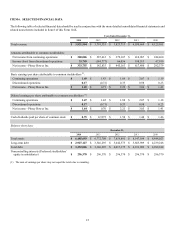

Pitney Bowes 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

The following discussion and analysis should be read in conjunction with our consolidated financial statements and related notes. This

discussion and analysis contains forward-looking statements based on management's current expectations, estimates and projections and

involve risks and uncertainties. Our actual results may differ significantly from those currently expressed in our forward-looking statements

as a result of various factors, including those factors described under "Forward-Looking Statements" and "Risk Factors" contained

elsewhere in this Annual Report. All table amounts are presented in thousands of dollars, unless otherwise stated.

Overview

Revenue for 2014 increased 1% to $3,822 million compared to $3,791 million in 2013. Business service revenue increased 23% over the

prior year, primarily due to growth in our global ecommerce solutions and higher volumes of first-class mail processed and improved

operational efficiencies in our presort business. Software revenue increased 8% due to higher software licensing revenue. Supplies revenue

increased 5% due to the growing base of production print equipment and improved sales in our mailing business. Partially offsetting

these increases was a decline in equipment sales of 11% primarily due to strong sales of production print equipment in 2013 and lower

equipment sales in our mailing business. Rentals and support services declined 5% and 3%, respectively, due to a decline in the number

of installed meters worldwide and financing revenue declined 4% because of lower equipment sales in prior periods.

Looking at our operating segments, DCS revenue grew 21% primarily due to increased parcel volumes using our global ecommerce

solutions and higher software licensing revenue. Enterprise Business Solutions revenue declined 2% due to a 10% decline in Production

Mail revenue primarily as a result of strong sales of production print equipment in 2013. This decline was partially offset by a 6% increase

in Presort Services due to higher volumes of first-class mail processed and improved operational efficiencies. SMB revenue declined 4%

primarily due to continued declines in mail volumes and our installed meter population.

Net income from continuing operations and earnings per diluted share for the year were $300 million and $1.47, respectively, compared

to $288 million and $1.42, respectively, in 2013. The increase was primarily due to lower selling, general and administrative expenses

primarily due to the benefits of our restructuring actions, changes in our go-to-market strategy and other productivity initiatives. An

increase in the effective tax rate partially offset these benefits.

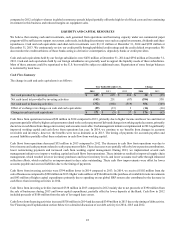

We generated cash flow from operations of $656 million, received $102 million from the sale of businesses and issued $509 million of

long-term debt. We used these proceeds to redeem $600 million of debt, fund capital investments of $181 million, pay dividends of $170

million and repurchased $50 million of our common shares. At December 31, 2014, cash and cash equivalents was $1,079 million.

Outlook

Our growth initiatives continue to focus on leveraging our expertise in physical and digital communications, hybrid communications and

the development of products, software, services and solutions that help our clients connect with customers to power commerce and grow

their businesses. In 2015, we will make significant investments to begin implementing our ERP program, expand our marketing efforts

to build awareness of our unique capabilities and refreshed brand identity and complete our go-to-market initiatives globally. We anticipate

these incremental expenses could approximate $0.15 to $0.18 per diluted share in 2015. However, we anticipate the continued benefits

from prior restructuring programs and the transition to an inside sales organization should mostly offset the incremental costs associated

with the ERP implementation and expanded brand and marketing programs. We also expect the incremental expenses incurred in 2015

to provide profitability benefits in 2016 and beyond.

We expect revenue and profitability growth in our DCS segment to be driven by increasing volumes associated with our global ecommerce

solutions, including a full year benefit of our U.K. outbound cross-border services, continued licensing demand for our location intelligence,

customer information management and customer engagement solutions and higher revenue from marketing services and shipping solutions

driven by new client acquisitions and expanded services provided to existing clients.

Within the SMB group, we expect revenue to decline, but at a moderating rate as trends in our North America mailing business continue

to progress and stabilize and we see improved sales productivity from our go-to-market initiatives. In our International Mailing business,

we expect revenue to be challenged due in part to the uncertain macro-economic environment in Europe, potential distractions from the

roll-out of our go-to-market strategy, and as a result of our 2014 initiatives to exit certain non-core product lines in Norway and transition

our business in certain European countries to a dealer network.

Within the Enterprise Business Solutions group, we expect continued revenue and profitability growth in our Presort Services segment

due to client expansion, higher processed mail volumes and operational efficiencies. Within our Production Mail segment, we anticipate