Napa Auto Parts 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Genuine Parts Company and Subsidiaries

Notes to Consolidated Financial Statements — (Continued)

December 31, 2015

The guarantees related to borrowings are discussed further in the guarantees footnote.

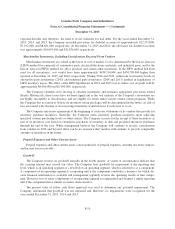

Self-Insurance

The Company is self-insured for the majority of group health insurance costs. A reserve for claims incurred

but not reported is developed by analyzing historical claims data provided by the Company’s claims admin-

istrators. These reserves are included in accrued expenses in the accompanying consolidated balance sheets as the

expenses are expected to be paid within one year.

Long-term insurance liabilities consist primarily of reserves for the workers’ compensation program. In

addition, the Company carries various large risk deductible workers’ compensation policies for the majority of

workers’ compensation liabilities. The Company records the workers’ compensation reserves based on an analy-

sis performed by an independent actuary. The analysis calculates development factors, which are applied to total

reserves as provided by the various insurance companies who underwrite the program. While the Company

believes that the assumptions used to calculate these liabilities are appropriate, significant differences in actual

experience or significant changes in these assumptions may materially affect workers’ compensation costs.

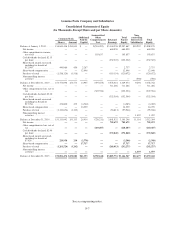

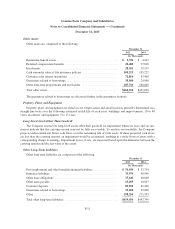

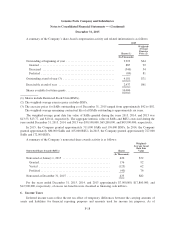

Accumulated Other Comprehensive Loss

Accumulated other comprehensive loss is comprised of the following:

December 31

2015 2014

(In Thousands)

Foreign currency translation ...................................... $(394,984) $(186,998)

Unrecognized net actuarial loss, net of tax ........................... (540,018) (538,614)

Unrecognized prior service credit, net of tax ......................... 4,384 5,401

Total accumulated other comprehensive loss ......................... $(930,618) $(720,211)

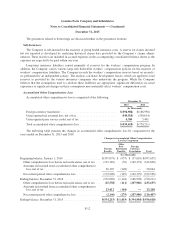

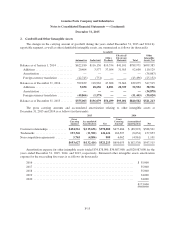

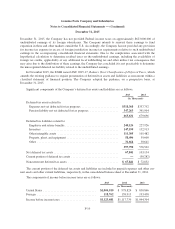

The following table presents the changes in accumulated other comprehensive loss by component for the

years ended on December 31, 2015 and 2014:

Changes in Accumulated Other Comprehensive

Loss by Component

Pension

Benefits

Other

Post-

Retirement

Benefits

Foreign

Currency

Translation Total

(In Thousands)

Beginning balance, January 1, 2014 ......................... $(359,079) $ (957) $ (37,619) $(397,655)

Other comprehensive loss before reclassifications, net of tax . . . (193,182) (39) (149,379) (342,600)

Amounts reclassified from accumulated other comprehensive

loss, net of tax ...................................... 20,192 (148) — 20,044

Net current period other comprehensive loss ................ (172,990) (187) (149,379) (322,556)

Ending balance, December 31, 2014 ......................... (532,069) (1,144) (186,998) (720,211)

Other comprehensive loss before reclassifications, net of tax . . . (25,558) (111) (207,986) (233,655)

Amounts reclassified from accumulated other comprehensive

loss, net of tax ...................................... 23,412 (164) — 23,248

Net current period other comprehensive loss ................ (2,146) (275) (207,986) (210,407)

Ending balance, December 31, 2015 ......................... $(534,215) $(1,419) $(394,984) $(930,618)

F-12