Pitney Bowes 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

67

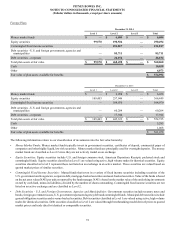

13. Retirement Plans and Postretirement Medical Benefits

We provide certain retirement benefits to our U.S. employees hired prior to January 1, 2005 and to eligible employees outside the U.S.

under various defined benefit retirement plans. Benefit accruals under most of our defined benefit plans, including our two largest U.S.

pension plans, our U.K. pension plans and Canadian pension plans, have been frozen.

We also provide certain employer subsidized health care and employer provided life insurance benefits in the U.S. and Canada to eligible

retirees and their dependents. Employees hired before January 1, 2005 in the U.S. and April 1, 2005 in Canada become eligible for retiree

medical benefits after reaching age 55 and with the completion of the required service period. The cost of these benefits is recognized

over the period the employee provides credited service to the company.

Retirement Plans

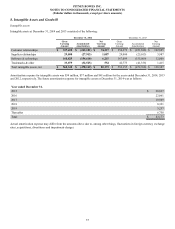

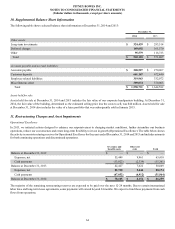

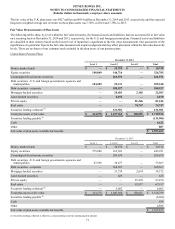

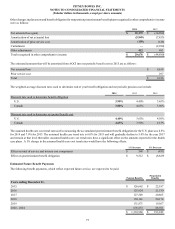

The benefit obligations and funded status of defined benefit pension plans are as follows:

United States Foreign

2014 2013 2014 2013

Accumulated benefit obligation $ 1,866,914 $ 1,611,457 $ 698,176 $ 659,602

Projected benefit obligation

Benefit obligation - beginning of year $ 1,622,591 $ 1,822,677 $ 672,773 $ 663,826

Service cost 6,908 13,981 3,565 6,272

Interest cost 77,655 74,370 28,518 27,365

Plan participants' contributions ——59 496

Actuarial loss (gain) 306,718 (154,996)89,695 (1,224)

Foreign currency changes ——(52,750)(204)

Settlement / curtailment (16,867)(3,275)—(86)

Special termination benefits —548 1,238 935

Benefits paid (128,829)(130,714)(27,811)(24,607)

Benefit obligation - end of year $ 1,868,176 $ 1,622,591 $ 715,287 $ 672,773

Fair value of plan assets available for benefits

Fair value of plan assets - beginning of year $ 1,523,679 $ 1,583,932 $ 561,078 $ 509,331

Actual return on plan assets 195,946 60,569 67,306 62,777

Company contributions 19,534 9,892 15,323 14,509

Plan participants' contributions ——59 496

Settlement / curtailment (16,867)———

Foreign currency changes ——(40,963)(1,428)

Benefits paid (128,829)(130,714)(27,811)(24,607)

Fair value of plan assets - end of year $ 1,593,463 $ 1,523,679 $ 574,992 $ 561,078

Amounts recognized in the Consolidated Balance Sheets

Non-current asset $ 300 $ 195 $ 5,813 $ 11,951

Current liability (6,590)(18,097)(1,008)(1,051)

Non-current liability (268,423)(81,010)(145,100)(122,595)

Funded status $(274,713)$(98,912)$(140,295)$ (111,695)

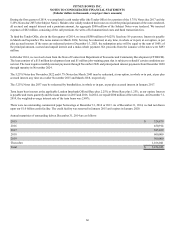

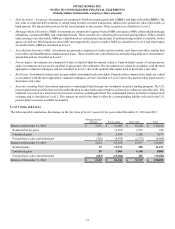

In October 2014, the Society of Actuaries published updated mortality tables for U.S. plans (RP-2014) and an updated improvement scale

(MP-2014), which both reflect improved longevity. We have historically utilized the Society of Actuaries' published mortality data in our

plan assumptions. Accordingly, we adopted RP-2014 and MP-2014 for purposes of measuring the pension obligation at year end. The

change to the mortality assumption increased the year-end pension obligation by $110 million.