Oracle 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2015

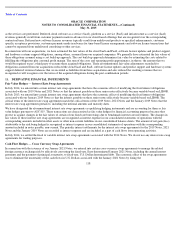

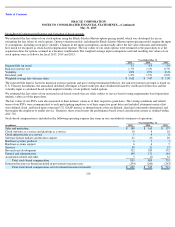

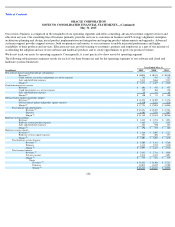

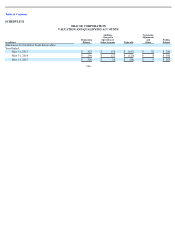

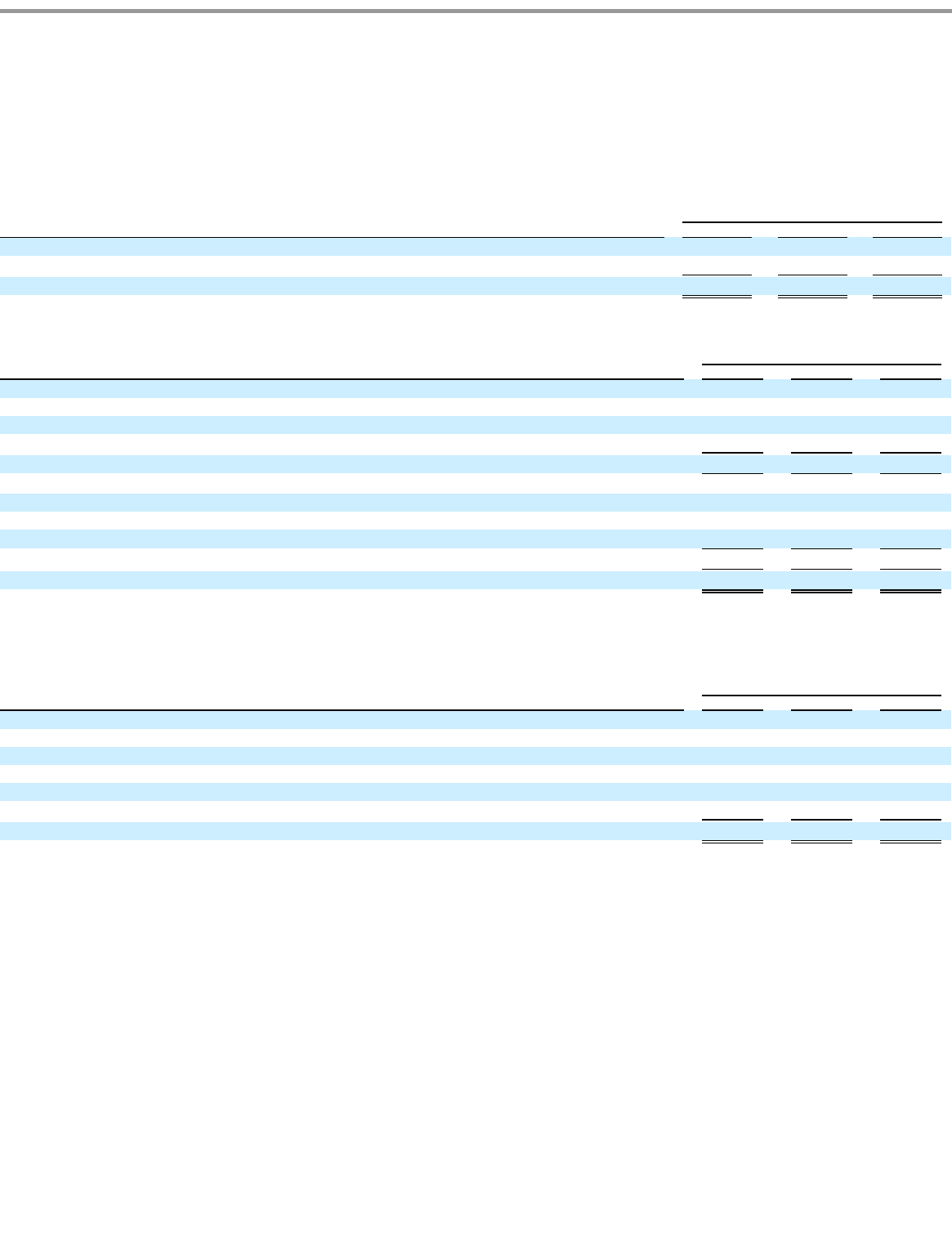

The following is a geographical breakdown of income before the provision for income taxes:

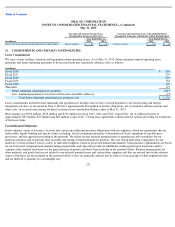

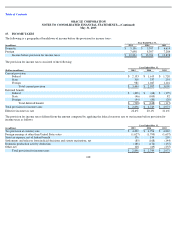

The provision for income taxes consisted of the following:

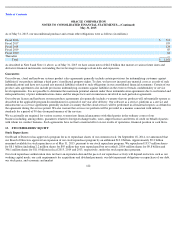

The provision for income taxes differed from the amount computed by applying the federal statutory rate to our income before provision for

income taxes as follows:

128

15.

INCOME TAXES

Year Ended May 31,

(in millions)

2015

2014

2013

Domestic

$

5,136

$

5,397

$

6,614

Foreign

7,698

8,307

7,284

Income before provision for income taxes

$

12,834

$

13,704

$

13,898

Year Ended May 31,

(Dollars in millions)

2015

2014

2013

Current provision:

Federal

$

2,153

$

1,613

$

1,720

State

310

337

254

Foreign

981

1,047

1,116

Total current provision

$

3,444

$

2,997

$

3,090

Deferred benefit:

Federal

$

(408

)

$

(68

)

$

(179

)

State

(46

)

(100

)

82

Foreign

(94

)

(80

)

(20

)

Total deferred benefit

$

(548

)

$

(248

)

$

(117

)

Total provision for income taxes

$

2,896

$

2,749

$

2,973

Effective income tax rate

22.6%

20.1%

21.4%

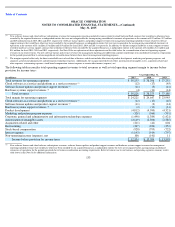

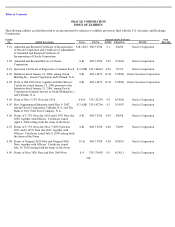

Year Ended May 31,

(in millions)

2015

2014

2013

Tax provision at statutory rate

$

4,492

$

4,796

$

4,865

Foreign earnings at other than United States rates

(1,627

)

(1,790

)

(1,637

)

State tax expense, net of federal benefit

176

154

299

Settlements and releases from judicial decisions and statute expirations, net

(85

)

(168

)

(144

)

Domestic production activity deduction

(188

)

(174

)

(155

)

Other, net

128

(69

)

(255

)

Total provision for income taxes

$

2,896

$

2,749

$

2,973