Pitney Bowes 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

83

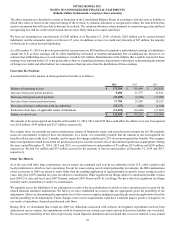

Stock Plans

We have a long-term incentive program whereby eligible employees may be granted restricted stock units, non-qualified stock options,

other stock-based awards, cash or any combination thereof. The Executive Compensation Committee of the Board of Directors administers

these plans. We settle employee stock compensation awards with treasury shares. At December 31, 2014, there were 19,715,336 shares

available for future grants under our long-term incentive program.

Restricted Stock Units

Restricted stock units (RSUs) entitle the holder to shares of common stock as the units vest, typically over a three or four year service

period. The fair value of the units is determined based on the stock price on the grant date less the present value of expected dividends.

At December 31, 2014, there was $13 million of unrecognized compensation cost related to RSUs that is expected to be recognized over

a weighted-average period of 1.8 years. The intrinsic value of RSUs outstanding at December 31, 2014 was $44 million. The intrinsic

value of RSUs vested during 2014, 2013 and 2012 was $18 million, $15 million and $11 million, respectively. The fair value of RSUs

vested during 2014, 2013 and 2012 was $10 million, $18 million and $13 million, respectively. During 2012, we granted 999,381 RSUs

at a weighted average fair value of $14.72.

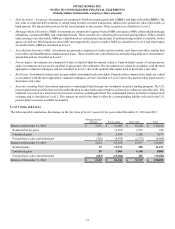

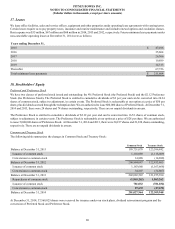

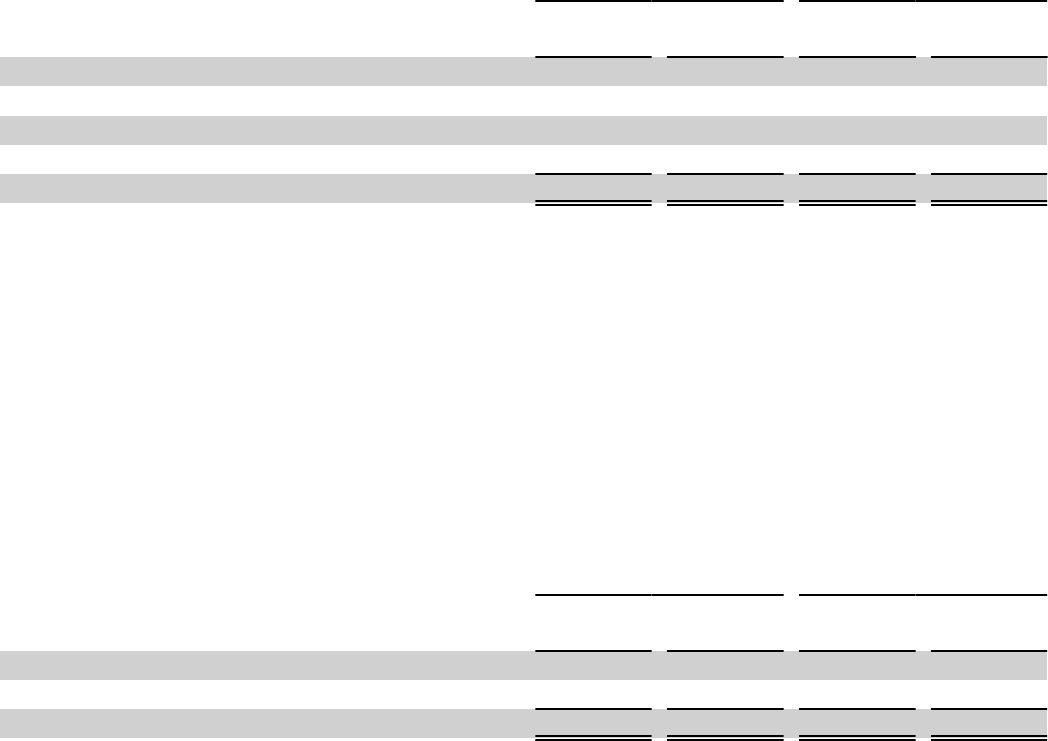

The following table summarizes information about restricted stock units during 2014 and 2013:

2014 2013

Shares

Weighted

average grant

date fair value Shares

Weighted

average grant

date fair value

Restricted stock units outstanding - beginning of the year 1,941,312 $ 13.19 1,909,160 $ 17.68

Granted 685,994 23.62 1,365,798 10.37

Vested (713,886) 14.50 (1,049,572) 17.52

Forfeited (94,181) 15.11 (284,074) 13.33

Restricted stock units outstanding - end of the year 1,819,239 $ 16.41 1,941,312 $ 13.19

Market Stock Units

Market stock units (MSUs) are stock awards that entitle the holder to receive a number of shares, adjusted for the attainment of certain

performance and market conditions. The award vests at the end of a three-year performance period and the actual number of shares the

recipient receives may range from 50% to 200% of the shares awarded. The expense for these awards, net of estimated forfeitures, is

recorded over the performance period based on the fair value of the award, which was determined on the grant date using a Monte Carlo

simulation model. At December 31, 2014, substantially all of expense for these awards has been recognized as the award fully vests in

February 2015. In February 2015, 259,531 shares were issued with an intrinsic value of $6 million.

There were no MSUs awarded during 2014 or 2013 and in 2012, we awarded 205,013 MSUs at a weighted average fair value of $17.91.

The fair value of MSUs was determined based on the following assumptions: expected dividend yield - 6.7%, expected stock price

volatility - 29.7%, and risk-free interest rate - 0.4%.

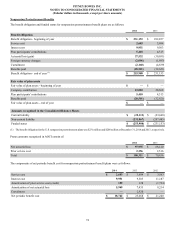

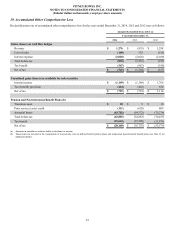

The following table summarizes information about market stock units during 2014 and 2013:

2014 2013

Shares

Weighted

average grant

date fair value Shares

Weighted

average grant

date fair value

Market stock units outstanding - beginning of the year 188,427 $ 17.91 198,145 $ 17.91

Forfeited ——

(9,718) 17.91

Market stock units outstanding - end of the year 188,427 $ 17.91 188,427 $ 17.91

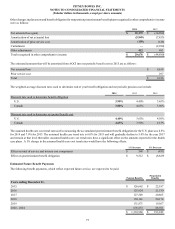

Performance Stock Units

Performance stock units (PSUs) are stock awards where the number of shares ultimately received by the employee is conditional upon

the attainment of certain performance targets as well as total shareholder return relative to peer companies. PSUs vest at the end of a

three-year service period and the actual number of shares awarded may range from 0% to 200% of the target award. However, the final

determination of the number of shares to be issued is made by our Board of Directors, who may reduce, but not increase, the ultimate