Oracle 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

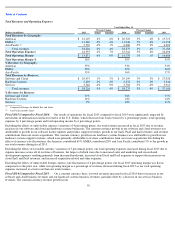

Table of Contents

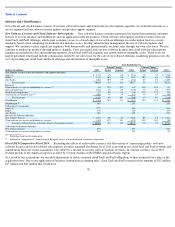

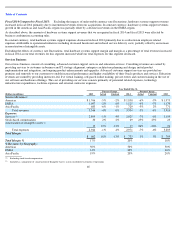

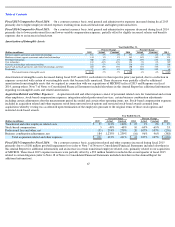

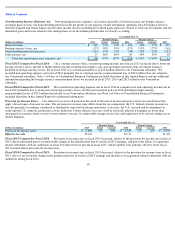

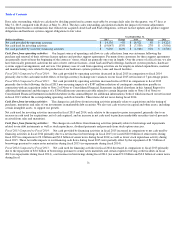

Fiscal 2015 Compared to Fiscal 2014: Excluding the effects of unfavorable currency rate fluctuations of 5 percentage points, total hardware

systems products revenues were flat in fiscal 2015 in comparison to the prior year as revenues from our recently acquired companies, including

MICROS, and increases in hardware revenues attributable to our Oracle Engineered Systems products were offset by reductions in the sales

volumes of certain of our other hardware product offerings. On a constant currency basis, revenue increases in the Americas region and EMEA

region were offset by declines in the Asia Pacific region.

Excluding the effects of favorable currency rate fluctuations of 5 percentage points, total hardware systems products expenses decreased in fiscal

2015 primarily due to lower bad debt expenses and a reduction in amortization of intangible assets. These fiscal 2015 expense decreases were

partially offset by higher fiscal 2015 employee related expenses due to increased headcount from our recent acquisitions and higher direct

product costs that were primarily attributable to higher revenues from recently acquired companies.

In constant currency, total margin and margin as a percentage of revenues increased in fiscal 2015 due to the decrease in total expenses for this

segment.

Fiscal 2014 Compared to Fiscal 2013:

Excluding the effects of currency rate fluctuations, total hardware systems products revenues modestly

decreased in fiscal 2014. The decrease in revenues during fiscal 2014, which was attributable to reductions in the sales volumes of certain of our

product lines, was partially offset by incremental revenues from our acquired companies and increases in hardware revenues attributable to the

sales of our Oracle Engineered Systems.

In constant currency, total hardware systems products expenses increased in fiscal 2014 primarily due to an increase in employee related

expenses due primarily to an increase in sales and marketing headcount, partially offset by a decrease in amortization of intangible assets.

63

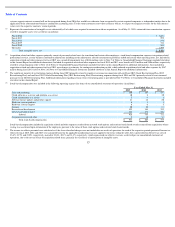

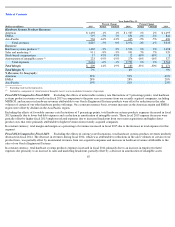

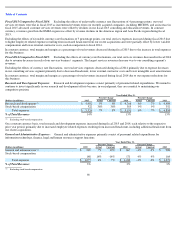

Year Ended May 31,

Percent Change

Percent Change

(Dollars in millions)

2015

Actual

Constant

2014

Actual

Constant

2013

Hardware Systems Products Revenues:

Americas

$

1,492

-

1%

1%

$

1,507

1%

2%

$

1,495

EMEA

797

-

5%

7%

834

-

1%

-

3%

842

Asia Pacific

536

-

16%

-

12%

635

-

9%

-

5%

696

Total revenues

2,825

-

5%

0%

2,976

-

2%

-

1%

3,033

Expenses:

Hardware systems products

1,465

-

3%

3%

1,516

1%

3%

1,498

Sales and marketing

911

-

8%

-

3%

991

7%

7%

929

Stock

-

based compensation

17

47%

47%

12

49%

49%

8

Amortization of intangible assets

223

-

19%

-

19%

274

-

16%

-

16%

327

Total expenses

2,616

-

6%

-

1%

2,793

1%

2%

2,762

Total Margin

$

209

14%

19%

$

183

-

33%

-

30%

$

271

Total Margin %

7%

6%

9%

% Revenues by Geography:

Americas

53%

51%

49%

EMEA

28%

28%

28%

Asia Pacific

19%

21%

23%

Excluding stock

-

based compensation

Included as a component of

‘

Amortization of Intangible Assets

’

in our consolidated statements of operations

(1)

(1)

(2)

(1)

(2)