Pitney Bowes 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

We believe that the valuation techniques and the approach utilized to develop the underlying assumptions are appropriate in estimating

the fair value of our stock-based awards. If factors change and we use different assumptions, our stock-based compensation expense

could be different in the future. Estimates of fair value are not intended to predict actual future events or the value ultimately realized by

employees who receive equity awards, and subsequent events are not indicative of the reasonableness of the original estimates of fair

value. In addition, we are required to estimate the expected forfeiture rate and recognize expense only for those shares expected to vest.

If our actual forfeiture rate is materially different from our estimate, stock-based compensation expense could be significantly different

from what we have recorded in the current period.

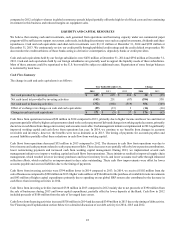

Restructuring

We have undertaken restructuring actions which require management to utilize certain estimates related to the amount and timing of

expenses. If the actual amounts differ from our estimates, the amount of the restructuring charges could be impacted. On a quarterly basis,

we update our estimates of future remaining obligations and costs associated with all restructuring actions and compare these updated

estimates to our current restructuring reserves, and make adjustments if necessary.

Loss contingencies

In the ordinary course of business, we are routinely defendants in, or party to, a number of pending and threatened legal actions. On a

quarterly basis, we review the status of each significant matter and assess the potential financial exposure. If the potential loss from any

claim or legal action is considered probable and can be reasonably estimated, we establish a liability for the estimated loss. The assessment

of the ultimate outcome of each claim or legal action and the determination of the potential financial exposure requires significant

judgment. Estimates of potential liabilities for claims or legal actions are based only on information that is available at that time. As

additional information becomes available, we may revise our estimates, and these revisions could have a material impact on our results

of operations and financial position.

Legal and Regulatory Matters

See Legal Proceedings in Item 3 for information regarding our legal proceedings and Other Tax Matters in Note 14 to the Consolidated

Financial Statements for regulatory matters regarding our tax returns.

Foreign Currency Exchange

During 2014, we derived 28% of our consolidated revenue from operations outside the United States. The functional currency for most

of our foreign operations is the local currency. Our largest foreign currency exposures are to the British pound, Euro, Canadian dollar,

Australian dollar and Japanese Yen (see Note 9 to the Consolidated Financial Statements for information regarding our foreign exchange

derivative instruments). Changes in the value of the U.S. dollar relative to the currencies of countries in which we operate impact our

reported assets, liabilities, revenue and expenses. Exchange rate fluctuations can also impact the settlement of intercompany receivables

and payables between our subsidiaries in different countries. For the years ended December 31, 2014, 2013 and 2012, currency rate

movements did not have a significant impact on our revenue, decreasing revenue 0.4%, 0.4% and 1.1%, respectively. However, in recent

months, we have seen a considerable strengthening of the U.S. dollar. A continuing strong U.S. dollar could adversely affect our reported

revenues and profitability, both from a translation perspective as well as a competitive perspective, as the cost of our international

competitors' products and solutions improves relative to our products and solutions. A strengthening dollar could also affect the demand

for U.S. goods sold to consumers in other countries through our global ecommerce solutions.