Oracle 2014 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2015

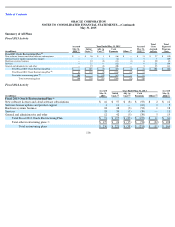

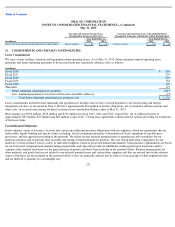

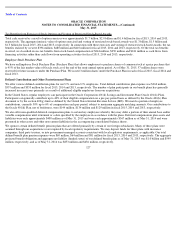

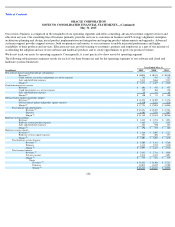

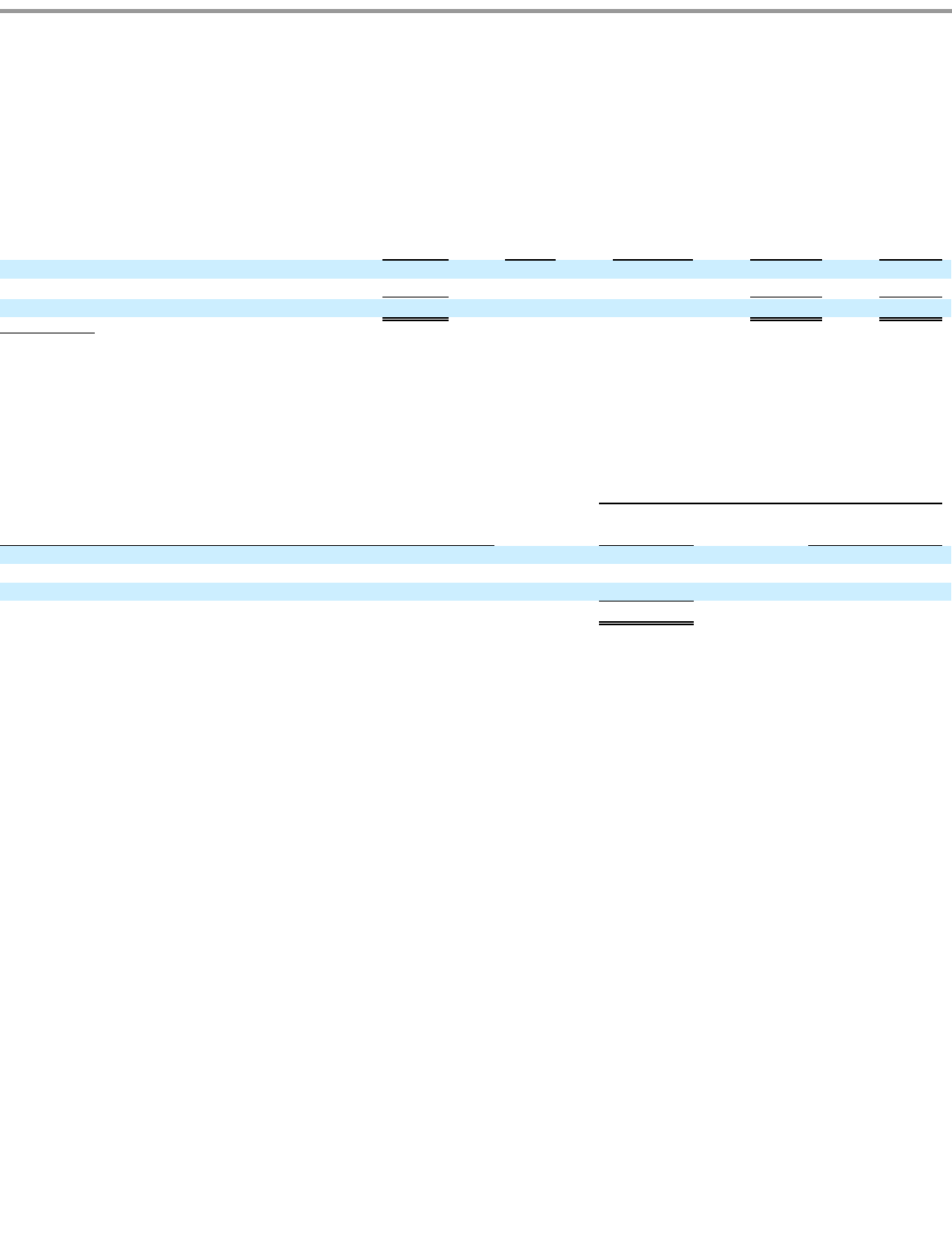

Options outstanding that have vested and that are expected to vest as of May 31, 2015 were as follows:

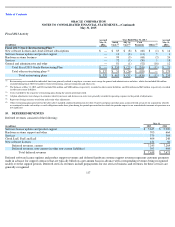

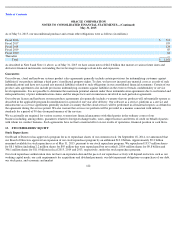

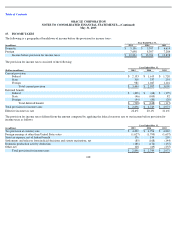

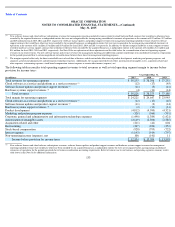

Restricted stock-based award activity and the number of restricted stock-based awards outstanding were not significant prior to fiscal 2015. The

following table summarizes restricted stock-based awards activity, including service-based awards and performance-based awards and including

awards granted pursuant to Oracle-based stock plans and stock plans assumed from our acquisitions for our fiscal year ended May 31, 2015:

The total grant date fair value of restricted stock-based awards that vested in fiscal 2015 was $28 million. As of May 31, 2015, total

unrecognized stock compensation expense related to non-vested restricted stock-

based awards was $774 million and is expected to be recognized

over the remaining weighted-average vesting period of 3.22 years.

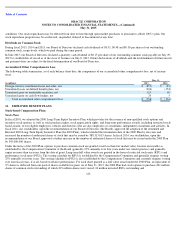

In fiscal 2015, 3 million PSUs were granted which vest upon the attainment of certain performance metrics and service-based vesting. Based

upon actual attainment relative to the “target” performance metric, certain participants have the ability to be issued up to 150% of the target

number of PSUs originally granted, or to be issued no PSUs at all. As of May 31, 2015, no PSUs had vested and 3 million remained outstanding.

125

Outstanding

Options

(in millions)

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contract Term

(in years)

In

-

the

-

Money

Options as of

May 31, 2015

(in millions)

Aggregate

Intrinsic

Value

(in millions)

Vested

223

$

25.53

5.07

222

$

4,034

Expected to vest

175

$

32.17

7.77

175

1,986

Total

398

$

28.45

6.26

397

$

6,020

The aggregate intrinsic value was calculated based on the gross difference between our closing stock price on the last trading day of fiscal 2015 of $43.49 and the exercise prices for all

“

in

-

the

-

money

”

options outstanding, excluding tax effects.

The unrecognized compensation expense calculated under the fair value method for shares expected to vest (unvested shares net of expected forfeitures) as of May 31, 2015 was

approximately $804 million and is expected to be recognized over a weighted average period of 2.16 years. Approximately 15 million shares outstanding as of May 31, 2015 were not

expected to vest.

Restricted Stock

-

Based Awards Outstanding

(in millions, except fair value)

Number of

Shares

Weighted Average

Grant Date

Fair Value

Balance, May 31, 2014

1

$

35.29

Granted

28

$

40.73

Canceled

(1

)

$

39.52

Balance, May 31, 2015

28

$

40.63

(1)

(2)

(1)

(2)