Napa Auto Parts 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Genuine Parts Company and Subsidiaries

Notes to Consolidated Financial Statements — (Continued)

December 31, 2015

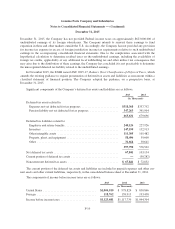

December 31, 2015, the Company has not provided Federal income taxes on approximately $623,000,000 of

undistributed earnings of its foreign subsidiaries. The Company intends to reinvest these earnings to fund

expansion in these and other markets outside the U.S. Accordingly, the Company has not provided any provision

for income tax expense in excess of foreign jurisdiction income tax requirements relative to such undistributed

earnings in the accompanying consolidated financial statements. Due to the complexities associated with the

hypothetical calculation to determine residual taxes on the undistributed earnings, including the availability of

foreign tax credits, applicability of any additional local withholding tax and other indirect tax consequence that

may arise due to the distribution of these earnings, the Company has concluded it is not practicable to determine

the unrecognized deferred tax liability related to the undistributed earnings.

In November 2015, the FASB issued ASU 2015-17, Balance Sheet Classification of Deferred Taxes, which

amends the existing guidance to require presentation of deferred tax assets and liabilities as noncurrent within a

classified statement of financial position. The Company adopted the guidance, on a prospective basis, at

December 31, 2015.

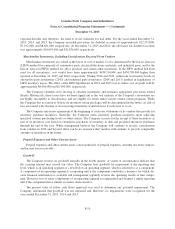

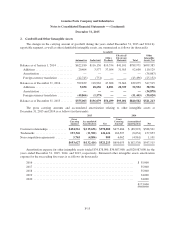

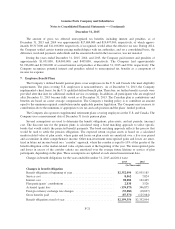

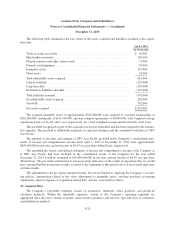

Significant components of the Company’s deferred tax assets and liabilities are as follows:

2015 2014

(In Thousands)

Deferred tax assets related to:

Expenses not yet deducted for tax purposes ......................... $318,368 $337,792

Pension liability not yet deducted for tax purposes ................... 347,263 341,904

665,631 679,696

Deferred tax liabilities related to:

Employee and retiree benefits .................................... 249,126 227,926

Inventory .................................................... 147,199 152,913

Other intangible assets ......................................... 111,305 105,482

Property, plant, and equipment ................................... 58,496 59,600

Other ....................................................... 31,664 30,641

597,790 576,562

Net deferred tax assets ............................................ 67,841 103,134

Current portion of deferred tax assets ................................ —(30,282)

Noncurrent net deferred tax assets .................................. $ 67,841 $ 72,852

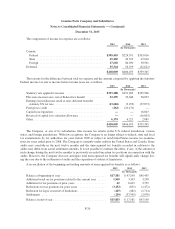

The current portion of the deferred tax assets and liabilities are included in prepaid expenses and other cur-

rent assets and other current liabilities, respectively, in the consolidated balance sheet at December 31, 2014.

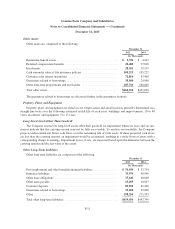

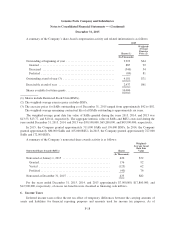

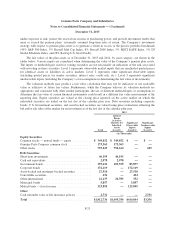

The components of income before income taxes are as follows:

2015 2014 2013

(In Thousands)

United States .................................... $1,004,919 $ 978,824 $ 850,866

Foreign ........................................ 118,762 138,915 193,438

Income before income taxes ........................ $1,123,681 $1,117,739 $1,044,304

F-19