Napa Auto Parts 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014, approximately $125 million and $265 million were outstanding under this line of credit, respectively. Due

to the workers’ compensation and insurance reserve requirements in certain states, the Company also had unused

letters of credit of approximately $63 million outstanding at December 31, 2015 and 2014.

At December 31, 2015, the Company had unsecured Senior Notes outstanding under financing arrangement

as follows: $250 million series D and E senior unsecured notes, 3.35% fixed, due 2016; and $250 million series F

senior unsecured notes, 2.99% fixed, due 2023. These borrowings contain covenants related to a maximum debt-

to-capitalization ratio and certain limitations on additional borrowings. At December 31, 2015, the Company was

in compliance with all such covenants. The weighted average interest rate on the Company’s total outstanding

borrowings was approximately 2.76% at December 31, 2015 and 2.46% at December 31, 2014. Total interest

expense, net of interest income, for all borrowings was $20.4 million, $24.2 million and $24.3 million in 2015,

2014 and 2013, respectively.

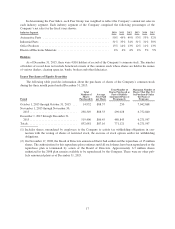

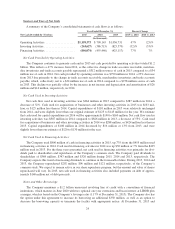

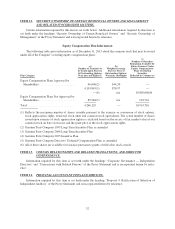

Contractual and Other Obligations

The following table shows the Company’s approximate obligations and commitments, including interest due

on credit facilities, to make future payments under specified contractual obligations as of December 31, 2015:

Contractual Obligations

Payment Due by Period

Total

Less Than

1 Year 1-3 Years 3-5 Years

Over

5 Years

(In thousands)

Credit facilities ..................... $ 693,300 $390,900 $ 15,000 $ 15,000 $272,400

Operating leases .................... 767,900 207,800 281,400 126,400 152,300

Total contractual cash obligations ....... $1,461,200 $598,700 $296,400 $141,400 $424,700

Due to the uncertainty of the timing of future cash flows associated with the Company’s unrecognized tax

benefits at December 31, 2015, the Company is unable to make reasonably reliable estimates of the period of

cash settlement with the respective taxing authorities. Therefore, $18 million of unrecognized tax benefits have

been excluded from the contractual obligations table above. Refer to Note 6 of the Consolidated Financial State-

ments for a discussion on income taxes.

Purchase orders or contracts for the purchase of inventory and other goods and services are not included in

our estimates. We are not able to determine the aggregate amount of such purchase orders that represent con-

tractual obligations, as purchase orders may represent authorizations to purchase rather than binding agreements.

Our purchase orders are based on our current distribution needs and are fulfilled by our vendors within short time

horizons. The Company does not have significant agreements for the purchase of inventory or other goods speci-

fying minimum quantities or set prices that exceed our expected requirements.

25