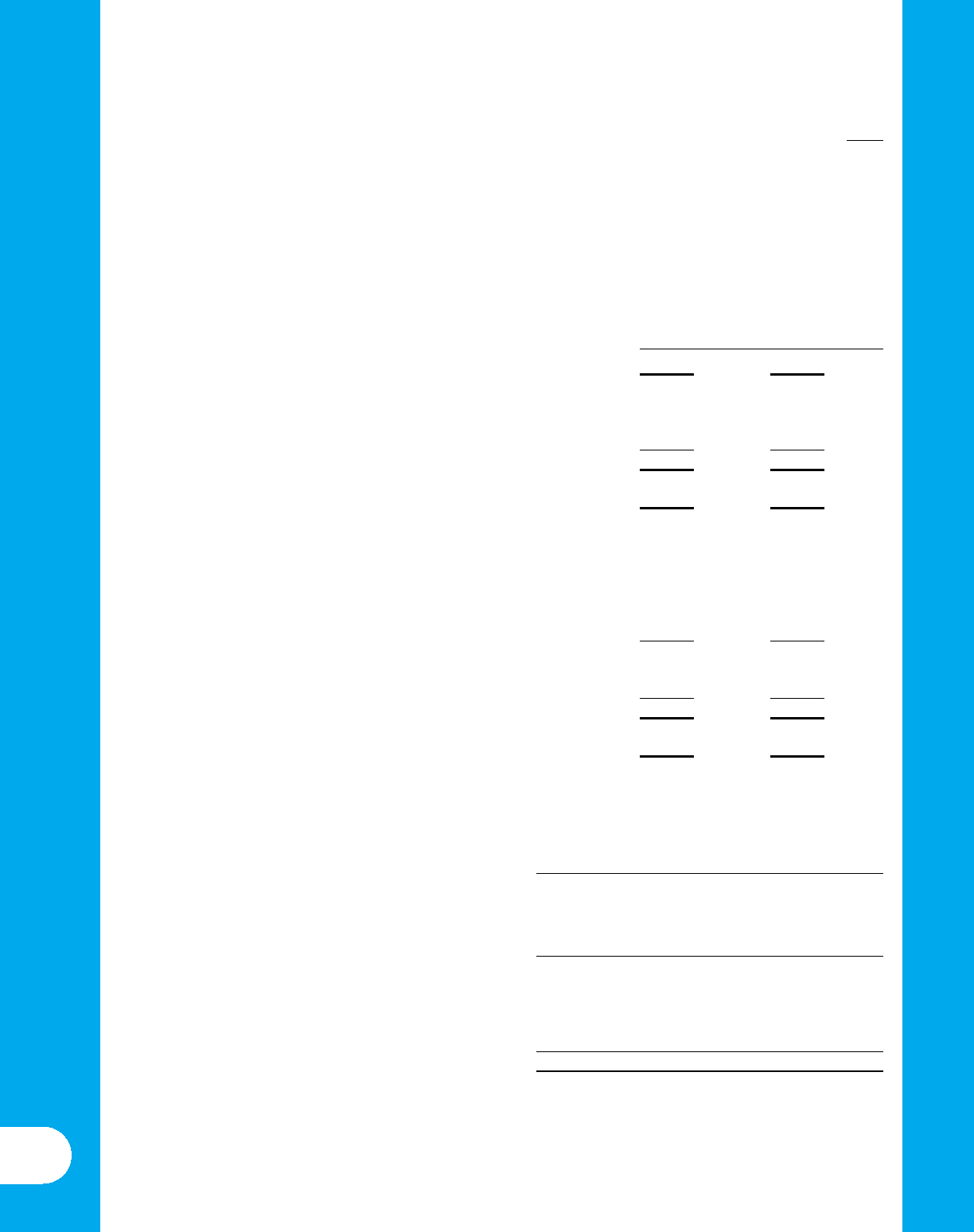

Worldwide Results of Operations

% B(W) % B(W)

1999 vs. 1998 1998 vs. 1997

System Sales $ 21,762 6 $ 20,620 1

Revenues

Company sales $ 7,099 (10) $ 7,852 (14)

Franchise and

license fees(1) 723 15 627 8

Total Revenues $ 7,822 (8) $ 8,479 (12)

Company

Restaurant Margin $ 1,091 3 $ 1,058 —

% of sales 15.4% 1.9 ppts)

.13.5% 1.9 ppts)

.

Ongoing

operating profit $ 881 15 $ 768 14

Accounting changes(2) 29 NM ——

Facility actions

net gain (loss) 381 38 275 NM

Unusual items (51) NM (15) NM

Operating Profit 1,240 21 1,028 NM

Interest expense, net 202 26 272 1

Income Tax Provision 411 (32) 311 NM

Net Income (Loss) $ 627 41 $ 445 NM

Diluted Earnings

Per Share $ 3.92 38 $ 2.84 NM

(1) Excluding the special 1997 KFC renewal fees, 1998 increased 13% over 1997.

(2) See Note 5 for complete discussion of our 1999 favorable accounting changes.

26

Worldwide Restaurant Unit Activity

Unconsolidated

Company Affiliates Franchisees Licensees Total

Balance at Dec. 27, 1997 10,117 1,090 15,097 3,408 29,712

New Builds & Acquisitions 225 63 790 544 1,622

Refranchising & Licensing (1,373) (9) 1,302 80 —

Closures (572) (24) (539) (436) (1,571)

Balance at Dec. 26, 1998 8,397 1,120 16,650 3,596 29,763

New Builds & Acquisitions 323 83 858 586 1,850

Refranchising & Licensing (1,435) (5) 1,443 (3) —

Closures (301) (20) (434) (646) (1,401)

Other (3) — (103) (124) (230)

Balance at Dec. 25, 1999 6,981(a) 1,178 18,414 3,409 29,982

% of total 23.3% 3.9% 61.4% 11.4% 100.0%

(a) Includes 37 Company units approved for closure but not yet closed at December 25, 1999.