Napa Auto Parts 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

not highly susceptible to obsolescence and are eligible for return under various vendor return programs. While

the Company has no reason to believe its inventory return privileges will be discontinued in the future, its risk of

loss associated with obsolete or slow moving inventories would increase if such were to occur.

Allowance for Doubtful Accounts — Methodology

The Company evaluates the collectability of trade accounts receivable based on a combination of factors.

The Company estimates an allowance for doubtful accounts as a percentage of net sales based on historical bad

debt experience and periodically adjusts this estimate when the Company becomes aware of a specific customer’s

inability to meet its financial obligations (e.g., bankruptcy filing) or as a result of changes in the overall aging of

accounts receivable. While the Company has a large customer base that is geographically dispersed, a general

economic downturn in any of the industry segments in which the Company operates could result in higher than

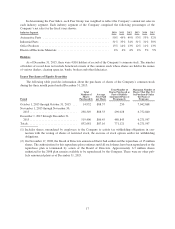

expected defaults and, therefore, the need to revise estimates for bad debts. For the years ended December 31,

2015, 2014 and 2013, the Company recorded provisions for doubtful accounts of approximately $12.4 million,

$7.2 million, and $8.7 million, respectively.

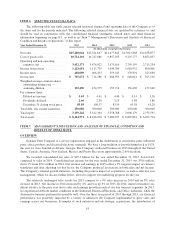

Consideration Received from Vendors

The Company enters into agreements at the beginning of each year with many of its vendors that provide for

inventory purchase incentives. Generally, the Company earns inventory purchase incentives upon achieving

specified volume purchasing levels or other criteria. The Company accrues for the receipt of these incentives as

part of its inventory cost based on cumulative purchases of inventory to date and projected inventory purchases

through the end of the year. While management believes the Company will continue to receive consideration

from vendors in 2016 and beyond, there can be no assurance that vendors will continue to provide comparable

amounts of incentives in the future or that we will be able to achieve the specified volumes necessary to take

advantage of such incentives.

Impairment of Property, Plant and Equipment and Goodwill and Other Intangible Assets

At least annually, the Company evaluates property, plant and equipment, goodwill and other intangible

assets for potential impairment indicators. The Company’s judgments regarding the existence of impairment

indicators are based on market conditions and operational performance, among other factors. Future events could

cause the Company to conclude that impairment indicators exist and that assets associated with a particular oper-

ation are impaired. Evaluating for impairment also requires the Company to estimate future operating results and

cash flows which require judgment by management. Any resulting impairment loss could have a material adverse

impact on the Company’s financial condition and results of operations.

Employee Benefit Plans

The Company’s benefit plan committees in the U.S. and Canada establish investment policies and strategies

and regularly monitor the performance of the Company’s pension plan assets. The pension plan investment strat-

egy implemented by the Company’s management is to achieve long-term objectives and invest the pension assets

in accordance with the applicable pension legislation in the U.S. and Canada, as well as fiduciary standards. The

long-term primary objectives for the pension plan funds are to provide for a reasonable amount of long-term

growth of capital without undue exposure to risk, protect the assets from erosion of purchasing power and pro-

vide investment results that meet or exceed the pension plans’ actuarially assumed long term rates of return. The

Company’s investment strategy with respect to pension plan assets is to generate a return in excess of the passive

portfolio benchmark (49% S&P 500 Index, 5% Russell Mid Cap Index, 8% Russell 2000 Index, 5% MSCI EAFE

Index, 5% DJ Global Moderate Index and 28% BarCap U.S. Govt/Credit).

We make several critical assumptions in determining our pension plan assets and liabilities and related pen-

sion expense. We believe the most critical of these assumptions are the expected rate of return on plan assets and

the discount rate. Other assumptions we make relate to employee demographic factors such as rate of compensa-

tion increases, mortality rates, retirement patterns and turnover rates. Refer to Note 7 of the Consolidated Finan-

cial Statements for more information regarding these assumptions.

27