Napa Auto Parts 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Genuine Parts Company and Subsidiaries

Notes to Consolidated Financial Statements — (Continued)

December 31, 2015

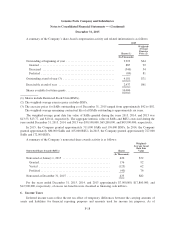

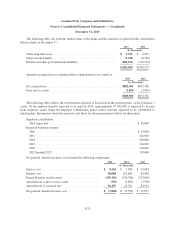

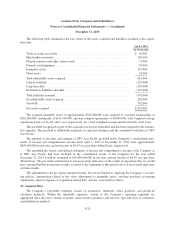

The actuarial loss incurred in the year ended December 31, 2014 is primarily attributable to a lower discount

rate, as well as changes in the mortality assumptions.

The benefit obligations for the Company’s U.S. pension plans included in the above were $2,012,935,000

and $2,135,827,000 at December 31, 2015 and 2014, respectively. The total accumulated benefit obligation for

the Company’s defined benefit pension plans in the U.S. and Canada was approximately $2,179,626,000 and

$2,328,489,000 at December 31, 2015 and 2014, respectively.

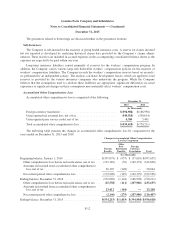

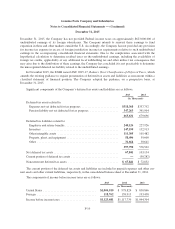

The assumptions used to measure the pension benefit obligations for the plans at December 31, 2015 and

2014, were:

2015 2014

Weighted-average discount rate ............................................ 4.82% 4.26%

Rate of increase in future compensation levels ................................. 3.12% 3.07%

Changes in plan assets for the years ended December 31, 2015 and 2014 were:

2015 2014

(In Thousands)

Changes in plan assets

Fair value of plan assets at beginning of year ................................. $2,021,837 $1,933,063

Actual return on plan assets .............................................. (45,529) 174,652

Foreign currency exchange rate changes .................................... (33,382) (17,616)

Employer contributions .................................................. 54,543 53,296

Plan participants’ contributions ............................................ 2,838 3,526

Benefits paid .......................................................... (87,571) (125,084)

Fair value of plan assets at end of year ...................................... $1,912,736 $2,021,837

The fair values of plan assets for the Company’s U.S. pension plans included in the above were

$1,731,368,000 and $1,819,747,000 at December 31, 2015 and 2014, respectively.

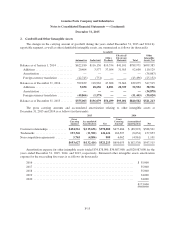

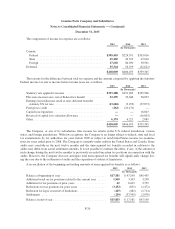

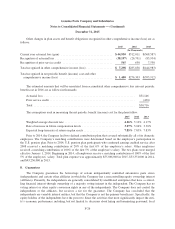

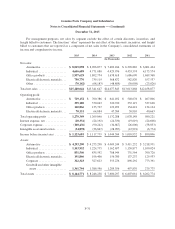

The asset allocations for the Company’s funded pension plans at December 31, 2015 and 2014, and the tar-

get allocation for 2016, by asset category were:

Target

Allocation

2016

Percentage of

Plan Assets at

December 31

2015 2014

Asset Category

Equity securities ......................................................... 71% 69% 70%

Debt securities .......................................................... 29% 31% 30%

100% 100% 100%

The Company’s benefit plan committees in the U.S. and Canada establish investment policies and strategies

and regularly monitor the performance of the funds. The pension plan strategy implemented by the Company’s

management is to achieve long-term objectives and invest the pension assets in accordance with the applicable

pension legislation in the U.S. and Canada, as well as fiduciary standards. The long-term primary investment

objectives for the pension plans are to provide for a reasonable amount of long-term growth of capital, without

F-22