Pitney Bowes 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

64

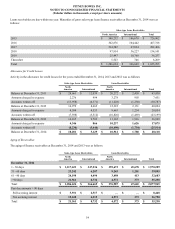

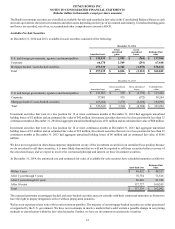

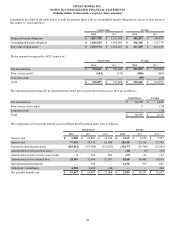

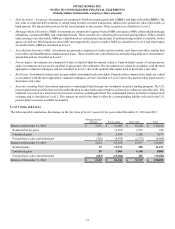

10. Supplemental Balance Sheet Information

The following table shows selected balance sheet information at December 31, 2014 and 2013:

December 31,

2014 2013

Other assets:

Long-term investments $ 324,439 $ 293,514

Deferred charges 149,092 161,570

Other 95,579 116,723

Total $ 569,110 $ 571,807

Accounts payable and accrued liabilities:

Accounts payable $ 268,527 $ 270,067

Customer deposits 661,167 672,440

Employee related liabilities 319,963 332,072

Miscellaneous other 309,074 370,003

Total $ 1,558,731 $ 1,644,582

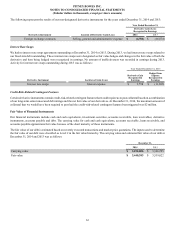

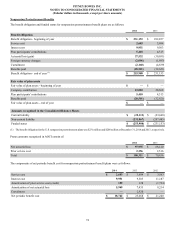

Assets held for sale

Assets held for sale at December 31, 2014 and 2013 includes the fair value of our corporate headquarters building. At December 31,

2014, the fair value of the building, determined as the estimated selling price less the costs to sell, was $44 million. Assets held for sale

at December 31, 2014 also includes the value of a lease portfolio that was subsequently sold in January 2015.

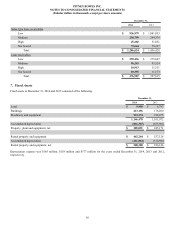

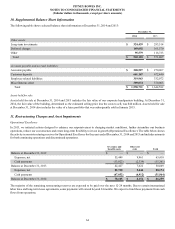

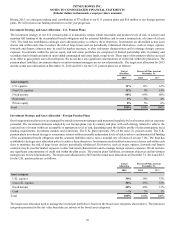

11. Restructuring Charges and Asset Impairments

Operational Excellence

In 2013, we initiated actions designed to enhance our responsiveness to changing market conditions, further streamline our business

operations, reduce our cost structure and create long-term flexibility to invest in growth (Operational Excellence). The table below shows

the activity in our restructuring reserves for Operational Excellence for the years ended December 31, 2014 and 2013 and includes amounts

for both continuing operations and discontinued operations.

Severance and

benefits costs

Other exit

costs Total

Balance at December 31, 2012 $ — $ — $ —

Expenses, net 55,449 9,961 65,410

Cash payments (13,022)(2,339) (15,361)

Balance at December 31, 2013 42,427 7,622 50,049

Expenses, net 82,730 5,444 88,174

Cash payments (47,052)(4,912) (51,964)

Balance at December 31, 2014 $ 78,105 $ 8,154 $ 86,259

The majority of the remaining restructuring reserves are expected to be paid over the next 12-24 months. Due to certain international

labor laws and long-term lease agreements, some payments will extend beyond 24 months. We expect to fund these payments from cash

flows from operations.