Oracle 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2015

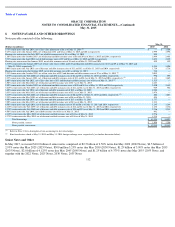

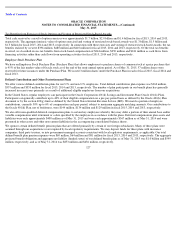

principal amount of the January 2021 Notes at $1.6 billion with a fixed annual interest rate of 3.53%. We have designated these cross-currency

swap agreements as qualifying hedging instruments and are accounting for these as cash flow hedges pursuant to ASC 815. The critical terms of

the cross-currency swap agreements correspond to the January 2021 Notes, including the annual interest payments being hedged, and the cross-

currency swap agreements mature at the same time as the January 2021 Notes.

We used the hypothetical derivative method to measure the effectiveness of our cross-currency swap agreements. The fair values of these cross-

currency swap agreements are recognized as other assets or other non-current liabilities in our consolidated balance sheets. The effective

portions of the changes in fair values of these cross-currency swap agreements are reported in accumulated other comprehensive loss in our

consolidated balance sheets and an amount is reclassified out of accumulated other comprehensive loss into non-

operating income (expense), net

in the same period that the carrying value of the Euro denominated January 2021 Notes is remeasured and the interest expense is recognized. The

ineffective portion of the unrealized gains and losses on these cross-currency swaps, if any, is recorded immediately to non-operating income

(expense), net. We evaluate the effectiveness of our cross-currency swap agreements on a quarterly basis. We did not record any ineffectiveness

for fiscal 2015 or 2014. The cash flows related to the cross-currency swap agreements that pertain to the periodic interest settlements are

classified as operating activities and the cash flows that pertain to the principal balance are classified as financing activities.

We do not use any cross-currency swap agreements for trading purposes.

Net Investment Hedge — Foreign Currency Borrowings

In July 2013, we designated our July 2025 Notes as a net investment hedge of our investments in certain of our international subsidiaries that use

the Euro as their functional currency in order to reduce the volatility in stockholders’ equity caused by the changes in foreign currency exchange

rates of the Euro with respect to the U.S. Dollar.

We used the spot method to measure the effectiveness of our net investment hedge. Under this method, for each reporting period, the change in

the carrying value of the Euro denominated July 2025 Notes due to remeasurement of the effective portion is reported in accumulated other

comprehensive loss on our consolidated balance sheet and the remaining change in the carrying value of the ineffective portion, if any, is

recognized in non-operating income (expense), net in our consolidated statements of operations. We evaluate the effectiveness of our net

investment hedge at the beginning of every quarter. We did not record any ineffectiveness for fiscal 2015 or 2014.

Foreign Currency Forward Contracts Not Designated as Hedges

We transact business in various foreign currencies and have established a program that primarily utilizes foreign currency forward contracts to

offset the risks associated with the effects of certain foreign currency exposures. Under this program, our strategy is to enter into foreign

currency forward contracts so that increases or decreases in our foreign currency exposures are offset by gains or losses on the foreign currency

forward contracts in order to mitigate the risks and volatility associated with our foreign currency transactions. We may suspend this program

from time to time. Our foreign currency exposures typically arise from intercompany sublicense fees, intercompany loans and other

intercompany transactions that are generally expected to be cash settled in the near term. Our foreign currency forward contracts are generally

short-term in duration. Our ultimate realized gain or loss with respect to currency fluctuations will generally depend on the size and type of

cross-currency exposures that we enter into, the currency exchange rates associated with these exposures and changes in those rates, the net

realized and unrealized gains or losses on foreign currency forward contracts to offset these exposures and other factors.

119