Oracle 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2015

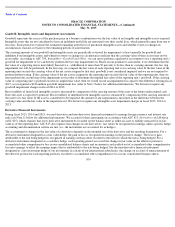

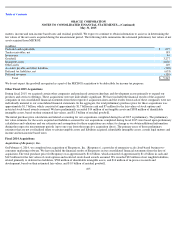

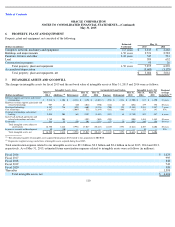

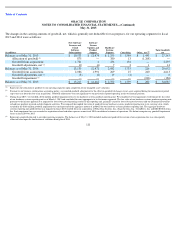

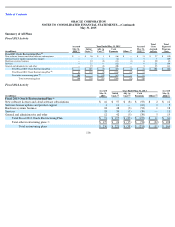

Property, plant and equipment, net consisted of the following:

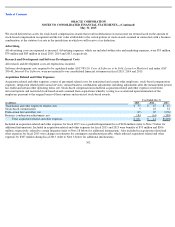

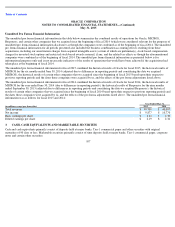

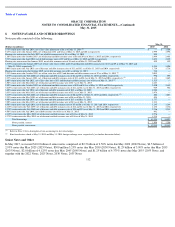

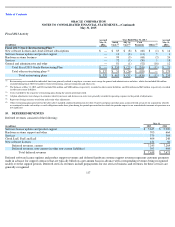

The changes in intangible assets for fiscal 2015 and the net book value of intangible assets at May 31, 2015 and 2014 were as follows:

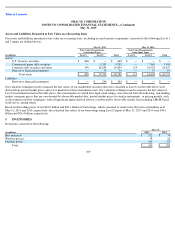

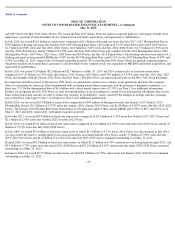

Total amortization expense related to our intangible assets was $2.1 billion, $2.3 billion and $2.4 billion in fiscal 2015, 2014 and 2013,

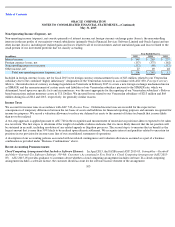

respectively. As of May 31, 2015, estimated future amortization expenses related to intangible assets were as follows (in millions):

110

6.

PROPERTY, PLANT AND EQUIPMENT

Estimated

Useful Life

May 31,

(Dollars in millions)

2015

2014

Computer, network, machinery and equipment

1

-

5 years

$

3,345

$

2,468

Buildings and improvements

1

-

50 years

2,721

2,582

Furniture, fixtures and other

3

-

10 years

547

531

Land

—

589

632

Construction in progress

—

93

26

Total property, plant and equipment

1

-

50 years

7,295

6,239

Accumulated depreciation

(3,609

)

(3,178

)

Total property, plant and equipment, net

$

3,686

$

3,061

7.

INTANGIBLE ASSETS AND GOODWILL

Intangible Assets, Gross

Accumulated Amortization

Intangible Assets, Net

Weighted

Average

Useful Life

(Dollars in millions)

May 31,

2014

Additions

Retirements

May 31,

2015

May 31,

2014

Expense

Retirements

May 31,

2015

May 31,

2014

May 31,

2015

Software support agreements and related

relationships

$

5,218

$

1,206

$

(2,234

)

$

4,190

$

(4,403

)

$

(531

)

$

2,234

$

(2,700

)

$

815

$

1,490

13 years

Hardware systems support agreements and

related relationships

969

63

(20

)

1,012

(530

)

(144

)

20

(654

)

439

358

10 years

Developed technology

4,387

736

(521

)

4,602

(2,176

)

(700

)

521

(2,355

)

2,211

2,247

7 years

Core technology

1,617

—

(

1,065

)

552

(1,294

)

(182

)

1,065

(411

)

323

141

N.A.

Customer relationships and contract

backlog

2,054

204

(61

)

2,197

(1,459

)

(312

)

61

(1,710

)

595

487

6 years

SaaS, PaaS and IaaS agreements and

related relationships and other.

1,789

204

—

1,993

(305

)

(203

)

—

(

508

)

1,484

1,485

10 years

Trademarks

516

35

(50

)

501

(276

)

(77

)

50

(303

)

240

198

10 years

Total intangible assets subject to

amortization

16,550

2,448

(3,951

)

15,047

(10,443

)

(2,149

)

3,951

(8,641

)

6,107

6,406

10 years

In

-

process research and development

30

(30

)

—

—

—

—

—

—

30

—

N.A.

Total intangible assets, net

$

16,580

$

2,418

$

(3,951

)

$

15,047

$

(10,443

)

$

(2,149

)

$

3,951

$

(8,641

)

$

6,137

$

6,406

The substantial majority of intangible assets acquired during fiscal 2015 related to our acquisition of MICROS.

Represents weighted average useful lives of intangible assets acquired during fiscal 2015.

Fiscal 2016

$

1,624

Fiscal 2017

995

Fiscal 2018

848

Fiscal 2019

742

Fiscal 2020

598

Thereafter

1,599

Total intangible assets, net

$

6,406

(2)

(1)

(1)

(2)