Oracle 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

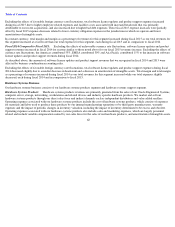

options in our stock in order to estimate future stock price trends as we believe that implied volatility is more representative of future stock price

trends than historical volatility. In order to determine the estimated period of time that we expect employees to hold their stock options, we have

used historical rates of employee groups by seniority of job classification. Our expected dividend rate is based upon an annualized dividend yield

based on the per share dividend declared by our Board of Directors. The aforementioned inputs entered into the option valuation model we use to

fair value our stock awards are subjective estimates and changes to these estimates will cause the fair values of our stock awards and related

stock-based compensation expense that we record to vary.

We issue PSUs to certain key executives. We estimate the fair values of the PSUs based upon their intrinsic values as of the grant dates as the

vesting conditions and related terms of the PSUs were communicated to each participating employee as of their respective grant dates and

include attainment metrics that are defined, fixed and consistently determined based upon consistent U.S. GAAP metrics or internal metrics and

that require the employee to render service. The performance conditions of the PSUs affect the number of PSUs that will ultimately vest and be

issued to the grantee based upon a “target” that is subject to certain attainment maximums, with the possibility that none will vest if applicable

performance conditions are not met. We update the amount of stock-based compensation expense, net of forfeitures, to record as of the end of

each reporting period based on the expected attainment of performance targets, which is subject to change until a final determination is known.

Changes to the target estimates are reflected in the amount of stock-based compensation expense that we recognize for each PSU tranche on a

cumulative basis during the reporting period in which the target estimates are altered and may cause the amount of stock-based compensation

expense that we record for such reporting period to vary.

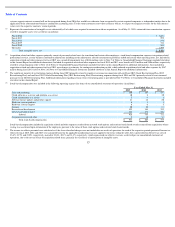

We record deferred tax assets for stock-based compensation awards that result in deductions on our income tax returns, based on the amount of

stock-based compensation recognized and the fair values attributable to the vested portion of stock awards assumed in connection with a

business combination, at the statutory tax rate in the jurisdiction in which we will receive a tax deduction. Because the deferred tax assets we

record are based upon the stock-based compensation expenses in a particular jurisdiction, the aforementioned inputs that affect the fair values of

our stock awards may also indirectly affect our income tax expense. In addition, differences between the deferred tax assets recognized for

financial reporting purposes and the actual tax deduction reported on our income tax returns are recorded in additional paid-in capital.

To the extent we change the terms of our employee stock-based compensation programs, experience market volatility in the pricing of our

common stock that increases the implied volatility calculation of publicly traded options in our stock, refine different assumptions in future

periods such as forfeiture rates or PSU target performance attainment that differ from our current estimates, or assume stock awards from

acquired companies that are different in nature than our stock award arrangements, among other potential impacts, the stock-

based compensation

expense that we record in future periods and the tax benefits that we realize may differ significantly from what we have recorded in previous

reporting periods.

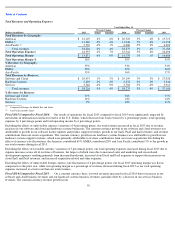

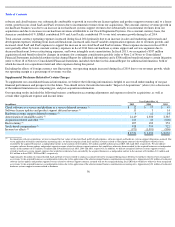

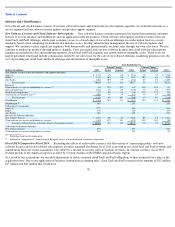

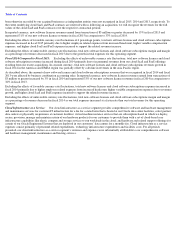

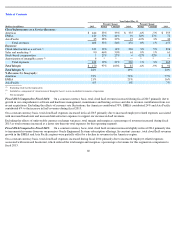

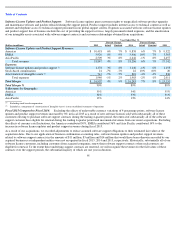

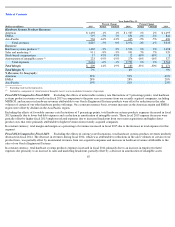

Results of Operations

Impact of Acquisitions

The comparability of our operating results in fiscal 2015 compared to fiscal 2014 was impacted by our acquisitions, primarily our acquisitions of

MICROS in the second quarter of fiscal 2015 and Responsys in the third quarter of fiscal 2014.

The comparability of our operating results in fiscal 2014 compared to fiscal 2013 was impacted by our acquisitions, primarily our acquisitions of

Responsys in the third quarter of fiscal 2014, Tekelec in the first quarter of fiscal 2014 and Acme Packet in the fourth quarter of fiscal 2013.

In our discussion of changes in our results of operations from fiscal 2015 compared to fiscal 2014 and fiscal 2014 compared to fiscal 2013, we

may qualitatively disclose the impact of our acquired products and services (for the one year period subsequent to the acquisition date) to the

growth in certain of our operating segments’ revenues where such qualitative discussions would be meaningful for an understanding of the

factors that influenced the changes in our results of operations. When material, we may also provide quantitative disclosures related to such

53