Napa Auto Parts 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Genuine Parts Company and Subsidiaries

Notes to Consolidated Financial Statements — (Continued)

December 31, 2015

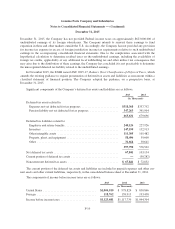

70% interest in GPC Asia Pacific for approximately $590,000,000, net of cash acquired of $70,000,000, and the

assumption of approximately $230,000,000 in debt. The acquisition was financed using a combination of cash on

hand and borrowings under existing credit facilities. GPC Asia Pacific, which is headquartered in Melbourne,

Australia, is a leading aftermarket distributor of automotive replacement parts and accessories in Australasia,

with annual revenues of approximately $1,000,000,000 and a company-owned store footprint of approximately

500 locations across Australia and New Zealand. This acquisition provides an opportunity for the Company to

participate in the ongoing and significant growth opportunities in the Australasian aftermarket.

The Company recognized certain one-time positive purchase accounting pre-tax adjustments of approx-

imately $33,000,000, or $0.21 net of taxes on a per share diluted basis, as a result of the acquisition. The net one-

time purchase accounting adjustments consisted of a gain of approximately $59,000,000 related to remeasuring

the 30% investment in GPC Asia Pacific held before the business combination to fair value, the post-closing sale

of acquired inventory written up to fair value of $21,000,000 as part of the purchase price allocation, and certain

negative adjustments of approximately $5,000,000.

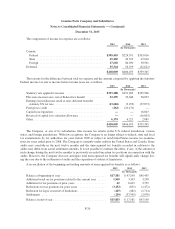

Prior to the 70% acquisition, the Company accounted for the 30% investment under the equity method of

accounting. The acquisition-date fair value of the 30% investment was approximately $234,000,000 and is

included in the measurement of the consideration transferred. The difference between the acquisition-date fair

value and the carrying amount of the equity method investment resulted in the recognition of a gain of approx-

imately $59,000,000 on the acquisition date. The acquisition-date fair value was determined using a market and

income approach with the assistance of a third party valuation firm. Both approaches were given equal weight in

the conclusion of fair value, which the Company believes is a reasonable approach. For the market approach, the

Company utilized companies that are comparable in line of business, size, operating performance, and financial

condition to GPC Asia Pacific to develop a market multiple. For the income approach, the Company utilized

GPC Asia Pacific’s projected cash flows, an appropriate discount rate, and an expected long-term growth rate.

For both approaches, the Company applied discounts for lack of control and lack of marketability.

As part of the allocation of purchase price described below, acquired inventory was written up to fair value,

which was approximately $21,000,000 above the cost of the acquired inventory. Based on the inventory turn of

the acquired inventories, the entire write-up was recognized in cost of goods sold during 2013.

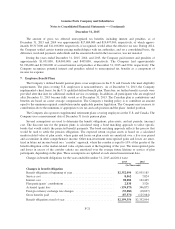

The net $54,000,000 of one-time gain and other adjustments are included in the line item selling, admin-

istrative and other expenses and the acquired inventory adjustment of $21,000,000 is included in cost of goods

sold in the consolidated statements of income and comprehensive income for the year ended December 31, 2013.

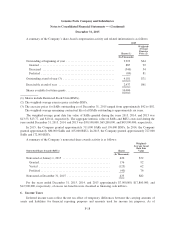

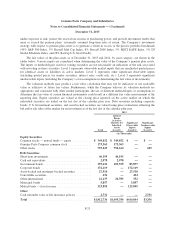

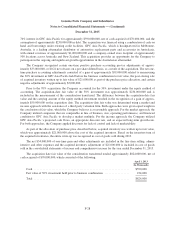

The acquisition date fair value of the consideration transferred totaled approximately $824,000,000, net of

cash acquired of $70,000,000, which consisted of the following:

April 1, 2013

(In Thousands)

Cash ................................................................. $590,000

Fair value of 30% investment held prior to business combination ................. 234,000

Total ................................................................. $824,000

F-28