Oracle 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2015

We neither use these foreign currency forward contracts for trading purposes nor do we designate these forward contracts as hedging instruments

pursuant to ASC 815. Accordingly, we recorded the fair values of these contracts as of the end of our reporting period to our consolidated

balance sheet with changes in fair values recorded to our consolidated statement of operations. The balance sheet classification for the fair values

of these forward contracts is prepaid expenses and other current assets for a net unrealized gain position and other current liabilities for a net

unrealized loss position. The statement of operations classification for changes in fair values of these forward contracts is non-operating income

(expense), net, for both realized and unrealized gains and losses.

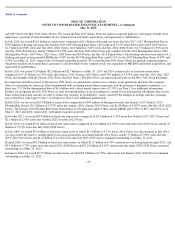

As of May 31, 2015 and 2014, respectively, the notional amounts of the forward contracts we held to purchase U.S. Dollars in exchange for

other major international currencies were $2.2 billion and $3.6 billion, respectively, and the notional amounts of forward contracts we held to

sell U.S. Dollars in exchange for other major international currencies were $1.2 billion and $2.0 billion, respectively. The fair values of our

outstanding foreign currency forward contracts were nominal at May 31, 2015 and 2014.

Included in our non-operating income (expense), net were $60 million, $(69) million and $(64) million of net gains (losses) related to these

forward contracts for the years ended May 31, 2015, 2014 and 2013, respectively. The cash flows related to these foreign currency contracts are

classified as operating activities.

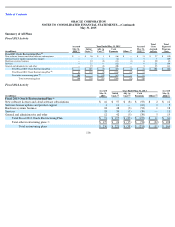

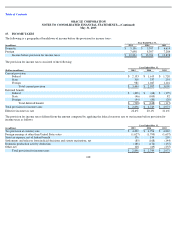

The effects of derivative and non-

derivative instruments designated as hedges on certain of our consolidated financial statements were as follows

as of or for each of the respective periods presented below (amounts presented exclude any income tax effects):

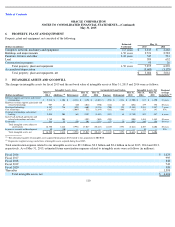

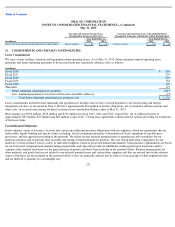

Fair Values of Derivative and Non-Derivative Instruments Designated as Hedges in Consolidated Balance Sheets

Effects of Derivative and Non-Derivative Instruments Designated as Hedges on Income and Other Comprehensive Income (OCI) or

Loss (OCL)

120

May 31, 2015

May 31, 2014

(in millions)

Balance Sheet Location

Fair Value

Balance Sheet Location

Fair Value

Interest rate swap agreements designated as fair value hedges

Other assets

$

74

Other assets

$

15

Interest rate swap agreements designated as fair value hedges

Not applicable

$

—

Prepaid expenses and other current assets

$

8

Cross

-

currency swap agreements designated as cash flow hedges

Other non-current

liabilities

$

(244

)

Other assets

$

74

Foreign currency borrowings designated as net investment hedge

Notes payable, non

-

current

$

(981

)

Notes payable, non

-

current

$

(1,116

)

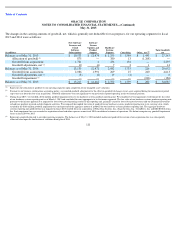

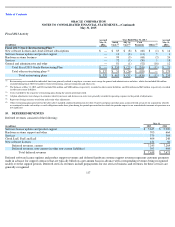

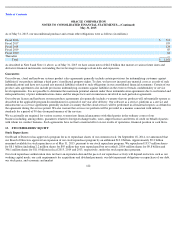

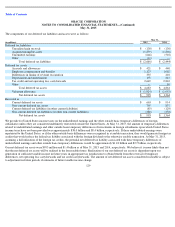

Amount of (Loss) Gain Recognized in

Accumulated OCI or OCL (Effective Portion)

Location and Amount of (Loss) Gain Reclassified from

Accumulated OCI or OCL into Income (Effective Portion)

Year Ended May 31,

Year Ended May 31,

(in millions)

2015

2014

2015

2014

Cross-currency swap agreements

designated as cash flow hedges

$

(318

)

$

74

Non

-

operating income (expense), net

$

(348

)

$

69

Foreign currency borrowings

designated as net investment

hedge

$

208

$

(34

)

Not applicable

$

—

$

—