Napa Auto Parts 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

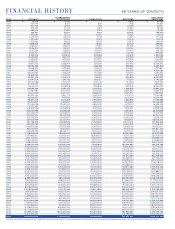

FINANCIAL STRENGTH

Genuine Parts Company further improved its financial strength in 2015 with

a continued emphasis on sales and earnings growth initiatives and effective

management of the balance sheet. Our focus in these key areas produced

strong cash flows, with cash from operations reaching a record $1.2

billion and, after dividends paid of $368 million and capital expenditures

of $110 million, our free cash flow was $682 million, also a record for us.

At December 31, 2015, our total cash on hand was $212 million and total

debt of $625 million was a modest 16.5% of total capitalization.

OPERATIONS

The Company’s 2015 revenues included core sales growth of

approximately 1.5% and a 1% contribution from acquisitions. These

growth components were offset by the negative impact of currency

translation of approximately 3%.

The Automotive Group, our largest segment at 52% of 2015 revenues,

reported a 1% sales decline for the year. This reflects core sales growth

of approximately 3.5% and a slight benefit from acquisitions, offset by an

approximate 5% currency impact. Each of our four geographic regions, the

United States, Canada, Mexico and Australasia, generated positive core

sales increases in their local currencies. In addition, we experienced sales

growth from both our commercial and retail customers. The fundamentals

supporting demand in the automotive aftermarket remain favorable and

combined with our internal initiatives, we are optimistic for continued

growth in 2016 and beyond.

Motion Industries, our industrial distribution business, represents 30% of

our 2015 revenues. Sales for Motion were off 3% from 2014, consisting of a

3% decrease in core sales and a 1% headwind from currency, which were

partially offset by a 1% contribution from acquisitions. The manufacturing

indices we track in this segment, which had improved in 2014, progressively

weakened throughout 2015. This correlates to lower demand among our

customer base and, in particular, those customers dependent on exports

as well as the oil and gas sector. EIS, our electrical/electronic distribution

segment, represents 5% of our 2015 revenues. As with Motion, this

business is dependent on the manufacturing segment of the economy. EIS

grew sales by approximately 1.5% for the year, driven by a 5% contribution

from acquisitions, less a 2.5% decrease in core sales and a 1% headwind

from falling copper prices. Looking ahead, we expect the tough industrial

economy to persist well into 2016. That said, we have multiple initiatives in

place at both Motion and EIS to help us overcome these challenges.

S. P. Richards, our office products distribution business, represents 13%

of our 2015 revenues and had sales growth of 7.5% for the year. This

follows a 10% sales increase in 2014, and consists of core sales growth

of 5% and a 3% contribution from acquisitions, net of a 0.5% unfavorable

currency translation. New business with a key customer, initiated in 2014,

and growth initiatives to diversify the SPR business positively impacted

our core sales. Turning to 2016, the office team will continue to focus on

its growth initiatives, including the ongoing diversification of product and

customer portfolios, market share gains and select acquisitions.

ACQUISITIONS

Acquisitions continue to be a very important component of our growth

strategy. During 2015, we expanded our automotive network with the

purchase of three automotive store groups in the U.S. and two new

businesses in Australasia. At Motion, we made four acquisitions, further

expanding our U.S. distribution footprint while also complementing our vast

product offering of industrial MRO (maintenance, repair and operations)

and supply items. Our electrical distribution business acquired a specialty

wire and cable distributor and, finally, the office segment completed

three acquisitions, further diversifying their product offering and

customer channels.

Thus far in 2016, we have made one acquisition for the U.S. automotive

business, which enhances our OE (original equipment) import parts

distribution capabilities. We are encouraged by the growth prospects for

our recent acquisitions and will continue to pursue additional strategic

acquisition targets throughout 2016.

SHARE REPURCHASES

We returned more than $660 million to our shareholders through the

combination of share repurchases and dividends in 2015. For the year,

we repurchased approximately 3.3 million shares of our Company stock

and as of December 31, 2015, we were authorized to repurchase up to an

additional 6.3 million shares. We expect to continue making opportunistic

share repurchases during 2016 as we view this as a good use of cash.

GPC DIRECTORS

In April of 2016, Mr. Jean Douville will retire from our Board of Directors and

from his role as Chairman of UAP Inc. (“NAPA Canada”). Mr. Douville has

served on our Board since 1992 and as UAP’s Chairman since 1999, and

we extend him our sincerest gratitude and appreciation for his many years of

dedicated service.

At our August 2015 Board meeting, Elizabeth W. “Betsy” Camp was elected

by the Board as a new Director of the Company. Since 2000, Ms. Camp has

served as President and Chief Executive Officer of DF Management, Inc.,

TO OUR SHAREHOLDERS

2015 turned out to be a year of mixed results for Genuine Parts Company. On the positive side, our team did a fine job of managing the assets of the

Company and in keeping our balance sheet in excellent condition. Cash from operations and free cash generation each reached record levels and our

team did a good job on the operating side of the business as well, producing record earnings per share of $4.63, despite the impact of an unfavorable

currency translation of $0.14 per share.

Conversely, our revenue production was a bit inconsistent

across our four business segments and we ended the year

with sales of $15.3 billion, which was down just slightly from

2014. The difficult macro-economic environment significantly

weakened customer demand in our industrial and electrical

distribution businesses. Likewise, the impact of currency

translation associated with our Canadian, Australasian and

Mexican operations was a headwind for both the automotive

and industrial businesses. The office products business mostly

avoided these conditions and recorded solid revenue growth

for the year.

Despite the tempered growth for 2015, when we adjust our

results for the 3% negative impact of currency translation

the Company produced an increase in both sales and net

earnings. These increases reflect the positive impact of our

sales initiatives and cost control measures and, combined with

our reduced investment in net working capital and record cash

flows, represent meaningful accomplishments. Our progress in

2015 supports our investment in growth opportunities such as

acquisitions, as well as the return of capital to shareholders via

a strong dividend and share repurchases.

L-R: Carol B. Yancey Executive Vice President and Chief Financial Officer

Thomas C. Gallagher Chairman and Chief Executive Officer

Paul D. Donahue President