Oracle 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

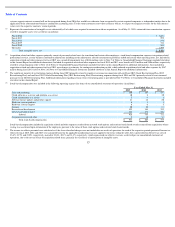

Table of Contents

services, both on-premises and remote, to Oracle customers to enable increased performance and higher availability of their products and

services. Depending upon the nature of the arrangement, revenues from these services are recognized as the services are performed or ratably

over the term of the service period, which is generally one year or less.

Education revenues are also a part of our services business and include instructor-led, media-based and internet-based training in the use of our

software and hardware products. Education revenues are recognized as the classes or other education offerings are delivered.

If an arrangement contains multiple elements and does not qualify for separate accounting for the product and service transactions, then new

software licenses revenues and/or hardware systems products revenues, including the costs of hardware systems products, are generally

recognized together with the services based on contract accounting using either the percentage-of-completion or completed-contract method.

Contract accounting is applied to any bundled software and cloud, hardware systems and services arrangements: (1) that include milestones or

customer specific acceptance criteria that may affect collection of the software license or hardware systems product fees; (2) where consulting

services include significant modification or customization of the software or hardware systems product or are of a specialized nature and

generally performed only by Oracle; (3) where significant consulting services are provided for in the software license contract or hardware

systems product contract without additional charge or are substantially discounted; or (4) where the software license or hardware systems

product payment is tied to the performance of consulting services. For the purposes of revenue classification of the elements that are accounted

for as a single unit of accounting, we allocate revenues to software and nonsoftware elements based on a rational and consistent methodology

utilizing our best estimate of the relative selling price of such elements.

We also evaluate arrangements with governmental entities containing “fiscal funding” or “termination for convenience” provisions, when such

provisions are required by law, to determine the probability of possible cancellation. We consider multiple factors, including the history with the

customer in similar transactions, the “essential use” of the software or hardware systems products and the planning, budgeting and approval

processes undertaken by the governmental entity. If we determine upon execution of these arrangements that the likelihood of cancellation is

remote, we then recognize revenues once all of the criteria described above have been met. If such a determination cannot be made, revenues are

recognized upon the earlier of cash receipt or approval of the applicable funding provision by the governmental entity.

We assess whether fees are fixed or determinable at the time of sale and recognize revenues if all other revenue recognition requirements are

met. Our standard payment terms are net 30 days. However, payment terms may vary based on the country in which the agreement is executed.

Payments that are due within six months are generally deemed to be fixed or determinable based on our successful collection history on such

arrangements, and thereby satisfy the required criteria for revenue recognition.

While most of our arrangements for sales within our businesses include short-term payment terms, we have a standard practice of providing

long-term financing to creditworthy customers primarily through our financing division. Since fiscal 1989, when our financing division was

formed, we have established a history of collection, without concessions, on these receivables with payment terms that generally extend up to

five years from the contract date. Provided all other revenue recognition criteria have been met, we recognize new software licenses revenues

and hardware systems products revenues for these arrangements upon delivery, net of any payment discounts from financing transactions. We

have generally sold receivables financed through our financing division on a non-recourse basis to third party financing institutions within 90

days of the contracts’

dates of execution and we classify the proceeds from these sales as cash flows from operating activities in our consolidated

statements of cash flows. We account for the sales of these receivables as “true sales” as defined in ASC 860, Transfers and Servicing

, as we are

considered to have surrendered control of these financing receivables.

In addition, we enter into arrangements with leasing companies for the sale of our hardware systems products. These leasing companies, in turn,

lease our products to end-users. The leasing companies generally have no recourse to us in the event of default by the end-user and we recognize

revenue upon delivery, if all other revenue recognition criteria have been met.

47