Oracle 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2015

consistent with the acquisition of other software licenses. If a cloud computing arrangement does not include a software license, the customer

should account for the arrangement as a service contract. The new guidance does not change the accounting for a customer’s accounting for

service contracts. ASU 2015-05 is effective for us in our first quarter of fiscal 2017 with early adoption permitted using either of two methods:

(i) prospective to all arrangements entered into or materially modified after the effective date and represent a change in accounting principle; or

(ii) retrospectively. We are currently evaluating the impact of our pending adoption of ASU 2015-05 on our consolidated financial statements.

Revenue Recognition:

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers: Topic 606 (ASU 2014-09), to

supersede nearly all existing revenue recognition guidance under U.S. GAAP. The core principle of ASU 2014-

09 is to recognize revenues when

promised goods or services are transferred to customers in an amount that reflects the consideration that is expected to be received for those

goods or services. ASU 2014-09 defines a five step process to achieve this core principle and, in doing so, it is possible more judgment and

estimates may be required within the revenue recognition process than are required under existing U.S. GAAP, including identifying

performance obligations in the contract, estimating the amount of variable consideration to include in the transaction price and allocating the

transaction price to each separate performance obligation. ASU 2014-09 is effective for us in our first quarter of fiscal 2018 using either of two

methods: (i) retrospective application of ASU 2014-09 to each prior reporting period presented with the option to elect certain practical

expedients as defined within ASU 2014-09; or (ii) retrospective application of ASU 2014-09 with the cumulative effect of initially applying

ASU 2014-09 recognized at the date of initial application and providing certain additional disclosures as defined per ASU 2014-09. We are

currently evaluating the impact of our pending adoption of ASU 2014-09 on our consolidated financial statements.

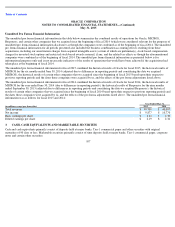

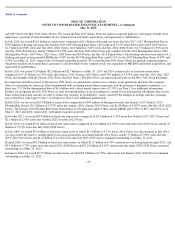

Acquisition of MICROS Systems, Inc.

On June 22, 2014, we entered into an Agreement and Plan of Merger (Merger Agreement) with MICROS Systems, Inc. (MICROS), a provider

of integrated software, hardware and services solutions to the hospitality and retail industries. On July 3, 2014, pursuant to the Merger

Agreement, we commenced a tender offer to purchase all of the issued and outstanding shares of common stock of MICROS at a purchase price

of $68.00 per share, net to the holder in cash, without interest thereon, based upon the terms and subject to the conditions set forth in the Merger

Agreement. Between September 3, 2014 and September 8, 2014, pursuant to the terms of the tender offer, we accepted and paid for the

substantial majority of outstanding shares of MICROS common stock. On September 8, 2014, we effectuated the merger of MICROS with and

into a wholly-owned subsidiary of Oracle pursuant to the terms of the Merger Agreement and applicable Maryland law and MICROS became an

indirect, wholly-owned subsidiary of Oracle. Pursuant to the merger, shares of MICROS common stock that remained outstanding and were not

acquired by us were converted into, and cancelled in exchange for, the right to receive $68.00 per share in cash. The unvested equity awards to

acquire MICROS common stock that were outstanding immediately prior to the conclusion of the merger were converted into equity awards

denominated in shares of Oracle common stock based on formulas contained in the Merger Agreement. We acquired MICROS to, among other

things, expand our software and cloud, hardware and related services offerings for hotels, food and beverage industries, facilities, and retailers.

We have included the financial results of MICROS in our consolidated financial statements from the date of acquisition.

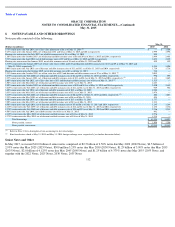

Pursuant to our business combinations accounting policy, we estimated the preliminary fair values of net tangible and intangible assets acquired

and the excess of the consideration transferred over the aggregate of such fair values was recorded as goodwill. The preliminary fair values of

net tangible assets and intangible assets acquired were based upon preliminary valuations and our estimates and assumptions are subject to

change within the measurement period (up to one year from the acquisition date). The primary areas that remain preliminary relate to the fair

values of intangible assets acquired, certain tangible assets and liabilities acquired, certain legal

104

2.

ACQUISITIONS