Oracle 2014 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

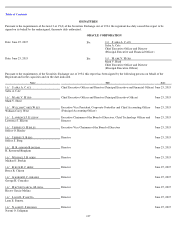

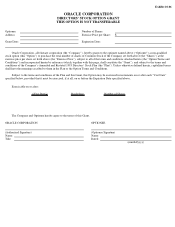

3.

Manner of Exercise.

a) Exercise Agreement . This Option shall be exercisable by delivery to the Company of an executed written Directors Stock Option

Exercise Agreement (the “Exercise Agreement”) in the form attached hereto as Exhibit A, or in such other form as may be

approved by the Committee, which shall set forth Optionee’s election to exercise some or all of the Option, the number of Shares

being purchased, any restrictions imposed on the Shares and such other representations and agreements regarding Optionee’s

investment intent and access to information as may be required by the Company to comply with applicable securities laws.

b) Payment

. Payment of the exercise price upon exercise of any Option shall be made (i) by cash or check; (ii) provided that a public

market for the Company’s stock exists, through a “same day sale” commitment from the Optionee and a broker-dealer that is a

member of the National Association of Securities Dealers (an “NASD Dealer”) whereby Optionee irrevocably elects to exercise

the Option and to sell a portion of the Shares so purchased to pay for the exercise price and whereby the NASD Dealer irrevocably

commits upon receipt of such Shares to forward the exercise price directly to the Company; (iii) provided that a public market for

the Company’s Stock exists, through a “margin” commitment from the Optionee and an NASD Dealer whereby the Optionee

irrevocably elects to exercise the Option and to pledge the Shares so purchased to the NASD Dealer in a margin account as

security for a loan from the NASD Dealer in the amount of the exercise price, and whereby the NASD Dealer irrevocably

commits upon receipt of such Shares to forward the exercise price directly to the Company; (iv) where permitted by applicable

law, by tender of a full recourse promissory note secured by collateral other than the Shares having such terms as may be

approved by the Committee and bearing interest at a rate sufficient to avoid imputation of income under Section 484 and 1274 of

the Code, provided that the portion of the exercise price equal to the par value of the Shares must be paid in cash or other legal

consideration; or (v) in any combination of the foregoing.

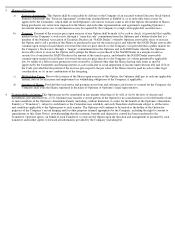

c) Withholding Taxes

. Prior to the issuance of the Shares upon exercise of this Option, the Optionee shall pay in cash any applicable

federal, state or local income and employment tax withholding obligations of the Company, if applicable.

d) Issuance of Shares

. Provided that such notice and payment are in form and substance satisfactory to counsel for the Company, the

Company shall issue the Shares registered in the name of Optionee or Optionee

’

s legal representative.

4. Transferability of Option. This Option may not be transferred in any manner other than (i) by will, or (ii) by the laws of descent and

distribution, provided however, a U.S. Optionee may transfer a vested portion of the Option for no consideration to or for the benefit of one

or more members of the Optionee’s Immediate Family (including, without limitation, to a trust for the benefit of the Optionee’s Immediate

Family) (a “Transferee”), subject to such limits as the Committee may establish, and such Transferee shall remain subject to all the terms

and conditions applicable to the Option prior to such transfer. The Optionee will continue to be treated as the holder of the Option for

purposes of the Company’s record keeping and for other purposes deemed appropriate by the Company, including the right to consent to

amendments to this Grant Notice; notwithstanding that the economic benefits and dispositive control has been transferred to the

Transferee. Optionee agrees, on behalf of each Transferee, to exercise the Option upon the direction and arrangement of payment by such

transferee and further agrees to forward all information provided by the Company (including but