Pizza Hut 1999 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

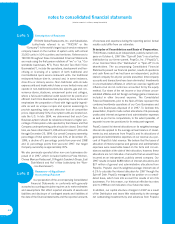

Our primary bank credit agreement, as amended in March

1999 and February 2000, is currently comprised of a senior,

unsecured Term Loan Facility and a $3 billion senior unse-

cured Revolving Credit Facility (collectively referred to as the

“Credit Facilities”) which mature on October 2, 2002. Our U.S.

Core Businesses have guaranteed the Credit Facilities.

Amounts borrowed under the Term Loan Facility that we repay

may not be reborrowed.

The Credit Facilities are subject to various covenants includ-

ing financial covenants relating to maintenance of specific

leverage and fixed charge coverage ratios. In addition, the

Credit Facilities contain affirmative and negative covenants

including, among other things, limitations on certain additional

indebtedness including guarantees of indebtedness, cash

dividends, aggregate non-U.S. investment and certain other

transactions, as defined in the agreement. Since October 6,

1997, we have complied with all covenants governing the

Credit Facilities. The Credit Facilities contain mandatory pre-

payment terms for certain capital market transactions and

refranchising of restaurants as defined in the agreement.

The amended Credit Facilities, under which at amendment we

voluntarily reduced our maximum borrowing under the

Revolving Credit Facility by $250 million, gives us additional flex-

ibility with respect to acquisitions and other permitted

investments and the repurchase of Common Stock or payment

of dividends. We deferred the Credit Facilities amendment costs

of approximately $2.6 million. These costs are being amortized

to interest expense over the remaining life of the Credit Facilities.

Additionally, an insignificant amount of our previously deferred

original Credit Facilities costs was written off in the second quar-

ter of 1999 as a result of this amendment.

In addition, on February 25, 2000, we entered into an agree-

ment to amend certain terms of our Credit Facilities. This

amendment will give us additional flexibility with respect to per-

mitted liens, restricted payments, other permitted investments

and transferring assets to foreign subsidiaries. We deferred the

Credit Facilities amendment costs of approximately $2 million.

These costs will be amortized into interest expense over the

remaining life of the Credit Facilities.

Interest on amounts borrowed is payable at least quarterly at

rates which are variable, based principally on the London

Interbank Offered Rate (“LIBOR”) plus a variable margin fac-

tor as defined in the credit agreement. At December 25, 1999

and December 26, 1998, the weighted average interest rate on

our variable rate debt was 6.6% and 6.2%, respectively, which

includes the effects of associated interest rate swaps and

collars. See Note 13 for a discussion of our use of derivative

instruments, our management of inherent credit risk and fair

value information related to debt and interest rate swaps.

At December 25, 1999, we had unused borrowings available

under the Revolving Credit Facility of $1.9 billion, net of out-

standing letters of credit of $152 million. Under the terms of

the Revolving Credit Facility, we may borrow up to $3.0 billion

until maturity less outstanding letters of credit. We pay a facil-

ity fee on the Revolving Credit Facility. The variable margin

factor and facility fee rate is determined based on the more

favorable of our leverage ratio or third-party senior debt ratings

as defined in the agreement. Facility fees accrued at

December 25, 1999 and December 26, 1998 were $1.1 mil-

lion and $1.7 million, respectively.

The initial borrowings of $4.55 billion under the Credit Facilities

at inception in October 1997 were primarily used to fund a

$4.5 billion Spin-off related payment to PepsiCo. We used the

remaining $50 million of the proceeds to provide cash collateral

securing certain obligations previously secured by PepsiCo, to

pay fees and expenses related to the Spin-off and the establish-

ment of the Credit Facilities and for general corporate purposes.

In 1997, we filed with the Securities and Exchange Commission

a shelf registration statement with respect to offerings of up to

$2 billion of senior unsecured debt. In May 1998, we issued

$350 million 7.45% Unsecured Notes due May 15, 2005 and

$250 million 7.65% Unsecured Notes due May 15, 2008

(collectively referred to as the “Notes”). We used the proceeds,

net of issuance costs, to reduce existing borrowings under the

Credit Facilities. We carry the Notes net of related discounts,

which are being amortized over the life of the Notes. The

unamortized discount for both issues was approximately

$1.0 million at December 25, 1999 and $1.1 million at

December 26, 1998. The amortization during 1999 and

1998 was not significant. Interest is payable May 15 and

November 15 and commenced on November 15, 1998. In

anticipation of the issuance of the Notes, we entered into

$600 million in treasury locks (the “Locks”) to reduce interest

rate sensitivity in pricing of the Notes. Concurrent with the

issuance of the Notes, the Locks were settled at a gain, which

is being amortized to interest expense over the life of the Notes.

The effective interest rate on the 2005 Notes and the 2008

Notes is 7.6% and 7.8%, respectively.

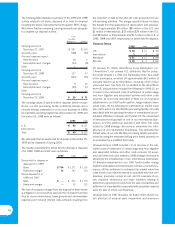

Interest expense on the short-term borrowings and long-term

debt was $218 million, $291 million and $290 million in 1999,

1998 and 1997, respectively. Interest expense in 1997

included the PepsiCo interest allocation of $188 million.