Napa Auto Parts 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Genuine Parts Company and Subsidiaries

Notes to Consolidated Financial Statements — (Continued)

December 31, 2015

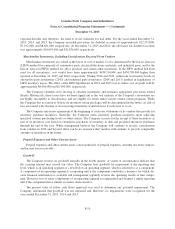

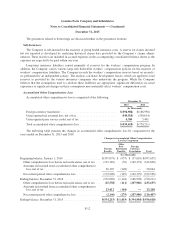

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

(“ASU”) No. 2014-9, Revenue from Contracts with Customers (“ASU 2014-9”), which creates a single, compre-

hensive revenue recognition model for all contracts with customers. The updated standard requires an entity to

recognize revenue to reflect the transfer of promised goods or services to customers at an amount that the entity

expects to be entitled to in exchange for those goods and services. ASU 2014-9 may be adopted either retro-

spectively or on a modified retrospective basis whereby the new standard would be applied to new contracts and

existing contracts with remaining performance obligations as of the effective date, with a cumulative catch-up

adjustment recorded to beginning retained earnings at the effective date for existing contracts with remaining

performance obligations. In August 2015, the FASB issued ASU No. 2015-14, Revenue from Contracts with

Customers (Topic 606): Deferral of the Effective Date, that deferred the effective date by one year to

December 15, 2017 for interim and annual reporting periods beginning after that date. The FASB permitted early

adoption of the standard, but not before the original effective date of December 15, 2016. The Company is cur-

rently evaluating the impact of ASU 2014-9 on the Company’s consolidated financial statements and related dis-

closures.

In February 2015, the FASB issued ASU 2015-02, Consolidation (Topic 810): Amendments to the Con-

solidation Analysis (“ASU 2015-02”). ASU 2015-02 amends the consolidation requirements and significantly

changes the consolidation analysis required. ASU 2015-02 requires management to reevaluate all legal entities

under a revised consolidation model to specifically (i) modify the evaluation of whether limited partnership and

similar legal entities are variable interest entities (“VIEs”), (ii) eliminate the presumption that a general partner

should consolidate a limited partnership, (iii) affect the consolidation analysis of reporting entities that are

involved with VIEs particularly those that have fee arrangements and related party relationships, and (iv) provide

a scope exception from consolidation guidance for reporting entities with interests in legal entities that are

required to comply with or operate in accordance with requirements that are similar to those in Rule 2a-7 of the

Investment Act of 1940 for registered money market funds. ASU 2015-02 will be effective for the Company’s

interim and annual periods beginning after December 15, 2015. The adoption of ASU 2015-02 is not expected to

have a material effect on the Company’s consolidated financial statements and related disclosures.

In November 2015, the FASB issued ASU 2015-17, Balance Sheet Classification of Deferred Taxes, which

amends the existing guidance to require presentation of deferred tax assets and liabilities as noncurrent within a

balance sheet. This guidance was adopted, on a prospective basis, at December 31, 2015. The adoption did not

have a material impact on the Company’s financial statements.

F-14