Pizza Hut 1999 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

counterparties, netting swap and forward rate payments within

contracts and limiting payments associated with the collars to

differences outside the collared range.

Open commodity future contracts and deferred gains and

losses at year-end 1999 and 1998, as well as gains and losses

recognized as part of cost of sales in 1999, 1998 and 1997,

were not significant.

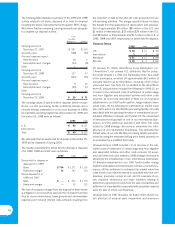

Fair Value. Excluding the financial instruments included in

the table below, the carrying amounts of our other financial

instruments approximate fair value.

The carrying amounts and fair values of TRICON’s financial

instruments are as follows:

1999 1998

Carrying Carrying

Amount Fair Value Amount Fair Value

Debt

Short-term borrowings

and long-term debt,

excluding

capital leases $ 2,411 $ 2,377 $ 3,415 $ 3,431

Debt-related derivative

instruments

Open contracts in an

(asset) liability

position — (3) 217

Debt, excluding

capital leases $ 2,411 $ 2,374 $ 3,417 $ 3,448

Guarantees $—$27$—$24

We estimated the fair value of debt, debt-related derivative

instruments and guarantees using market quotes and calcula-

tions based on market rates. See Note 2 for recently issued

accounting pronouncements relating to financial

instruments.

Pension Plans and Postretirement

Medical Benefits

We sponsor noncontributory defined benefit pen-

sion plans covering substantially all full-time U.S.

salaried employees and certain hourly employees and non-

contributory defined benefit pension plans covering certain

international employees. In addition, we provide postretirement

health care benefits to eligible retired employees and their

dependents, principally in the U.S. Salaried retirees who have

10 years of service and attain age 55 are eligible to participate

in the postretirement benefit plans; since 1994, these plans

have included retiree cost sharing provisions. We base bene-

fits generally on years of service and compensation or stated

amounts for each year of service.

The components of net periodic benefit cost are set forth

below:

Pension Benefits

1999 1998 1997

Service cost $20 $21 $18

Interest cost 22 20 17

Expected return on plan assets (24) (21) (19)

Amortization of prior service cost 1——

Amortization of transition

(asset) obligation —(2) (4)

Recognized actuarial loss —21

Net periodic benefit cost $ 19 $ 20 $ 13

Additional loss recognized due to:

Curtailment $4 $— $—

Special termination benefits —32

Postretirement Medical Benefits

1999 1998 1997

Service cost $2 $2 $2

Interest cost 332

Amortization of prior

service cost (2) (2) (2)

Net periodic benefit cost $3 $3 $2

Additional (gain) loss

recognized due to:

Curtailment $ (1) $ (3) $ —

Special termination benefits —1—

Prior service costs are amortized on a straight-line basis over

the average remaining service period of employees expected

to receive benefits.

note 14