Pitney Bowes 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

78

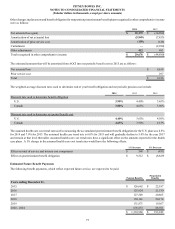

The above amounts are classified as current or long-term in the Consolidated Balance Sheets in accordance with the asset or liability to

which they relate or based on the expected timing of the reversal. A valuation allowance is recognized to reduce the total deferred tax

assets to an amount that will more-likely-than-not be realized. The valuation allowance relates primarily to certain foreign, state and local

net operating loss and tax credit carryforwards that are more likely than not to expire unutilized.

We have net operating loss carryforwards of $240 million as of December 31, 2014, of which, $210 million can be carried forward

indefinitely and the remainder expire over the next 15 years. In addition, we have tax credit carryforwards of $47 million, the majority

of which can be carried forward indefinitely.

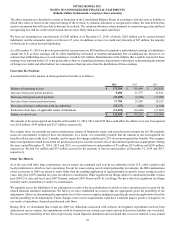

As of December 31, 2014 we have not provided for income taxes on $830 million of cumulative undistributed earnings of subsidiaries

outside the U.S. as these earnings will be either indefinitely reinvested or remitted substantially free of additional tax. However, we

estimate that withholding taxes on such remittances would be $12 million. Determination of the liability that would be incurred if these

earnings were remitted to the U.S. is not practicable as there is a significant amount of uncertainty with respect to determining the amount

of foreign tax credits and other indirect tax consequences that may arise from the distribution of these earnings.

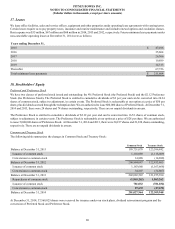

Uncertain Tax Positions

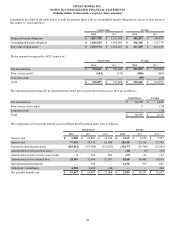

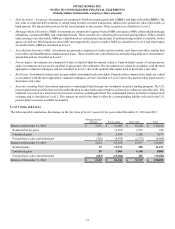

A reconciliation of the amount of unrecognized tax benefits is as follows:

2014 2013 2012

Balance at beginning of year $ 172,594 $ 151,098 $ 202,828

Increases from prior period positions 9,090 15,777 11,811

Decreases from prior period positions (33,692)(6,908) (17,985)

Increases from current period positions 17,704 23,549 28,255

Decreases relating to settlements with tax authorities (22,127)(482) (1,948)

Reductions from lapse of applicable statute of limitations (11,074)(10,440) (71,863)

Balance at end of year $ 132,495 $ 172,594 $ 151,098

The amount of the unrecognized tax benefits at December 31, 2014, 2013 and 2012 that would affect the effective tax rate if recognized

was $110 million, $148 million and $127 million, respectively.

On a regular basis, we conclude tax return examinations, statutes of limitations expire, and court decisions interpret tax law. We regularly

assess tax uncertainties in light of these developments. As a result, it is reasonably possible that the amount of our unrecognized tax

benefits will decrease in the next 12 months, and we expect this change could be up to 25% of our unrecognized tax benefits. We recognize

interest and penalties related to uncertain tax positions in our provision for income taxes or discontinued operations as appropriate. During

the years ended December 31, 2014, 2013 and 2012, we recorded interest and penalties of $2 million, $27 million and $(28) million,

respectively. We had $11 million and $37 million accrued for the payment of interest and penalties at December 31, 2014 and 2013,

respectively.

Other Tax Matters

As is the case with other large corporations, our tax returns are examined each year by tax authorities in the U.S., other countries and

local jurisdictions in which we have operations. Except for issues arising out of certain partnership investments, the IRS examinations

of tax years prior to 2009 are closed to audit. Other than the pending application of legal principles to specific issues arising in earlier

years, only post-2009 Canadian tax years are subject to examination. Other significant tax filings subject to examination include various

post-2004 U.S. state and local, post-2007 German, and post-2010 French and U.K. tax filings. We have other less significant tax filings

currently under examination or subject to examination.

We regularly assess the likelihood of tax adjustments in each of the tax jurisdictions in which we have operations and account for the

related financial statement implications. We believe we have established tax reserves that are appropriate given the possibility of tax

adjustments. However, determining the appropriate level of tax reserves requires judgment regarding the uncertain application of tax law

and the possibility of tax adjustments. Future changes in tax reserve requirements could have a material impact, positive or negative, on

our results of operations, financial position and cash flows.

During 2014, we determined that certain pre-2009 tax deductions associated with software development expenditures had not been

deducted on our tax returns, the expenditures could be claimed on our current year return and our deferred tax liability was overstated.

We assessed the materiality of this item on previously issued financial statements and concluded that it was not material to any annual