Pitney Bowes 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

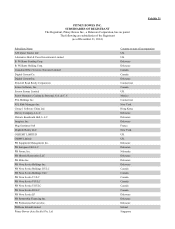

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

81

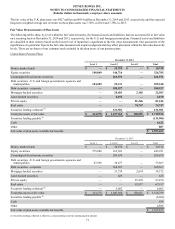

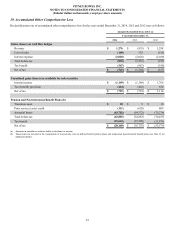

19. Accumulated Other Comprehensive Loss

Reclassifications out of accumulated other comprehensive loss for the years ended December 31, 2014, 2013 and 2012 were as follows:

Amounts Reclassified from AOCI (a)

Years Ended December 31,

2014 2013 2012

Gains (losses) on cash flow hedges

Revenue $ 1,276 $(835) $ 1,298

Cost of sales (140)332 (185)

Interest expense (2,028)(2,028) (2,028)

Total before tax (892)(2,531) (915)

Tax benefit (347)(987) (358)

Net of tax $(545)$(1,544) $ (557)

Unrealized gains (losses) on available for sale securities

Interest income $(1,149)$(1,140) $ 1,768

Tax (benefit) provision (424)(422) 654

Net of tax $(725)$(718) $ 1,114

Pension and Postretirement Benefit Plans (b)

Transition asset $10

$9$10

Prior service (costs) credit (111)(620) 809

Actuarial losses (43,702)(54,372) (75,274)

Total before tax (43,803)(54,983) (74,455)

Tax benefit (15,643)(19,228) (21,876)

Net of tax $(28,160)$(35,755) $ (52,579)

(a) Amounts in parentheses indicate debits (reductions) to income.

(b) These items are included in the computation of net periodic costs of defined benefit pension plans and nonpension postretirement benefit plans (see Note 13 for

additional details).