Napa Auto Parts 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

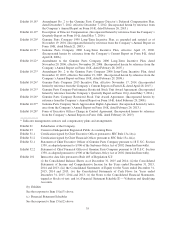

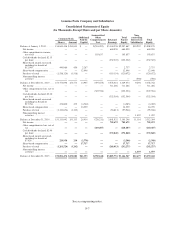

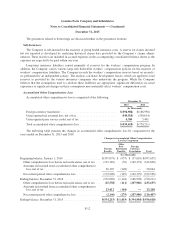

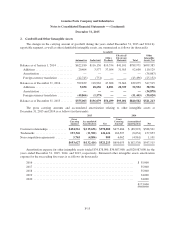

Genuine Parts Company and Subsidiaries

Consolidated Statements of Equity

(In Thousands, Except Share and per Share Amounts)

Common Stock Additional

Paid-In

Capital

Accumulated

Other

Comprehensive

Loss

Retained

Earnings

Total

Parent

Equity

Non-

controlling

Interests in

Subsidiaries

Total

EquityShares Amount

Balance at January 1, 2013 ....... 154,841,438 $154,841 $ — $(501,492) $3,344,538 $2,997,887 $10,292 $3,008,179

Net income ................. — — — — 684,959 684,959 — 684,959

Other comprehensive income,

netoftax................. — — — 103,837 — 103,837 — 103,837

Cash dividends declared, $2.15

per share ................. — — — — (332,322) (332,322) — (332,322)

Share-based awards exercised,

including tax benefit of

$12,905 .................. 449,986 450 2,287 — — 2,737 — 2,737

Share-based compensation ..... — — 12,648 — — 12,648 — 12,648

Purchase of stock ............ (1,518,326) (1,518) — — (119,154) (120,672) — (120,672)

Noncontrolling interest

activities ................. — — — — — — (598) (598)

Balance at December 31, 2013 .... 153,773,098 153,773 14,935 (397,655) 3,578,021 3,349,074 9,694 3,358,768

Net income ................. — — — — 711,286 711,286 — 711,286

Other comprehensive loss, net of

tax...................... — — — (322,556) — (322,556) — (322,556)

Cash dividends declared, $2.30

per share ................. — — — — (352,564) (352,564) — (352,564)

Share-based awards exercised,

including tax benefit of

$17,766 .................. 474,800 475 (4,760) — — (4,285) — (4,285)

Share-based compensation ..... — — 16,239 — — 16,239 — 16,239

Purchase of stock ............ (1,134,856) (1,135) — — (94,811) (95,946) — (95,946)

Noncontrolling interest

activities ................. — — — — — — 1,422 1,422

Balance at December 31, 2014 .... 153,113,042 153,113 26,414 (720,211) 3,841,932 3,301,248 11,116 3,312,364

Net income ................. — — — — 705,672 705,672 — 705,672

Other comprehensive loss, net of

tax...................... — — — (210,407) — (210,407) — (210,407)

Cash dividends declared, $2.46

per share ................. — — — — (372,840) (372,840) — (372,840)

Share-based awards exercised,

including tax benefit of

$7,024 ................... 229,958 230 (2,778) — — (2,548) — (2,548)

Share-based compensation ..... — — 17,717 — — 17,717 — 17,717

Purchase of stock ............ (3,261,526) (3,262) — — (289,013) (292,275) — (292,275)

Noncontrolling interest

activities ................. — — — — — — 1,559 1,559

Balance at December 31, 2015 .... 150,081,474 $150,081 $41,353 $(930,618) $3,885,751 $3,146,567 $12,675 $3,159,242

See accompanying notes.

F-7