Oracle 2014 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2015

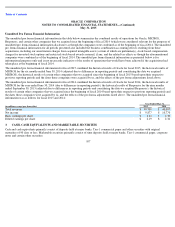

Other Fiscal 2014 Acquisitions

During fiscal 2014, we acquired certain other companies and purchased certain technology and development assets primarily to expand our

products and services offerings. These acquisitions were not individually significant. We have included the financial results of these companies

in our consolidated financial statements from their respective acquisition dates and the results from each of these companies were not

individually material to our consolidated financial statements. In the aggregate, the total purchase price for these acquisitions was approximately

$2.3 billion, which consisted primarily of cash consideration, and we recorded $230 million of net tangible liabilities, related primarily to

deferred tax liabilities, $1.1 billion of identifiable intangible assets, and $99 million of in-process research and development, based on their

estimated fair values, and $1.3 billion of residual goodwill.

Fiscal 2013 Acquisitions

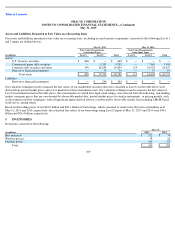

Acquisition of Acme Packet, Inc.

On March 28, 2013, we completed our acquisition of Acme Packet, Inc. (Acme Packet), a provider of session border control technology. We

have included the financial results of Acme Packet in our consolidated financial statements from the date of acquisition. The total purchase price

for Acme Packet was approximately $2.1 billion, which consisted of approximately $2.1 billion in cash and $12 million for the fair value of

stock options and restricted stock-based awards assumed. We have recorded $247 million of net tangible assets, $525 million of identifiable

intangible assets, and $45 million of in-process research and development, based on their estimated fair values, and $1.3 billion of residual

goodwill.

Acquisition of Eloqua, Inc.

On February 8, 2013, we completed our acquisition of Eloqua, Inc. (Eloqua), a provider of cloud-based marketing automation and revenue

performance management software. We have included the financial results of Eloqua in our consolidated financial statements from the date of

acquisition. The total purchase price for Eloqua was approximately $935 million, which consisted of approximately $933 million in cash and $2

million for the fair value of stock options assumed. We have recorded $1 million of net tangible assets and $327 million of identifiable intangible

assets, based on their estimated fair values, and $607 million of residual goodwill.

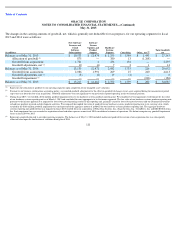

Other Fiscal 2013 Acquisitions

During fiscal 2013, we acquired certain other companies and purchased certain technology and development assets primarily to expand our

products and services offerings. These acquisitions were not significant individually or in the aggregate.

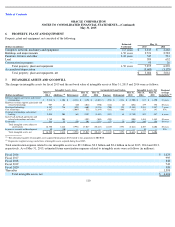

Contingent Consideration Related to the Acquisition of Pillar Data Systems, Inc.

In fiscal 2012, we acquired Pillar Data Systems, Inc. (Pillar Data), a provider of enterprise storage systems solutions. Pursuant to the agreement

and plan of merger dated as of June 29, 2011, we acquired all of the issued and outstanding equity interests of Pillar Data from the stockholders

in exchange for Pillar Data’s former stockholders to have rights to receive contingent cash consideration (Earn-Out), if any, pursuant to an Earn-

Out calculation. During fiscal 2013, we estimated that no amount of contingent consideration was to be payable pursuant to the Earn-Out

calculation and we recognized a benefit of $387 million. The Earn-Out period ended at the conclusion of our first quarter of fiscal 2015 and no

amounts were paid to Pillar Data’s former stockholders, including Lawrence J. Ellison, Oracle’s Executive Chairman of the Board and Chief

Technology Officer and largest stockholder.

106