Pizza Hut 1999 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 1999 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

charges included in our 1997 fourth quarter charge described

above; (2) charges to further reduce the carrying amounts of

the Non-core Businesses held for disposal to estimated market

value, less costs to sell; and (3) charges relating to the esti-

mated costs of settlement of certain wage and hour litigation

and the associated defense and other costs incurred.

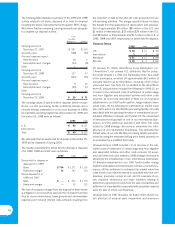

Franchise and License Fees

1999 1998 1997

Initial fees, including

renewal fees $71 $67 $86

Initial franchise fees included

in refranchising gains (45) (44) (41)

26 23 45

Continuing fees 697 604 533

$ 723 $ 627 $ 578

Initial fees in 1997 include $24 million of special KFC renewal

fees.

Other (Income) Expense

1999 1998 1997

Equity income from investments

in unconsolidated affiliates $ (19) $ (18) $ (8)

Foreign exchange net loss (gain) 3(6) 16

$ (16) $ (24) $ 8

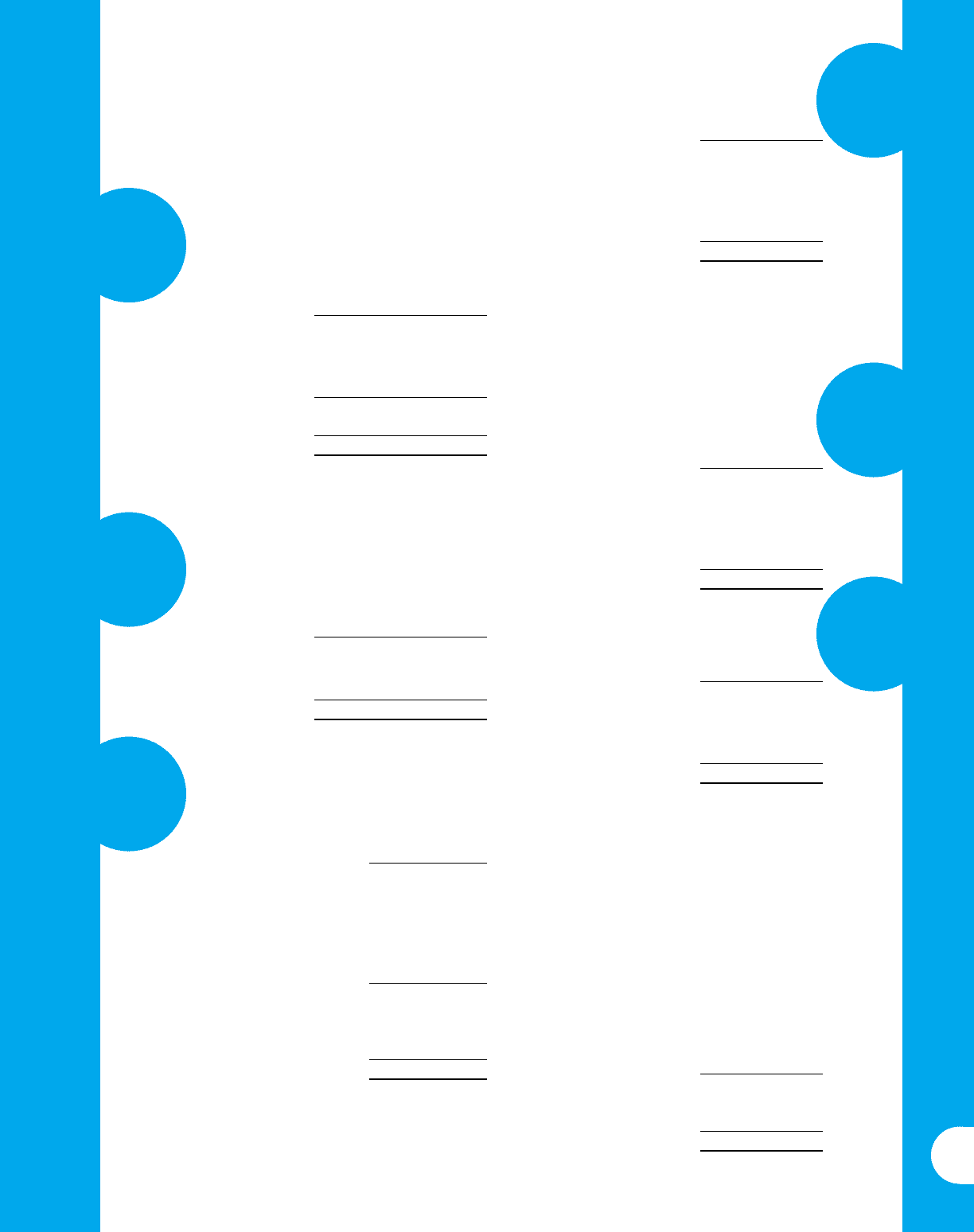

Property, Plant and Equipment, net

1999 1998

Land $572 $ 707

Buildings and

improvements 2,553 2,861

Capital leases,

primarily buildings 102 124

Machinery and equipment 1,598 1,795

4,825 5,487

Accumulated depreciation

and amortization (2,279) (2,491)

Disposal valuation allowances (15) (100)

$ 2,531 $ 2,896

Intangible Assets, net

1999 1998

Reacquired

franchise rights $ 326 $ 418

Trademarks and

other identifiable intangibles 124 123

Goodwill 77 110

$527 $ 651

In determining the above amounts, we have sub-

tracted accumulated amortization of $456 million for

1999 and $473 million for 1998. We have also sub-

tracted disposal valuation allowances of $18 million

for 1998.

Accounts Payable and Other

Current Liabilities

1999 1998

Accounts payable $ 375 $ 476

Accrued compensation

and benefits 281 310

Other accrued taxes 85 98

Other current liabilities 344 399

$ 1,085 $ 1,283

Short-term Borrowings and

Long-term Debt

1999 1998

Short-term Borrowings

Current maturities of

long-term debt $47$46

Other 70 50

$ 117 $96

Long-term Debt

Senior, unsecured

Term Loan Facility,

due October 2002 $ 774 $ 926

Senior, unsecured

Revolving Credit Facility,

expires October 2002 955 1,815

Senior, Unsecured Notes,

due May 2005 (7.45%) 352 352

Senior, Unsecured Notes,

due May 2008 (7.65%) 251 251

Capital lease obligations

(see Note 12) 97 117

Other, due through 2010

(6% – 11%) 921

2,438 3,482

Less current maturities of

long-term debt (47) (46)

$ 2,391 $ 3,436

note 9

note 10

note 6

note 7

note 11

note 8