Oracle 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

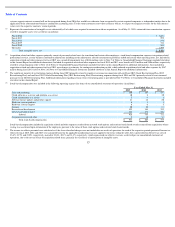

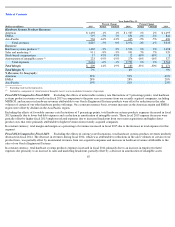

been otherwise recorded by our acquired businesses as independent entities were not recognized in fiscal 2015, 2014 and 2013, respectively. To

the extent underlying cloud SaaS and PaaS contracts are renewed with us following an acquisition, we will recognize the revenues for the full

values of the cloud SaaS and PaaS contracts over the respective contractual periods.

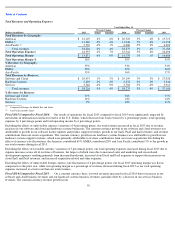

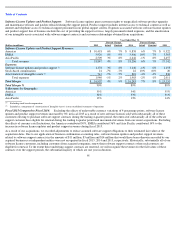

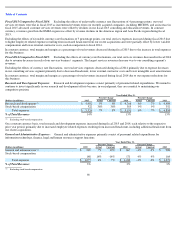

In reported currency, new software licenses revenues earned from transactions of $3 million or greater decreased by 15% in fiscal 2015 and

represented 31% of our new software licenses revenues in fiscal 2015 in comparison to 33% in fiscal 2014.

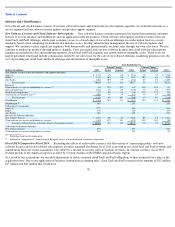

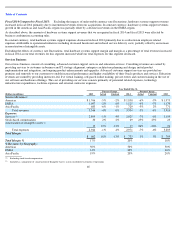

Excluding the effects of favorable currency rate fluctuations of 4 percentage points, total new software licenses and cloud software subscriptions

expenses increased in fiscal 2015 primarily due to higher employee related expenses from increased headcount, higher variable compensation

expenses, and higher cloud SaaS and PaaS expenses incurred to support the related revenues increase.

Excluding the effects of unfavorable currency rate fluctuations, total new software licenses and cloud software subscriptions margin and margin

as a percentage of revenues decreased in fiscal 2015 due to the growth in total expenses for this operating segment.

Fiscal 2014 Compared to Fiscal 2013: Excluding the effects of unfavorable currency rate fluctuations, total new software licenses and cloud

software subscriptions revenues increased during fiscal 2014 primarily due to incremental revenues from our cloud SaaS and PaaS offerings

resulting from our recent acquisitions. In constant currency, total new software licenses and cloud software subscriptions revenues growth in

fiscal 2014 in the Americas and EMEA region was partially offset by a decline in revenues in the Asia Pacific region.

As described above, the amount of new software licenses and cloud software subscriptions revenues that we recognized in fiscal 2014 and fiscal

2013 were affected by business combination accounting rules. In reported currency, new software licenses revenues earned from transactions of

$3 million or greater increased by 3% in fiscal 2014 and represented 33% of our new software licenses revenues in fiscal 2014 in comparison to

32% in fiscal 2013.

Excluding the effects of favorable currency rate fluctuations, total new software licenses and cloud software subscriptions expenses increased in

fiscal 2014 primarily due to higher employee related expenses from increased headcount, higher variable compensation expenses due to revenues

growth, and higher cloud SaaS and PaaS expenses incurred to support the related revenues increase.

Excluding the effects of unfavorable currency rate fluctuations, total new software licenses and cloud software subscriptions margin and margin

as a percentage of revenues decreased in fiscal 2014 as our total expenses increased at a faster rate than our total revenues for this operating

segment.

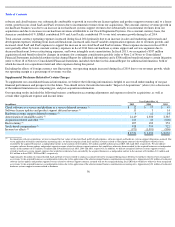

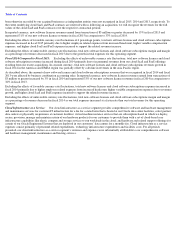

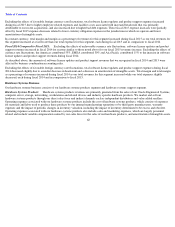

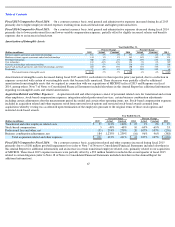

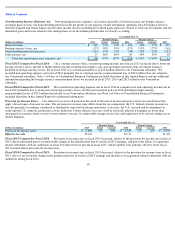

Cloud Infrastructure as a Service:

Our cloud infrastructure as a service segment provides comprehensive software and hardware management

and maintenance services for customer IT infrastructure for a fee for a stated term that is hosted at our Oracle data center facilities, select partner

data centers or physically on-premises at customer facilities; virtual machine instance services that are subscription-based in which we deploy,

secure, provision, manage and maintain certain of our hardware products for our customers to provide them with a set of cloud-based core

infrastructure capabilities like elastic compute and storage services to run workloads in the cloud; and hardware and related support offerings for

certain of our Oracle Engineered Systems that are deployed in our customers’ data centers for a monthly fee. Cloud infrastructure as a service

expenses consist primarily of personnel related expenditures, technology infrastructure expenditures and facilities costs. For all periods

presented, our cloud-infrastructure as a service segment’s revenues and expenses were substantially attributable to our comprehensive software

and hardware management, maintenance and hosting services.

59