Pitney Bowes 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

62

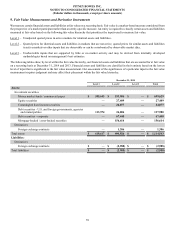

Derivative Instruments

The valuation of foreign exchange derivatives is based on a market approach using observable market data inputs, such as foreign currency

spot and forward rates and yield curves. As required by the fair value measurements guidance, we also incorporate counterparty credit

risk and our credit risk into the fair value measurement of our derivative assets and liabilities, respectively. We derive credit risk from

observable data in the credit default swap market.

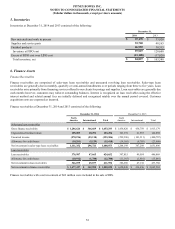

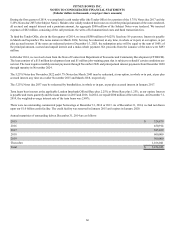

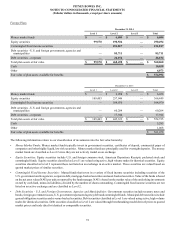

The fair value of our derivative instruments at December 31, 2014 and 2013 was as follows:

December 31,

Designation of Derivatives Balance Sheet Location 2014 2013

Derivatives designated as hedging instruments

Foreign exchange contracts Other current assets and prepayments $ 762 $ 546

Accounts payable and accrued liabilities —(526)

Derivatives not designated as hedging instruments

Foreign exchange contracts Other current assets and prepayments 624 812

Accounts payable and accrued liabilities (2,988)(2,483)

Total derivative assets 1,386 1,358

Total derivative liabilities (2,988)(3,009)

Total net derivative liability $(1,602)$ (1,651)

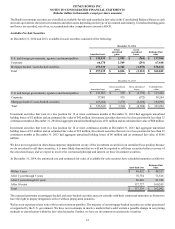

Foreign Exchange Contracts

We enter into foreign exchange contracts to mitigate the currency risk associated with the anticipated purchase of inventory between

affiliates and from third parties. These contracts are designated as cash flow hedges. The effective portion of the gain or loss on cash flow

hedges is included in AOCI in the period that the change in fair value occurs and is reclassified to earnings in the period that the hedged

item is recorded in earnings. At December 31, 2014 and 2013, we had outstanding contracts associated with these anticipated transactions

with a notional amount of $18 million and $26 million, respectively.

The amounts included in AOCI at December 31, 2014 will be recognized in earnings within the next 12 months. No amount of

ineffectiveness was recorded in earnings for these designated cash flow hedges.

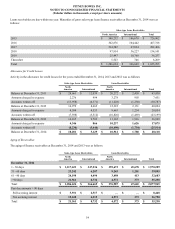

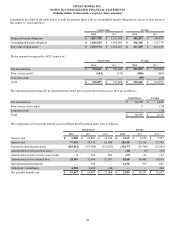

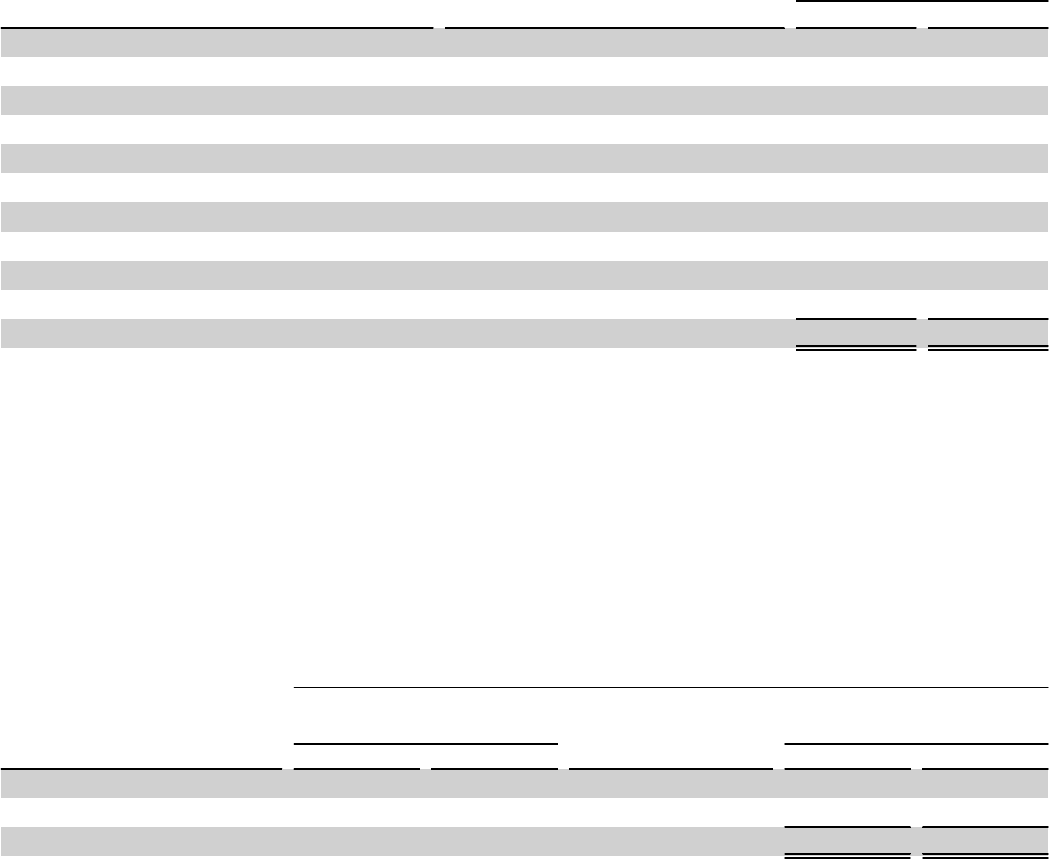

The following represents the results of cash flow hedging relationships for the years ended December 31, 2014 and 2013:

Year Ended December 31,

Derivative Gain (Loss)

Recognized in AOCI

(Effective Portion) Location of Gain (Loss)

(Effective Portion)

Gain (Loss) Reclassified

from AOCI to Earnings

(Effective Portion)

Derivative Instrument 2014 2013 2014 2013

Foreign exchange contracts $ 1,878 $ 241 Revenue $ 1,276 $ (835)

Cost of sales (140)332

$ 1,136 $ (503)

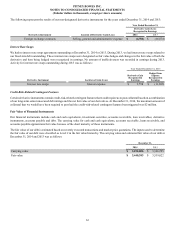

We also enter into foreign exchange contracts to minimize the impact of exchange rate fluctuations on short-term intercompany loans

and related interest that are denominated in a foreign currency. The revaluation of the intercompany loans and interest and the mark-to-

market adjustment on the derivatives are both recorded in earnings. All outstanding contracts at December 31, 2014 mature over the next

13 months.