Pitney Bowes 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

13

ITEM 5. MARKET FOR THE COMPANY'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

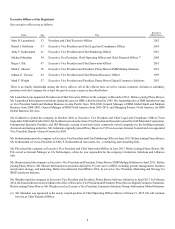

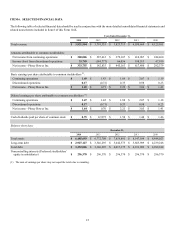

Our common stock is traded under the symbol "PBI" and is principally traded on the New York Stock Exchange (NYSE). At January 31,

2015, we had 18,689 common stockholders of record. The following table sets forth the high and low sales prices, as reported on the

NYSE, and the cash dividends paid per share of common stock, for the periods indicated.

Stock Price Dividend Per

ShareHigh Low

2014

First Quarter $ 26.63 $ 21.01 $ 0.1875

Second Quarter $ 28.23 $ 24.06 0.1875

Third Quarter $ 28.37 $ 24.63 0.1875

Fourth Quarter $ 25.68 $ 22.38 0.1875

$ 0.75

2013

First Quarter $ 15.56 $ 10.71 $ 0.3750

Second Quarter $ 16.43 $ 13.12 0.1875

Third Quarter $ 18.82 $ 13.76 0.1875

Fourth Quarter $ 24.18 $ 18.21 0.1875

$ 0.9375

Share Repurchases

We may periodically repurchase shares of our common stock to manage the dilution created by shares issued under employee stock

plans and for other purposes. During 2014, we repurchased 1,863,262 shares of our common stock in the open market at an average

share price of $26.84. There were no share repurchases during the fourth quarter of 2014. At December 31, 2014, we have authorization

to repurchase up to $100 million of our common stock.

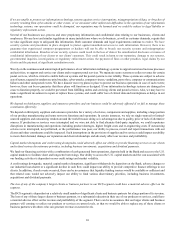

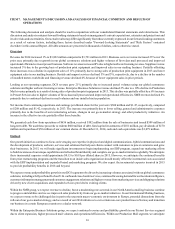

Stock Performance Graph

In 2014, we revised our peer group in response to our enhanced focus on software and technology. Our new peer group consists of

services, industrial and technology companies with revenues of $3 to $22 billion and market capitalization of $2 to $16 billion.

Our new peer group is comprised of: Alliance Data Systems Corporation, Diebold, Incorporated, DST Systems Inc., EchoStar Corp.,

Fidelity National Information Services, Inc., Fiserv, Inc., Harris Corporation, Iron Mountain Inc., Lexmark International Inc., NCR

Corp., Pitney Bowes Inc., R.R. Donnelley & Sons Company, Rockwell Automation Inc., Unisys Corporation, The Western Union

Company and Xerox Corporation.

Our prior peer group was comprised of: Agilent Technologies Inc., Alliance Data Systems Corporation, Avery Dennison Corp., Diebold,

Incorporated, DST Systems Inc., Fiserv, Inc., Harris Corporation, Iron Mountain Inc., Lexmark International Inc., NCR Corp., Pitney

Bowes Inc., R.R. Donnelley & Sons Company., Rockwell Automation Inc., Unisys Corporation and Xerox Corporation.

The accompanying graph and table below compare the most recent five-year share performance of Pitney Bowes, the Standard and

Poor's (S&P) 500 Composite Index, our new peer group and our prior peer group. On a total return basis, assuming reinvestment of

all dividends, $100 invested in Pitney Bowes, the S&P 500 Composite Index, the new peer group and the prior peer group on December

31, 2009 would have been worth $149, $205, $203 and $205, respectively, on December 31, 2014.

All information is based upon data independently provided to us by Standard & Poor's Corporation and is derived from their official

total return calculation. Total return for the S&P 500 Composite Index and each peer group is based on market capitalization, weighted

for each year. The stock price performance is not necessarily indicative of future stock price performance.