Oracle 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2015

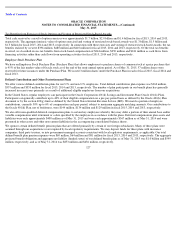

3 million unvested PSUs outstanding. As of May 31, 2015, approximately 409 million shares of common stock were available for future awards

under the 2000 Plan. To date, we have not issued any stock purchase rights or stock appreciation rights under the 2000 Plan.

In fiscal 1993, the Board adopted the 1993 Directors’ Stock Plan (the Directors’ Plan), which provides for the issuance of non-qualified stock

options and other stock-based awards, including RSUs, to non-employee directors. The Directors’ Plan has from time to time been amended and

restated. Under the terms of the Directors’ Plan, 10 million shares of common stock are reserved for issuance (including a fiscal 2013

amendment to increase the number of shares of our common stock reserved for issuance by 2 million shares). Options are granted at not less than

fair market value, vest over four years, and expire no more than ten years from the date of grant. RSUs granted under the Directors’ Plan also

vest over four years. The Directors’ Plan provides for automatic grants of stock awards to each non-employee director upon first becoming a

director and thereafter on an annual basis, as well as automatic nondiscretionary grants for chairing or vice chairing certain Board committees.

The Board will determine the particular terms of any such stock awards at the time of grant, but the terms will be consistent with those of stock

awards granted under the Directors’ Plan with respect to vesting or forfeiture schedules and treatment on termination of status as a director. As

of May 31, 2015, options to purchase approximately 4 million shares of common stock (of which approximately 2 million were vested) and

64,000 unvested RSUs were outstanding under the 1993 Directors’ Plan. As of May 31, 2015, approximately 2 million shares were available for

future stock awards under this plan.

In connection with certain of our acquisitions, we assumed certain outstanding stock options and other restricted stock-based awards under each

acquired company’s respective stock plans. These stock options and other restricted stock-based awards generally retain all of the rights, terms

and conditions of the respective plans under which they were originally granted. As of May 31, 2015, stock options to purchase 8 million shares

of common stock and 1 million shares of restricted stock-based awards were outstanding under these plans.

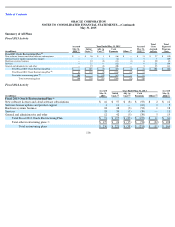

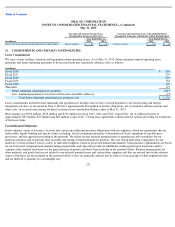

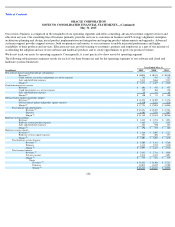

The following table summarizes stock option activity and includes awards granted pursuant to Oracle-

based stock plans and stock plans assumed

from our acquisitions for our last three fiscal years ended May 31, 2015:

124

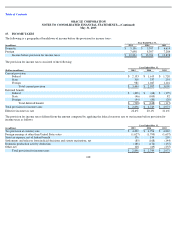

Options Outstanding

(in millions, except exercise price)

Shares Under

Option

Weighted

Average

Exercise Price

Balance, May 31, 2012

422

$

22.66

Granted

119

$

29.90

Assumed

9

$

32.52

Exercised

(83

)

$

17.38

Canceled

(20

)

$

28.94

Balance, May 31, 2013

447

$

25.48

Granted

131

$

31.02

Assumed

5

$

9.02

Exercised

(95

)

$

21.51

Canceled

(26

)

$

30.60

Balance, May 31, 2014

462

$

27.37

Granted

34

$

40.54

Assumed

3

$

21.98

Exercised

(70

)

$

24.49

Canceled

(16

)

$

33.76

Balance, May 31, 2015

413

$

28.64