Napa Auto Parts 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

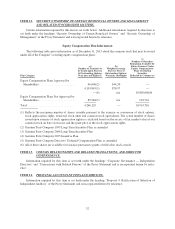

Exhibit 10.18* Amendment No. 2 to the Genuine Parts Company Director’s Deferred Compensation Plan,

dated December 7, 2012, effective December 7, 2012. (Incorporated herein by reference from

the Company’s Annual Report on Form 10-K, dated February 26, 2013.)

Exhibit 10.19* Description of Director Compensation. (Incorporated herein by reference from the Company’s

Quarterly Report on Form 10-Q, dated May 7, 2014.)

Exhibit 10.20* Genuine Parts Company 1999 Long-Term Incentive Plan, as amended and restated as of

November 19, 2001. (Incorporated herein by reference from the Company’s Annual Report on

Form 10-K, dated March 21, 2003.)

Exhibit 10.21* Genuine Parts Company 2006 Long-Term Incentive Plan, effective April 17, 2006.

(Incorporated herein by reference from the Company’s Current Report on Form 8-K, dated

April 18, 2006.)

Exhibit 10.22* Amendment to the Genuine Parts Company 2006 Long-Term Incentive Plan, dated

November 20, 2006, effective November 20, 2006. (Incorporated herein by reference from the

Company’s Annual Report on Form 10-K, dated February 28, 2007.)

Exhibit 10.23* Amendment No. 2 to the Genuine Parts Company 2006 Long-Term Incentive Plan, dated

November 19, 2007, effective November 19, 2007. (Incorporated herein by reference from the

Company’s Annual Report on Form 10-K, dated February 29, 2008.)

Exhibit 10.24* Genuine Parts Company 2015 Incentive Plan, effective November 17, 2014. (Incorporated

herein by reference from the Company’s Current Report on Form 8-K, dated April 28, 2015.)

Exhibit 10.25* Genuine Parts Company Performance Restricted Stock Unit Award Agreement. (Incorporated

herein by reference from the Company’s Quarterly Report on Form 10-Q, dated May 7, 2014.)

Exhibit 10.26* Genuine Parts Company Restricted Stock Unit Award Agreement. (Incorporated herein by

reference from the Company’s Annual Report on Form 10-K, dated February 29, 2008.)

Exhibit 10.27* Genuine Parts Company Stock Appreciation Rights Agreement. (Incorporated herein by refer-

ence from the Company’s Annual Report on Form 10-K, dated February 26, 2013.)

Exhibit 10.28* Form of Executive Officer Change in Control Agreement. (Incorporated herein by reference

from the Company’s Annual Report on Form 10-K, dated February 26, 2015)

* Indicates management contracts and compensatory plans and arrangements.

Exhibit 21 Subsidiaries of the Company.

Exhibit 23 Consent of Independent Registered Public Accounting Firm.

Exhibit 31.1 Certification signed by Chief Executive Officer pursuant to SEC Rule 13a-14(a).

Exhibit 31.2 Certification signed by Chief Financial Officer pursuant to SEC Rule 13a-14(a).

Exhibit 32.1 Statement of Chief Executive Officer of Genuine Parts Company pursuant to 18 U.S.C. Section

1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002 (furnished herewith).

Exhibit 32.2 Statement of Chief Financial Officer of Genuine Parts Company pursuant to 18 U.S.C. Section

1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002 (furnished herewith).

Exhibit 101 Interactive data files pursuant to Rule 405 of Regulation S-T:

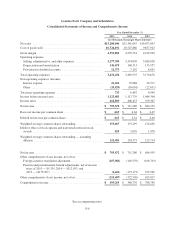

(i) the Consolidated Balance Sheets as of December 31, 2015 and 2014; (ii) the Consolidated

Statements of Income and Comprehensive Income for the Years ended December 31, 2015,

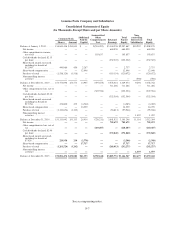

2014 and 2013; (iii) the Consolidated Statements of Equity for the Years ended December 31,

2015, 2014 and 2013; (iv) the Consolidated Statements of Cash Flows for Years ended

December 31, 2015, 2014 and 2013; (v) the Notes to the Consolidated Financial Statements,

tagged as blocks of text; and (vi) Financial Statement Schedule II — Valuation and Qualifying

Accounts.

(b) Exhibits

See the response to Item 15(a)(3) above.

(c) Financial Statement Schedules

See the response to Item 15(a)(2) above.

35