Napa Auto Parts 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

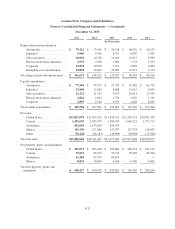

Genuine Parts Company and Subsidiaries

Notes to Consolidated Financial Statements — (Continued)

December 31, 2015

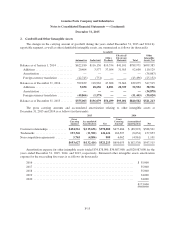

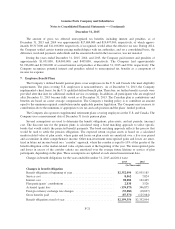

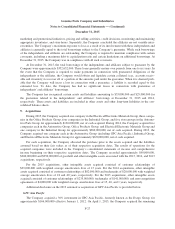

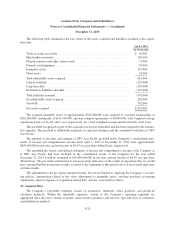

The following table sets forth the funded status of the plans and the amounts recognized in the consolidated

balance sheets at December 31:

2015 2014

(In Thousands)

Other long-term asset ........................................... $ 3,336 $ 4,247

Other current liability ........................................... (7,432) (6,740)

Pension and other post-retirement liabilities ......................... (282,524) (327,764)

$(286,620) $(330,257)

Amounts recognized in accumulated other comprehensive loss consist of:

2015 2014

(In Thousands)

Net actuarial loss ................................................ $882,464 $875,788

Prior service credit .............................................. (1,814) (2,436)

$880,650 $873,352

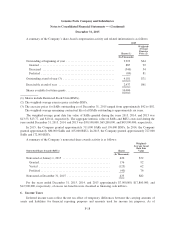

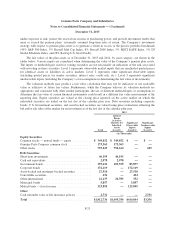

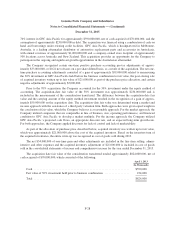

The following table reflects the total benefits expected to be paid from the pension plans’ or the Company’s

assets. Of the pension benefits expected to be paid in 2016, approximately $7,382,000 is expected to be paid

from employer assets. Expected employer contributions below reflect amounts expected to be contributed to

funded plans. Information about the expected cash flows for the pension plans follows (in thousands):

Employer contribution

2016 (expected) ......................................................... $ 49,000

Expected benefit payments:

2016 .................................................................. $ 93,000

2017 .................................................................. 102,000

2018 .................................................................. 109,000

2019 .................................................................. 116,000

2020 .................................................................. 124,000

2021 through 2025 ....................................................... 703,000

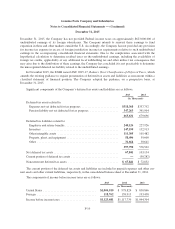

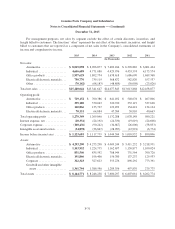

Net periodic benefit (income) cost included the following components:

2015 2014 2013

(In Thousands)

Service cost ....................................... $ 8,562 $ 7,824 $ 19,083

Interest cost ....................................... 98,088 102,465 89,408

Expected return on plan assets ......................... (150,130) (144,746) (133,816)

Amortization of prior service credit ..................... (565) (1,890) (7,538)

Amortization of actuarial loss ......................... 38,197 26,791 83,934

Net periodic benefit (income) cost ...................... $ (5,848) $ (9,556) $ 51,071

F-25