Napa Auto Parts 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

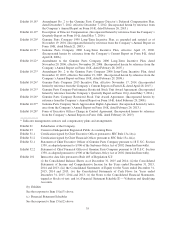

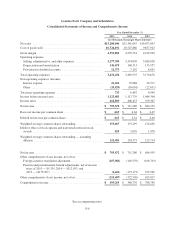

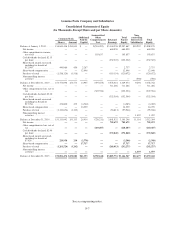

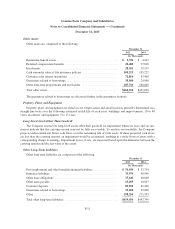

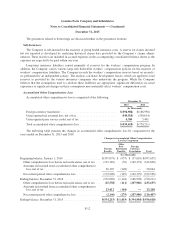

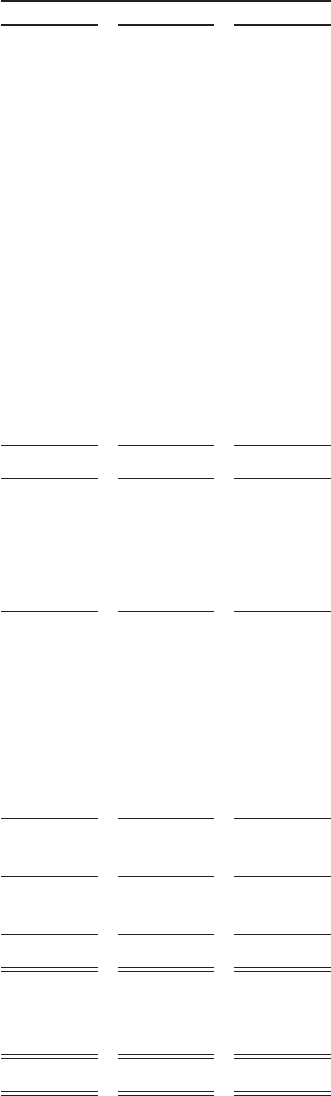

Genuine Parts Company and Subsidiaries

Consolidated Statements of Cash Flows

Year Ended December 31

2015 2014 2013

(In Thousands)

Operating activities

Net income .............................................. $ 705,672 $ 711,286 $ 684,959

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation and amortization ........................... 141,675 148,313 133,957

Excess tax benefits from share-based compensation .......... (7,024) (17,766) (12,905)

Gain on sale of property, plant, and equipment .............. (3,189) (3,719) (4,729)

Deferred income taxes .................................. 35,544 54,319 (21,622)

Share-based compensation .............................. 17,717 16,239 12,648

Gain on GPC Asia Pacific equity investment ................ —— (59,000)

Changes in operating assets and liabilities:

Trade accounts receivable, net ......................... 1,974 (225,178) (116,080)

Merchandise inventories, net .......................... (21,821) (100,820) (79,253)

Trade accounts payable ............................... 331,419 292,257 473,424

Other short-term assets and liabilities .................... 967 15,616 (14,418)

Other long-term assets and liabilities .................... (43,561) (100,402) 59,750

453,701 78,859 371,772

Net cash provided by operating activities ....................... 1,159,373 790,145 1,056,731

Investing activities

Purchases of property, plant and equipment ..................... (109,544) (107,681) (124,063)

Proceeds from sale of property, plant, and equipment ............. 8,618 8,866 10,657

Acquisition of businesses and other investing activities ............ (162,701) (287,900) (712,173)

Net cash used in investing activities ........................... (263,627) (386,715) (825,579)

Financing activities

Proceeds from debt ........................................ 3,862,224 2,727,924 3,019,931

Payments on debt ......................................... (4,005,191) (2,735,862) (2,995,335)

Share-based awards exercised, net of taxes paid ................. (9,572) (22,051) (15,728)

Excess tax benefits from share-based compensation .............. 7,024 17,766 12,905

Dividends paid ............................................ (368,284) (347,271) (326,217)

Purchase of stock .......................................... (292,275) (95,946) (120,673)

Net cash used in financing activities ........................... (806,074) (455,440) (425,117)

Effect of exchange rate changes on cash ........................ (15,771) (7,153) (12,237)

Net increase (decrease) in cash and cash equivalents .............. 73,901 (59,163) (206,202)

Cash and cash equivalents at beginning of year .................. 137,730 196,893 403,095

Cash and cash equivalents at end of year ....................... $ 211,631 $ 137,730 $ 196,893

Supplemental disclosures of cash flow information

Cash paid during the year for:

Income taxes ........................................... $ 352,153 $ 408,604 $ 342,372

Interest ................................................ $ 23,687 $ 25,155 $ 27,221

See accompanying notes.

F-8