Oracle 2014 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2015

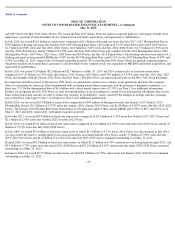

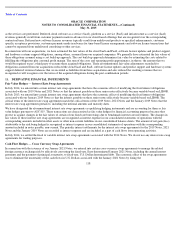

2013 Credit Agreement at any time during the term of the 2013 Credit Agreement. Interest under the 2013 Credit Agreement is based on either

(a) a LIBOR-based formula or (b) the Base Rate formula, each as set forth in the 2013 Credit Agreement. Any amounts drawn pursuant to the

2013 Credit Agreement are due on April 20, 2018. No amounts were outstanding pursuant to the 2013 Credit Agreement as of May 31, 2015 and

2014.

The 2013 Credit Agreement contains certain customary representations and warranties, covenants and events of default, including the

requirement that our total net debt to total capitalization ratio not exceed 45% on a consolidated basis. If any of the events of default occur and

are not cured within applicable grace periods or waived, any unpaid amounts under the 2013 Credit Agreement may be declared immediately

due and payable and the 2013 Credit Agreement may be terminated. We were in compliance with the 2013 Credit Agreement’s covenants as of

May 31, 2015.

On May 29, 2012, we borrowed $1.7 billion pursuant to a revolving credit agreement with JPMorgan Chase Bank, N.A., as initial lender and

administrative agent; and J.P. Morgan Securities, LLC, as sole lead arranger and sole bookrunner (the 2012 Credit Agreement). During fiscal

2013, we repaid the $1.7 billion and the 2012 Credit Agreement expired pursuant to its terms.

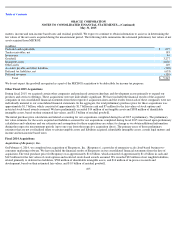

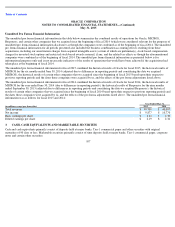

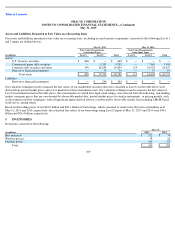

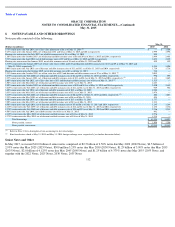

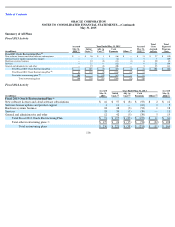

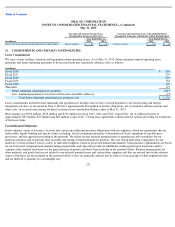

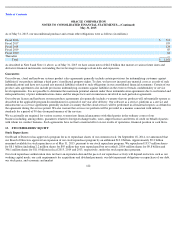

Fiscal 2015 Oracle Restructuring Plan

During the second quarter of fiscal 2015, our management approved, committed to and initiated plans to restructure and further improve

efficiencies in our operations due to our acquisition of MICROS and certain other operational activities (2015 Restructuring Plan). The total

estimated restructuring costs associated with the 2015 Restructuring Plan are up to $626 million and will be recorded to the restructuring expense

line item within our consolidated statements of operations as they are incurred. We recorded $100 million of restructuring expenses in

connection with the 2015 Restructuring Plan in fiscal 2015 and we expect to incur the majority of the estimated remaining $526 million through

the end of fiscal 2016. Any changes to the estimates of executing the 2015 Restructuring Plan will be reflected in our future results of operations.

Fiscal 2013 Oracle Restructuring Plan

During the first quarter of fiscal 2013, our management approved, committed to and initiated plans to restructure and further improve

efficiencies in our operations (2013 Restructuring Plan). Restructuring costs associated with the 2013 Restructuring Plan were recorded to the

restructuring expense line item within our consolidated statements of operations as they were incurred. We recorded $119 million, $174 million

and $325 million of restructuring expenses in connection with the 2013 Restructuring Plan in fiscal 2015, 2014 and 2013, respectively. Actions

pursuant to the 2013 Restructuring Plan were substantially complete as of May 31, 2015.

115

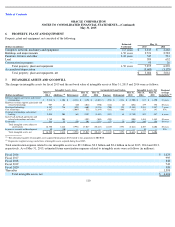

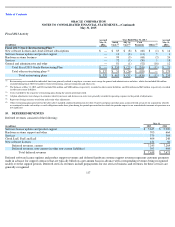

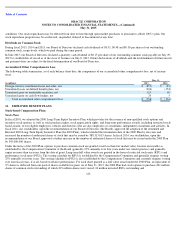

9.

RESTRUCTURING ACTIVITIES