Pitney Bowes 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

53

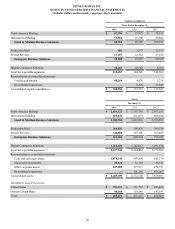

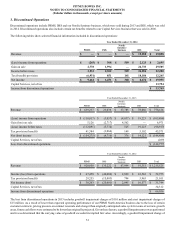

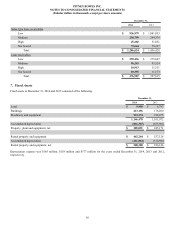

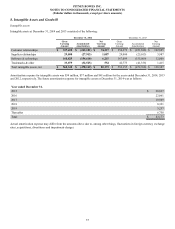

5. Inventories

Inventories at December 31, 2014 and 2013 consisted of the following:

December 31,

2014 2013

Raw materials and work in process $ 37,175 $ 33,920

Supplies and service parts 33,760 48,165

Finished products 26,992 38,515

Inventory at FIFO cost 97,927 120,600

Excess of FIFO cost over LIFO cost (13,100)(17,020)

Total inventory, net $ 84,827 $ 103,580

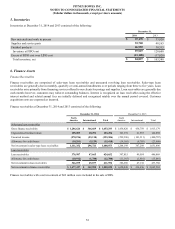

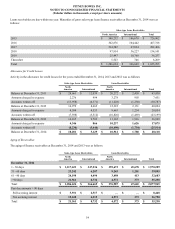

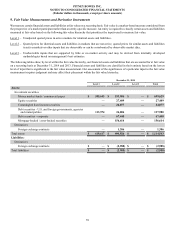

6. Finance Assets

Finance Receivables

Finance receivables are comprised of sales-type lease receivables and unsecured revolving loan receivables. Sales-type lease

receivables are generally due in monthly, quarterly or semi-annual installments over periods ranging from three to five years. Loan

receivables arise primarily from financing services offered to our clients for postage and supplies. Loan receivables are generally due

each month; however, customers may rollover outstanding balances. Interest is recognized on loan receivables using the effective

interest method and related annual fees are initially deferred and recognized ratably over the annual period covered. Customer

acquisition costs are expensed as incurred.

Finance receivables at December 31, 2014 and 2013 consisted of the following:

December 31, 2014 December 31, 2013

North

America International Total

North

America International Total

Sales-type lease receivables

Gross finance receivables $ 1,286,624 $ 366,669 $ 1,653,293 $ 1,456,420 $ 456,759 $ 1,913,179

Unguaranteed residual values 105,205 18,291 123,496 121,339 21,553 142,892

Unearned income (270,196) (83,110) (353,306) (299,396) (101,311) (400,707)

Allowance for credit losses (10,281) (5,129) (15,410) (14,165) (9,703) (23,868)

Net investment in sales-type lease receivables 1,111,352 296,721 1,408,073 1,264,198 367,298 1,631,496

Loan receivables

Loan receivables 376,987 47,665 424,652 397,815 49,054 446,869

Allowance for credit losses (10,912) (1,788) (12,700) (11,165) (1,916) (13,081)

Net investment in loan receivables 366,075 45,877 411,952 386,650 47,138 433,788

Net investment in finance receivables $ 1,477,427 $ 342,598 $ 1,820,025 $ 1,650,848 $ 414,436 $ 2,065,284

Finance receivables with a net investment of $62 million were included in the sale of DIS.