Oracle 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2015

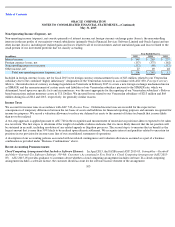

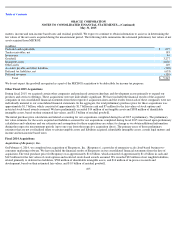

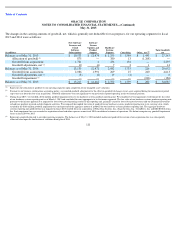

Non-Operating Income (Expense), net

Non

-operating income (expense), net consists primarily of interest income, net foreign currency exchange gains (losses), the noncontrolling

interests in the net profits of our majority-owned subsidiaries (primarily Oracle Financial Services Software Limited and Oracle Japan) and net

other income (losses), including net realized gains and losses related to all of our investments and net unrealized gains and losses related to the

small portion of our investment portfolio that we classify as trading.

Included in foreign currency losses, net for fiscal 2015 were foreign currency remeasurement losses of $23 million, related to our Venezuelan

subsidiary due to the continued “highly inflationary” designation of the Venezuelan economy in accordance with ASC 830, Foreign Currency

Matters

; the introduction of currency exchange legislation in Venezuela in February 2015 to create a new foreign exchange mechanism known

as SIMADI; and the remeasurement of certain assets and liabilities of our Venezuelan subsidiary pursuant to the SIMADI rate, which we

determined, based upon our specific facts and circumstances, was the most appropriate for the reporting of our Venezuelan subsidiary’s Bolivar

based transactions and net monetary assets in U.S. Dollars. We incurred losses related to our Venezuelan subsidiary of $213 million and $64

million during fiscal 2014 and 2013, respectively, for generally similar reasons.

Income Taxes

We account for income taxes in accordance with ASC 740, Income Taxes . Deferred income taxes are recorded for the expected tax

consequences of temporary differences between the tax bases of assets and liabilities for financial reporting purposes and amounts recognized for

income tax purposes. We record a valuation allowance to reduce our deferred tax assets to the amount of future tax benefit that is more likely

than not to be realized.

A two-

step approach is applied pursuant to ASC 740 in the recognition and measurement of uncertain tax positions taken or expected to be taken

in a tax return. The first step is to determine if the weight of available evidence indicates that it is more likely than not that the tax position will

be sustained in an audit, including resolution of any related appeals or litigation processes. The second step is to measure the tax benefit as the

largest amount that is more than 50% likely to be realized upon ultimate settlement. We recognize interest and penalties related to uncertain tax

positions in our provision for income taxes line of our consolidated statements of operations.

A description of our accounting policies associated with tax related contingencies and valuation allowances assumed as a part of a business

combination is provided under “Business Combinations” above.

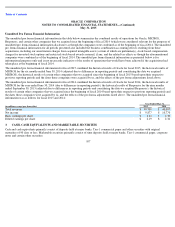

Recent Accounting Pronouncements

Cloud Computing Arrangements that Include a Software Element: In April 2015, the FASB issued ASU 2015-05, Intangibles—Goodwill

and Other—Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement (ASU 2015-

05) . ASU 2015-05 provides guidance to customers about whether a cloud computing arrangement includes software. If a cloud computing

arrangement includes a software license, the customer should account for the software license element of the arrangement

103

Year Ended May 31,

(in millions)

2015

2014

2013

Interest income

$

349

$

263

$

237

Foreign currency losses, net

(157

)

(375

)

(162

)

Noncontrolling interests in income

(113

)

(98

)

(112

)

Other income, net

27

69

48

Total non

-

operating income (expense), net

$

106

$

(141

)

$

11