Pizza Hut 1999 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management’s discussion and analysis

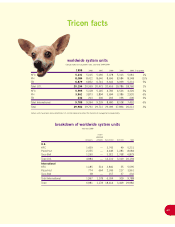

TRICON Global Restaurants, Inc. and Subsidiaries (collectively referred to as

“TRICON” or the “Company”) is comprised of the worldwide operations of KFC, Pizza

Hut and Taco Bell (the “Core Business(es)”) and is the world’s largest quick service

restaurant (“QSR”) company based on the number of system units. Separately, each

brand ranks in the top ten among QSR chains in U.S. system sales and units.

Our 9,000 plus international units make us the second largest QSR com-

pany outside the United States.

Throughout Management Discussion and Analysis (“MD&A”), we

make reference to ongoing operating profit which represents our

operating profit excluding the impact of our accounting and

human resources policy changes in 1999 (collectively, the

“accounting changes”), facility actions net gain and unusual

items. See Note 5 to the Consolidated Financial Statements for a

detailed discussion of these exclusions. We use ongoing operat-

ing profit as a key performance measure of our results of operations

for purposes of evaluating performance internally and as the base to

forecast future performance. Ongoing operating profit is not a measure

defined in generally accepted accounting principles (“GAAP”) and should not be con-

sidered in isolation or as a substitution for measures of performance in accordance

with GAAP.

In 1999, our international business accounted for 33% of system sales, 27% of total

revenues and 25% of operating profit before unallocated and corporate expenses,

gains and losses from foreign exchange, accounting changes, facility actions net gain

and unusual items. We anticipate that, despite the inherent risks and generally higher

general and administrative expenses required by international operations, we will con-

tinue to invest in key international markets with substantial growth potential.

TRICON became an independent, publicly owned company on October 6, 1997

(the “Spin-off Date”) via a tax free distribution of our Common Stock (the “Distribution”

or “Spin-off”) to the shareholders of our former parent, PepsiCo, Inc. (“PepsiCo”).

See Notes 2, 11 and 21 to the Consolidated Financial Statements. For purposes of this

MD&A, we include the worldwide operations of our Core Businesses and, through

their respective dates of disposal in 1997, our U.S. non-core businesses. These non-

core businesses consist of California Pizza Kitchen, Chevys Mexican Restaurant,

D’Angelo’s Sandwich Shops, East Side Mario’s and Hot ’n Now (collectively the “Non-

core Businesses”). Where significant to the discussion, we separately identify the

impact of the Non-core Businesses.

This MD&A should be read in conjunction with our Consolidated Financial Statements

on pages 38 – 65 and the Cautionary Statements on page 37. All Note references

herein refer to the Notes to the Consolidated Financial Statements on pages 42 – 65.

Tabular amounts are displayed in millions except per share and unit count amounts,

or as specifically identified.

Factors Affecting Comparability of 1999 Results to 1998

1997 Fourth Quarter Charge. In the fourth quarter of 1997, we recorded a

$530 million unusual charge ($425 million after-tax). The charge included estimates

for (1) costs of closing stores, primarily at Pizza Hut and internationally; (2) reduction

to fair market value, less costs to sell, of the carrying amounts of certain restaurants

we intended to refranchise; (3) impairment of certain restaurants intended to be used

in the business; (4) impairment of certain investments in unconsolidated affiliates to

be retained; and (5) costs of related personnel reductions.

24

management’s

discussion

and analysis

38

consolidated statement

of operations

39

consolidated statement

of cash flows

40

consolidated balance sheet

41

consolidated statement

of shareholders’ (deficit) equity

and comprehensive income

42

notes to consolidated

financial statements

66

management’s responsibility

for financial statements

& report of independent auditors

67

selected financial data

68

shareholder information

69

board of directors

and officers

introduction

24