Pitney Bowes 2014 Annual Report Download - page 57

Download and view the complete annual report

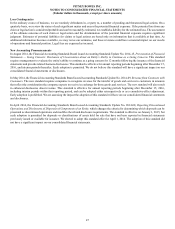

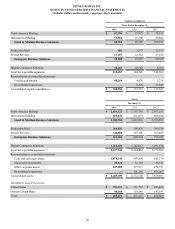

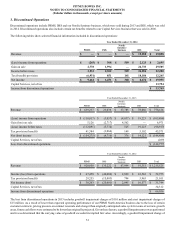

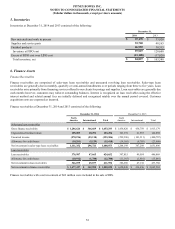

Please find page 57 of the 2014 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

47

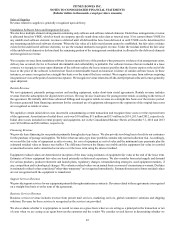

Loss Contingencies

In the ordinary course of business, we are routinely defendants in, or party to, a number of pending and threatened legal actions. On a

quarterly basis, we review the status of each significant matter and assess the potential financial exposure. If the potential loss from any

claim or legal action is considered probable and can be reasonably estimated, we establish a liability for the estimated loss. The assessment

of the ultimate outcome of each claim or legal action and the determination of the potential financial exposure requires significant

judgment. Estimates of potential liabilities for claims or legal actions are based only on information that is available at that time. As

additional information becomes available, we may revise our estimates, and these revisions could have a material impact on our results

of operations and financial position. Legal fees are expensed as incurred.

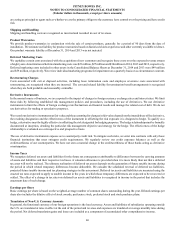

New Accounting Pronouncements

In August 2014, the Financial Accounting Standards Board issued Accounting Standards Update No. 2014-15, Presentation of Financial

Statements — Going Concern: Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. This standard

requires management to evaluate the entity's ability to continue as a going concern for 12 months following the issuance of the financial

statements and provide related footnote disclosures. This standard is effective for annual reporting periods beginning after December 15,

2016, and interim periods thereafter. Early adoption is permitted. We do not believe this standard will have a significant impact on our

consolidated financial statements or disclosures.

In May 2014, the Financial Accounting Standards Board issued Accounting Standards Update No. 2014-09, Revenue from Contracts with

Customers. The new standard requires companies to recognize revenue for the transfer of goods and services to customers in amounts

that reflect the consideration the company expects to receive in exchange for those goods and services. The new standard will also result

in enhanced disclosures about revenue. This standard is effective for annual reporting periods beginning after December 15, 2016,

including interim periods within that reporting period, and can be adopted either retrospectively or as a cumulative-effect adjustment.

Early adoption is prohibited. We are assessing the impact the adoption of this standard will have on our consolidated financial statements

and disclosures.

In April 2014, the Financial Accounting Standards Board issued Accounting Standards Update No. 2014-08, Reporting Discontinued

Operations and Disclosures of Disposals of Components of an Entity, which changes the criteria for determining which disposals can be

presented as discontinued operations and modifies the related disclosure requirements. The standard is effective on January 1, 2015, but

early adoption is permitted for disposals or classifications of assets held for sale that have not been reported in financial statements

previously issued or available for issuance. We elected to adopt this standard effective April 1, 2014. The adoption of this standard did

not have a significant impact on our consolidated financial statements.