Pitney Bowes 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

65

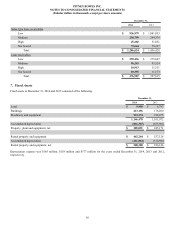

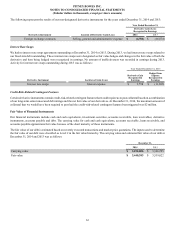

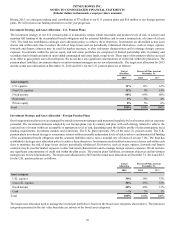

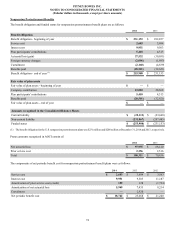

Other Plans

Other plans include workforce reduction actions taken in 2012 and strategic transformation initiatives announced in 2009 that were

implemented over a three year period. The table below shows the activity in our restructuring reserves for these other plans for the years

ended December 31, 2014, 2013 and 2012 and includes amounts for both continuing operations and discontinued operations.

Severance and

benefits costs

Other exit

costs Total

Balance at December 31, 2011 $ 105,036 $ 14,075 $ 119,111

Expenses, net 24,992 (1,627) 23,365

Cash payments (67,488)(7,230) (74,718)

Balance at December 31, 2012 62,540 5,218 67,758

Expenses, net (7,076) — (7,076)

Cash payments (39,333)(4,826) (44,159)

Balance at December 31, 2013 16,131 392 16,523

Expenses, net (8,405) — (8,405)

Cash payments (3,995)(203) (4,198)

Balance at December 31, 2014 $ 3,731 $ 189 $ 3,920

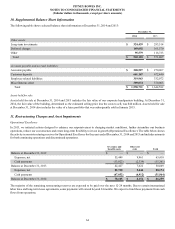

Asset Impairments

In 2013, we entered into an agreement to sell our corporate headquarters building and recorded a non-cash impairment charge of $26

million to write-down the carrying value of the building to its fair value. The fair value was determined based on the estimated selling

price less the costs to sell. The inputs used to determine the fair value were classified as Level 3. The impairment charge was included

as restructuring charges and asset impairments, net in the Consolidated Statements of Income.

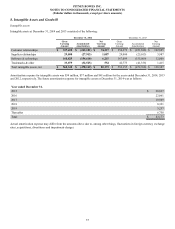

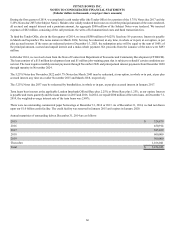

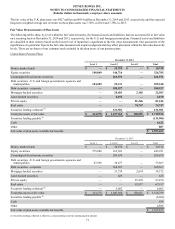

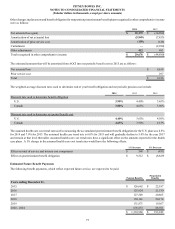

12. Debt

December 31,

Interest rate 2014 2013

Notes due March 2015 5.0% $ 274,879 $ 274,879

Notes due January 2016 4.75% 370,914 370,914

Notes due September 2017 5.75% 385,109 500,000

Notes due March 2018 5.6% 250,000 250,000

Notes due May 2018 4.75% 350,000 350,000

Notes due March 2019 6.25% 300,000 300,000

Notes due November 2022 5.25% 110,000 110,000

Notes due March 2024 4.625% 500,000 —

State of CT DECD loan due November 2024 2.0% 16,000 —

Notes due January 2037 5.25% 115,041 500,000

Notes due March 2043 6.7% 425,000 425,000

Term loans Variable 130,000 230,000

Principal amount 3,226,943 3,310,793

Less: unamortized discount 6,653 5,158

Plus: unamortized interest rate swap proceeds 31,716 40,660

Total debt 3,252,006 3,346,295

Less: current portion long-term debt 324,879 —

Long-term debt $ 2,927,127 $ 3,346,295