Pitney Bowes 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

82

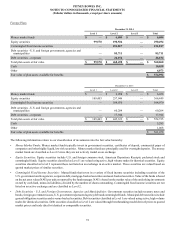

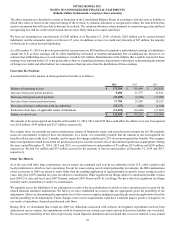

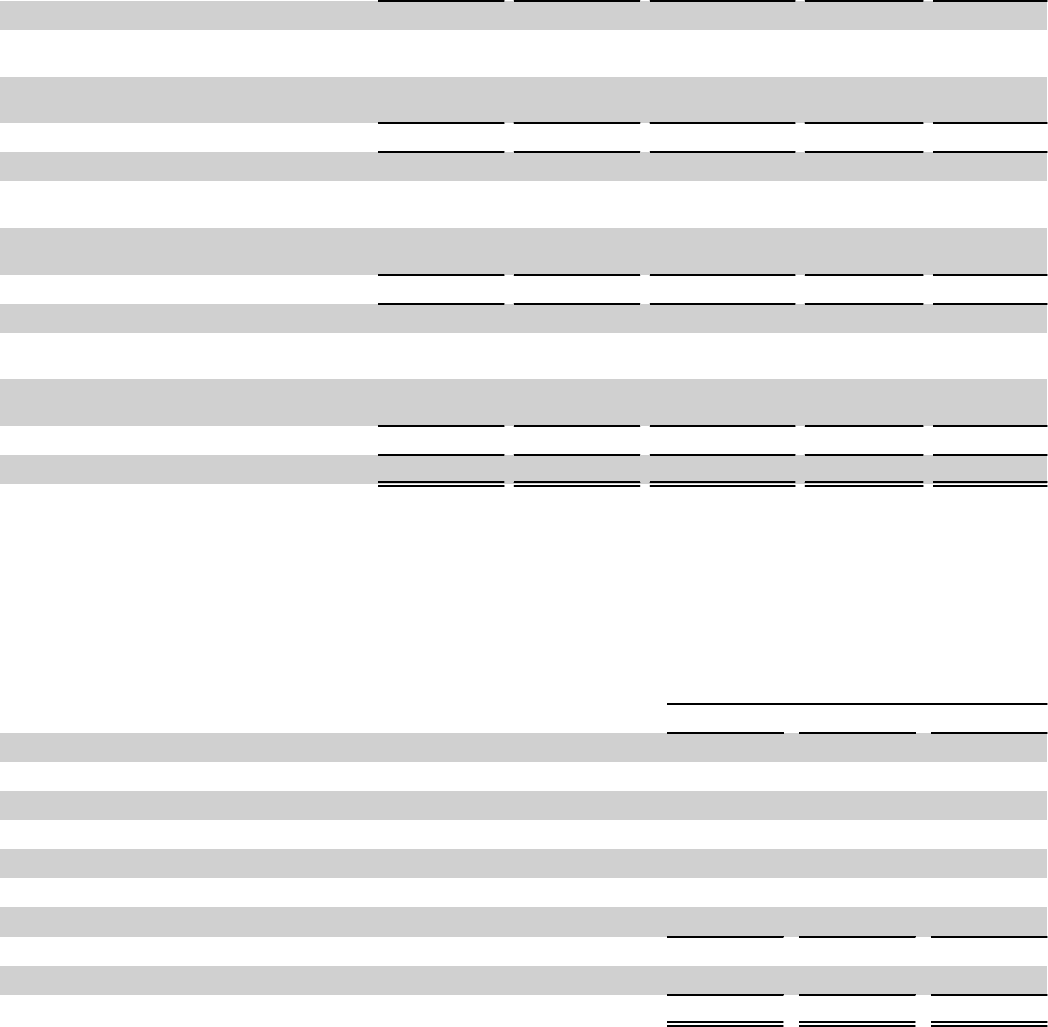

Changes in accumulated other comprehensive loss for the years ended December 31, 2014, 2013 and 2012 were as follows:

Gains (losses) on

cash flow hedges

Unrealized gains

(losses) on

available for sale

securities

Defined benefit

pension plans and

nonpension

postretirement

benefit plans

Foreign

currency items Total

Balance January 1, 2012 $(8,438) $ 4,387 $ (741,546) $ 83,952 $ (661,645)

Other comprehensive income (loss) before

reclassifications (a) 104 1,240 (70,232)(2,702) (71,590)

Amounts reclassified from accumulated other

comprehensive income (loss) (a), (b) 557 (1,114) 52,579 — 52,022

Net other comprehensive income (loss) 661 126 (17,653)(2,702) (19,568)

Balance at December 31, 2012 (7,777) 4,513 (759,199) 81,250 (681,213)

Other comprehensive income (loss) before

reclassifications (a) (147)(7,000) 122,023 (39,489) 75,387

Amounts reclassified from accumulated other

comprehensive income (loss) (a), (b), (c) 1,544 718 35,755 (6,747) 31,270

Net other comprehensive income (loss) 1,397 (6,282) 157,778 (46,236) 106,657

Balance at December 31, 2013 (6,380)(1,769)(601,421) 35,014 (574,556)

Other comprehensive income (loss) before

reclassifications (a) 1,146 4,010 (212,818)(89,584) (297,246)

Amounts reclassified from accumulated other

comprehensive income (loss) (a), (b), (c) 545 725 28,160 (3,784) 25,646

Net other comprehensive income (loss) 1,691 4,735 (184,658)(93,368) (271,600)

Balance at December 31, 2014 $(4,689) $ 2,966 $ (786,079)$ (58,354) $ (846,156)

(a) Amounts are net of tax. Amounts in parentheses indicate debits to AOCI.

(b) See table above for additional details of these reclassifications.

(c) Foreign currency item amount represents the recognition of deferred translation upon the sale of certain businesses.

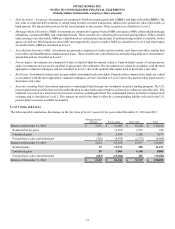

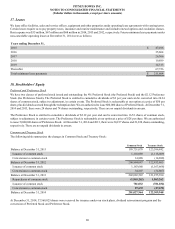

20. Stock-Based Compensation Plans

The following table shows stock-based compensation expense included in the Consolidated Statements of Income:

Years Ended December 31,

2014 2013 2012

Cost of equipment sales $ 1,004 $ 886 $ 1,212

Cost of software 95 ——

Cost of support services 607 382 522

Cost of business services 694 527 721

Selling, general and administrative 14,028 11,099 15,176

Research and development 1,018 435 596

Discontinued operations (1) —1,592 —

Stock-based compensation expense 17,446 14,921 18,227

Tax benefit (5,776)(5,759) (6,061)

Stock-based compensation expense, net of tax $ 11,670 $ 9,162 $ 12,166

(1) Amount represents the expense related to the immediate vesting of restricted stock units and stock options held by employees of PBMS upon the sale of the business.