Napa Auto Parts 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Genuine Parts Company and Subsidiaries

Notes to Consolidated Financial Statements — (Continued)

December 31, 2015

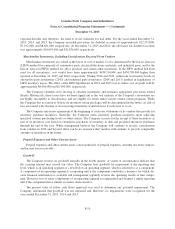

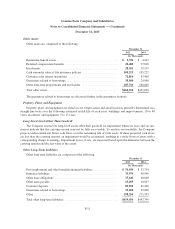

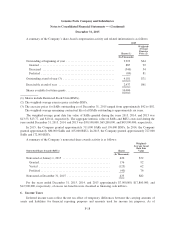

Other Assets

Other assets are comprised of the following:

December 31

2015 2014

(In Thousands)

Retirement benefit assets .......................................... $ 3,336 $ 4,247

Deferred compensation benefits .................................... 28,488 27,828

Investments .................................................... 28,351 29,139

Cash surrender value of life insurance policies ......................... 105,213 105,227

Customer sales returns inventories .................................. 72,814 67,400

Guarantees related to borrowings ................................... 35,000 29,000

Other long-term prepayments and receivables ......................... 187,716 188,849

Total other assets ................................................ $460,918 $451,690

The guarantees related to borrowings are discussed further in the guarantees footnote.

Property, Plant, and Equipment

Property, plant, and equipment are stated at cost. Depreciation and amortization is primarily determined on a

straight-line basis over the following estimated useful life of each asset: buildings and improvements, 10 to 40

years; machinery and equipment, 5 to 15 years.

Long-Lived Assets Other Than Goodwill

The Company assesses its long-lived assets other than goodwill for impairment whenever facts and circum-

stances indicate that the carrying amount may not be fully recoverable. To analyze recoverability, the Company

projects undiscounted net future cash flows over the remaining life of such assets. If these projected cash flows

are less than the carrying amount, an impairment would be recognized, resulting in a write-down of assets with a

corresponding charge to earnings. Impairment losses, if any, are measured based upon the difference between the

carrying amount and the fair value of the assets.

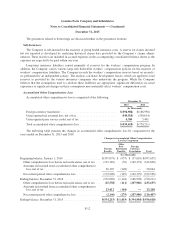

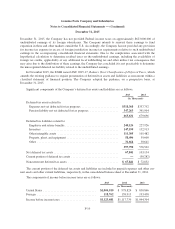

Other Long-Term Liabilities

Other long-term liabilities are comprised of the following:

December 31

2015 2014

(In Thousands)

Post-employment and other benefit/retirement liabilities ................. $ 54,034 $ 57,754

Insurance liabilities .............................................. 33,979 48,569

Other lease obligations ........................................... 37,642 40,040

Other taxes payable .............................................. 15,495 18,947

Customer deposits ............................................... 85,552 81,496

Guarantees related to borrowings ................................... 35,000 29,000

Other ......................................................... 198,254 171,943

Total other long-term liabilities .................................... $459,956 $447,749

F-11