Napa Auto Parts 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Genuine Parts Company and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2015

1. Summary of Significant Accounting Policies

Business

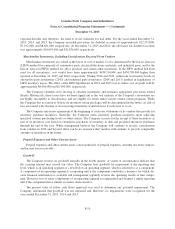

Genuine Parts Company and all of its majority-owned subsidiaries (the Company) is a distributor of automo-

tive replacement parts, industrial replacement parts, office products, and electrical/electronic materials. The

Company serves a diverse customer base through approximately 2,650 locations in North America and Austral-

asia and, therefore, has limited exposure from credit losses to any particular customer, region, or industry seg-

ment. The Company performs periodic credit evaluations of its customers’ financial condition and generally does

not require collateral. The Company has evaluated subsequent events through the date the financial statements

were issued.

Principles of Consolidation

The consolidated financial statements include all of the accounts of the Company. The net income attribut-

able to noncontrolling interests is not material to the Company’s consolidated net income. Intercompany

accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of the consolidated financial statements, in conformity with U.S. generally accepted

accounting principles, requires management to make estimates and assumptions that affect the amounts reported

in the consolidated financial statements and accompanying notes. Actual results may differ from those estimates

and the differences could be material.

Revenue Recognition

The Company records revenue when the following criteria are met: persuasive evidence of an arrangement

exists, delivery has occurred, the Company’s price to the customer is fixed and determinable and collectability is

reasonably assured. Delivery is not considered to have occurred until the customer assumes the risks and rewards

of ownership.

Foreign Currency Translation

The consolidated balance sheets and statements of income and comprehensive income of the Company’s

foreign subsidiaries have been translated into U.S. dollars at the current and average exchange rates, respectively.

The foreign currency translation adjustment is included as a component of accumulated other comprehensive

loss.

Cash and Cash Equivalents

The Company considers all highly liquid investments with original maturities of three months or less when

purchased to be cash equivalents.

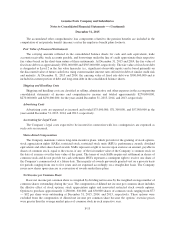

Trade Accounts Receivable and the Allowance for Doubtful Accounts

The Company evaluates the collectability of trade accounts receivable based on a combination of factors.

The Company estimates an allowance for doubtful accounts as a percentage of net sales based on historical bad

debt experience and periodically adjusts this estimate when the Company becomes aware of a specific customer’s

inability to meet its financial obligations (e.g., bankruptcy filing) or as a result of changes in the overall aging of

accounts receivable. While the Company has a large customer base that is geographically dispersed, a general

economic downturn in any of the industry segments in which the Company operates could result in higher than

F-9