Pizza Hut 1999 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

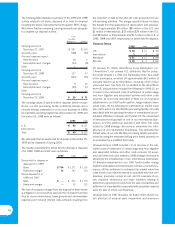

Income Taxes

The details of our income tax provision are set forth

below:

1999 1998 1997

Current:

Federal $ 342 $ 231 $ 106

Foreign 46 55 77

State 39 22 31

427 308 214

Deferred:

Federal (18) (2) (66)

Foreign 17 10 (59)

State (15) (5) (13)

(16) 3 (138)

$ 411 $ 311 $ 76

The 1998 and 1997 deferred state tax benefits included net

operating loss carryovers of $1 million that were utilized in 1999.

Taxes payable were reduced by $14 million, $3 million and less

than $1 million in 1999, 1998 and 1997, respectively, as a

result of stock option exercises. In addition, goodwill and other

intangibles were reduced by $22 million in 1999 as a result of

the settlement of a disputed claim with the Internal Revenue

Service relating to the deductibility of the amortization of reac-

quired franchise rights and other intangibles. Finally, the

valuation allowance as of the beginning of 1999 that related to

deferred tax assets in certain foreign countries was reduced by

$13 million as a result of establishing a pattern of profitability.

Our U.S. and foreign income (loss) before income taxes are set

forth below:

1999 1998 1997

U.S. $ 782 $ 542 $ 13

Foreign 256 214 (48)

$1,038 $ 756 $ (35)

Our 1999 and 1998 reconciliation of income taxes calculated

at the U.S. federal tax statutory rate to our effective tax rate is

set forth below:

1999 1998

U.S. federal statutory rate 35.0% 35.0%

State income tax, net of

federal tax benefit 3.0 2.7

Foreign and U.S. tax effects

attributable to foreign operations 1.7 4.4

Effect of unusual items (0.5) (0.6)

Adjustments relating to prior years 0.2 (2.1)

Other, net 0.1 1.6

Effective income tax rate 39.5% 41.1%

In 1997, our reconciliation of income taxes calculated at the

U.S. federal tax statutory rate was computed on a dollar basis,

as a reconciliation on a percentage basis is not meaningful due

to our pre-tax loss.

1997

Income taxes computed at the

U.S. federal statutory

rate of 35% $ (12)

State income tax,

net of federal tax benefit 18

Foreign and U.S. tax effects

attributable to

foreign operations 24

Effect of unusual items 79

Adjustments relating to

prior years 3

Other, net (36)

Income tax provision $ 76

Effective income tax rate (217.1%)

The details of our 1999 and 1998 deferred tax liabilities

(assets) are set forth below:

1999 1998

Intangible assets and property,

plant and equipment $ 170 $ 243

Other 25 8

Gross deferred tax liabilities $ 195 $ 251

Net operating loss and

tax credit carryforwards $ (140) $ (107)

Employee benefits (91) (58)

Self-insured casualty claims (38) (46)

Stores held for disposal (12) (62)

Various liabilities and other (178) (183)

Gross deferred tax assets (459) (456)

Deferred tax assets

valuation allowance 173 133

Net deferred tax assets (286) (323)

Net deferred tax

(asset) liability $ (91) $ (72)

Included in:

Deferred income tax assets $ (59) $ (137)

Other assets (51) —

Accounts payable and

other current liabilities 12 —

Deferred income taxes 765

$ (91) $ (72)

Our valuation allowance related to deferred tax assets

increased by $40 million in 1999 primarily due to additions

related to current and prior year operating losses and tempo-

rary differences in a number of foreign and state jurisdictions.

note 19