Oracle 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2015

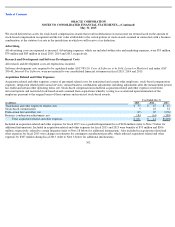

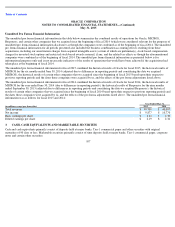

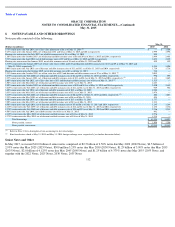

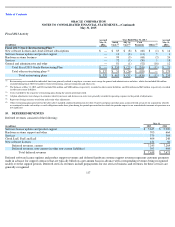

Notes payable consisted of the following:

Senior Notes and Other

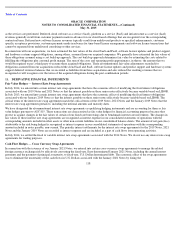

In May 2015, we issued $10.0 billion of senior notes comprised of $2.5 billion of 2.50% notes due May 2022 (2022 Notes), $2.5 billion of

2.95% notes due May 2025 (2025 Notes), $500 million 3.25% notes due May 2030 (2030 Notes), $1.25 billion of 3.90% notes due May 2035

(2035 Notes), $2.0 billion of 4.125% notes due May 2045 (2045 Notes) and $1.25 billion of 4.375% notes due May 2055 (2055 Notes, and

together with the 2022 Notes, 2025 Notes, 2030 Notes, 2035 Notes

112

8.

NOTES PAYABLE AND OTHER BORROWINGS

May 31,

(Dollars in millions)

2015

2014

3.75% senior notes due July 2014, net of fair value adjustment of $8 as of May 31, 2014

$

—

$

1,508

5.25% senior notes due January 2016, net of discount of $1 and $2 as of May 31, 2015 and 2014, respectively

1,999

1,998

Floating rate senior notes due July 2017, net of debt issuance cost of $1 as of May 31, 2015

999

—

1.20% senior notes due October 2017, net of discount and debt issuance costs of $6 and $9 as of May 31, 2015 and 2014, respectively

2,494

2,491

5.75% senior notes due April 2018, net of debt issuance costs of $7 and $8 as of May 31, 2015 and 2014, respectively

2,493

2,492

Floating rate senior notes due January 2019, net of debt issuance costs of $1 each as of May 31, 2015 and 2014

499

499

2.375% senior notes due January 2019, net of fair value losses of $21 and $15 and discount and debt issuance costs of $7 and $9 as of May 31, 2015 and

May 31, 2014, respectively

1,514

1,506

5.00% senior notes due July 2019, net of discount and debt issuance costs of $11 and $12 as of May 31, 2015 and 2014, respectively

1,739

1,738

Floating rate senior notes due October 2019, net of debt issuance cost of $2 as of May 31, 2015

748

—

2.25% senior notes due October 2019, net of fair value loss of $22 and discount and debt issuance cost of $7 as of May 31, 2015

2,015

—

3.875% senior notes due July 2020, net of discount and debt issuance costs of $4 and $5 as of May 31, 2015 and 2014, respectively

996

995

2.25% senior notes due January 2021, net of discount and debt issuance costs of $11 and $14 as of May 31, 2015 and 2014, respectively

1,341

1,685

2.80% senior notes due July 2021, net of fair value loss of $31 and discount and debt issuance cost of $6 as of May 31, 2015

1,525

—

2.50% senior notes due May 2022, net of discount and debt issuance cost of $17 as of May 31, 2015

2,483

—

2.50% senior notes due October 2022, net of discount and debt issuance costs of $10 and $11 as of May 31, 2015 and 2014, respectively

2,490

2,489

3.625% senior notes due July 2023, net of discount and debt issuance costs of $11 and $12 as of May 31, 2015 and 2014, respectively

989

988

3.40% senior notes due July 2024, net of discount and debt issuance cost of $12 as of May 31, 2015

1,988

—

2.95% senior notes due May 2025, net of discount and debt issuance cost of $22 as of May 31, 2015

2,478

—

3.125% senior notes due July 2025, net of discount and debt issuance costs of $6 and $9 as of May 31, 2015 and 2014, respectively

804

1,013

3.25% senior notes due May 2030, net of discount and debt issuance cost of $6 as of May 31, 2015

494

—

4.30% senior notes due July 2034, net of discount and debt issuance cost of $13 as of May 31, 2015

1,737

—

3.90% senior notes due May 2035, net of discount and debt issuance cost of $18 as of May 31, 2015

1,232

—

6.50% senior notes due April 2038, net of discount and debt issuance costs of $5 and $6 as of May 31, 2015 and 2014, respectively

1,245

1,244

6.125% senior notes due July 2039, net of discount and debt issuance costs of $12 and $14 as of May 31, 2015 and 2014, respectively

1,238

1,236

5.375% senior notes due July 2040, net of discount and debt issuance costs of $34 and $35 as of May 31, 2015 and 2014, respectively

2,216

2,215

4.50% senior notes due July 2044, net of debt issuance cost of $8 as of May 31, 2015

992

—

4.125% senior notes due May 2045, net of discount and debt issuance cost of $24 as of May 31, 2015

1,976

—

4.375% senior notes due May 2055, net of discount and debt issuance cost of $16 as of May 31, 2015

1,234

—

Total borrowings

$

41,958

$

24,097

Notes payable, current

$

1,999

$

1,508

Notes payable, non

-

current

$

39,959

$

22,589

Refer to Note 11 for a description of our accounting for fair value hedges.

Euro based notes valued at May 31, 2015 and May 31, 2014 foreign exchange rates, respectively (see further discussion below).

(1)

(1)

(1)

(2)

(1)

(2)

(1)

(2)