Pitney Bowes 2014 Annual Report Download - page 53

Download and view the complete annual report

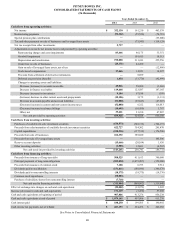

Please find page 53 of the 2014 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

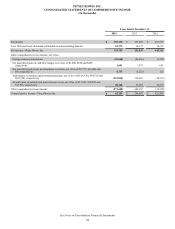

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

43

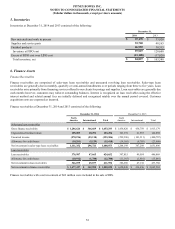

deems the account to be uncollectible. We believe that our accounts receivable credit risk is limited because of our large number of

customers, small account balances for most of our customers and customer geographic and industry diversification.

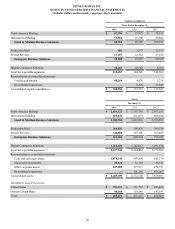

Finance Receivables and Allowance for Credit Losses

Finance receivables are composed of sales-type lease receivables and unsecured revolving loan receivables. We estimate our finance

receivable risks and provide an allowance for credit losses accordingly. We evaluate the adequacy of the allowance for credit losses based

on historical loss experience, the nature and volume of our portfolios, adverse situations that may affect a customer's ability to pay,

prevailing economic conditions and our ability to manage the collateral and make adjustments to the allowance as necessary. This

evaluation is inherently subjective and actual results may differ significantly from estimated reserves.

We establish credit approval limits based on the credit quality of the customer and the type of equipment financed. Our policy is to

discontinue revenue recognition for lease receivables that are more than 120 days past due and for unsecured loan receivables that are

more than 90 days past due. We resume revenue recognition when customer payments reduce the account balance aging to 60 days or

less past due. Finance receivables deemed uncollectible are written off against the allowance after all collection efforts have been exhausted

and management deems the account to be uncollectible. We believe that our finance receivable credit risk is limited because of our large

number of customers, small account balances for most of our customers and customer geographic and industry diversification.

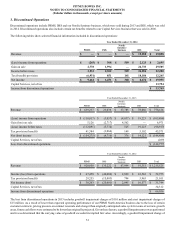

Inventories

Inventories are stated at the lower of cost or market. Cost is determined on the last-in, first-out (LIFO) basis for most U.S. inventories

and on the first-in, first-out (FIFO) basis for most non-U.S. inventories.

Fixed Assets

Property, plant and equipment and rental equipment are stated at cost and depreciated principally using the straight-line method over

their estimated useful lives, which are up to 50 years for buildings, three to 15 years for machinery and equipment, four to six years for

rental equipment and three to five years for computer equipment. Major improvements which add to productive capacity or extend the

life of an asset are capitalized while repairs and maintenance are charged to expense as incurred. Leasehold improvements are amortized

over the shorter of the estimated useful life or the remaining lease term.

We capitalize certain costs of software developed for internal use. Capitalized costs include purchased materials and services, payroll

and personnel-related costs and interest. The cost of internally developed software is amortized on a straight-line basis over its estimated

useful life, principally three to 10 years.

Fully depreciated assets are retained in fixed assets and accumulated depreciation until they are removed from service. In the case of

disposals, assets and related accumulated depreciation are removed from the accounts and the net amounts, less proceeds from disposal,

are included in earnings.

Intangible assets

Finite-lived intangible assets are amortized over their estimated useful lives, principally three to 15 years, using either the straight-line

method or an accelerated attrition method.

Costs incurred for the development of software to be sold, leased or otherwise marketed

Costs incurred for the development of software to be sold, leased or otherwise marketed are expensed as incurred until technological

feasibility has been established, at which time such costs are capitalized until the product is available for general release to the public.

Capitalized software development costs include purchased materials and services and payroll and personnel-related costs attributable to

programmers, software engineers, quality control and field certifiers, and are amortized on a straight-line basis over three to five years.

We did not capitalize any software development costs in 2014 and capitalized $4 million of software development costs in 2013.

Amortization of capitalized software development costs was $3 million, $8 million and $10 million for the years ended December 31,

2014, 2013 and 2012, respectively. Capitalized software development costs included in other assets in the Consolidated Balance Sheets

at December 31, 2014 and 2013 were $2 million and $5 million, respectively.

Research and Development Costs

Research and product development costs include engineering costs related to research and product development activities and are expensed

as incurred.

Impairment Review for Long-lived and Finite-Lived Intangible Assets

Long-lived assets and finite-lived intangible assets are reviewed for impairment whenever events or changes in circumstances indicate

that the carrying amount may not be fully recoverable. The related estimated future undiscounted cash flows expected to result from the

use of the asset and its eventual disposition is compared to the carrying amount. If the sum of the expected cash flows is less than the